🕑 3-minute read |

Choosing an investment can be a daunting task, but if you follow this basic guide you will reduce the number of poor investing decisions. Here are the 5 easy steps that I follow:

1) Don’t simply follow hot trends (cannabis, bitcoin-related companies etc) and avoid buying popular brands just because they are well known.

Invest in the companies where you understand how they make their money – if the product/ service is too complex to understand within 10 min, don’t bother.

Stay away from industries you know nothing about. For example, I skip the chemical industry, pharmaceuticals etc.

2) It’s fun reading stories here and other places online about people making 100% returns buying and selling, buying and selling, but the truth is that very few people make these sorts of returns trading and most lose money.

Rather buy companies you like and believe will grow in the future. The best industry practice is to keep the stock for at least 5-10 years unless you notice a material change in the company’s performance or industry.

3) Learn how to read a company’s annual report. I usually look for the company CEO’s slides (or video presentation) and executive summary.

That helps me to quickly filter the opportunities and lets me know if I want to spend more time on researching it.

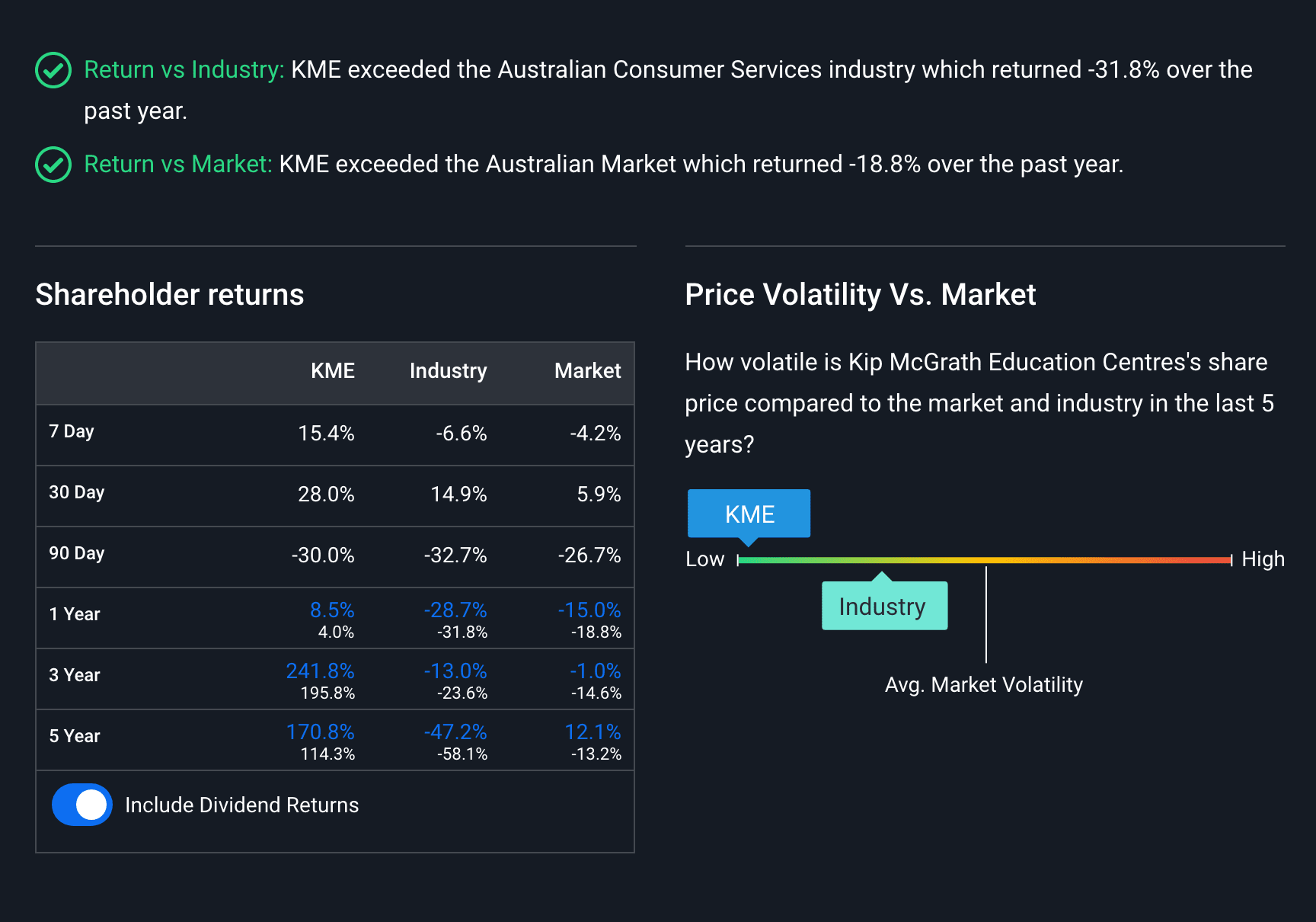

4) Compare Stock Return vs Industry and Stock Return vs Market (don’t forget the dividends!)

Markets go up and markets go down, a stock chart will always look like a zig zag so don’t stress about small movements, rather buy and check every once and awhile (not more than once a month), unless something about the company fundamentally changes

5) Create a checklist of the key the things you should be looking at as a starting point, and I’ll run through an example for you: KME (ASX)

– What do they do?

Run in person and online extra curricular tuition programs for kids.

– Do I understand where the money comes from and what the costs are?

Yes, parents pay the company to tutor their children and franchise fees, key costs are rent (of owned practices), tutor fees, software dev and maintenance, corporate costs.

– Do I think this company will grow in the future?

Yes – I believe this to be a growing sector, particularly as the world gets more competitive

– Have they consistently grown their earnings and what are debt levels like?

Yes earnings growth has been consistent and debt levels are low

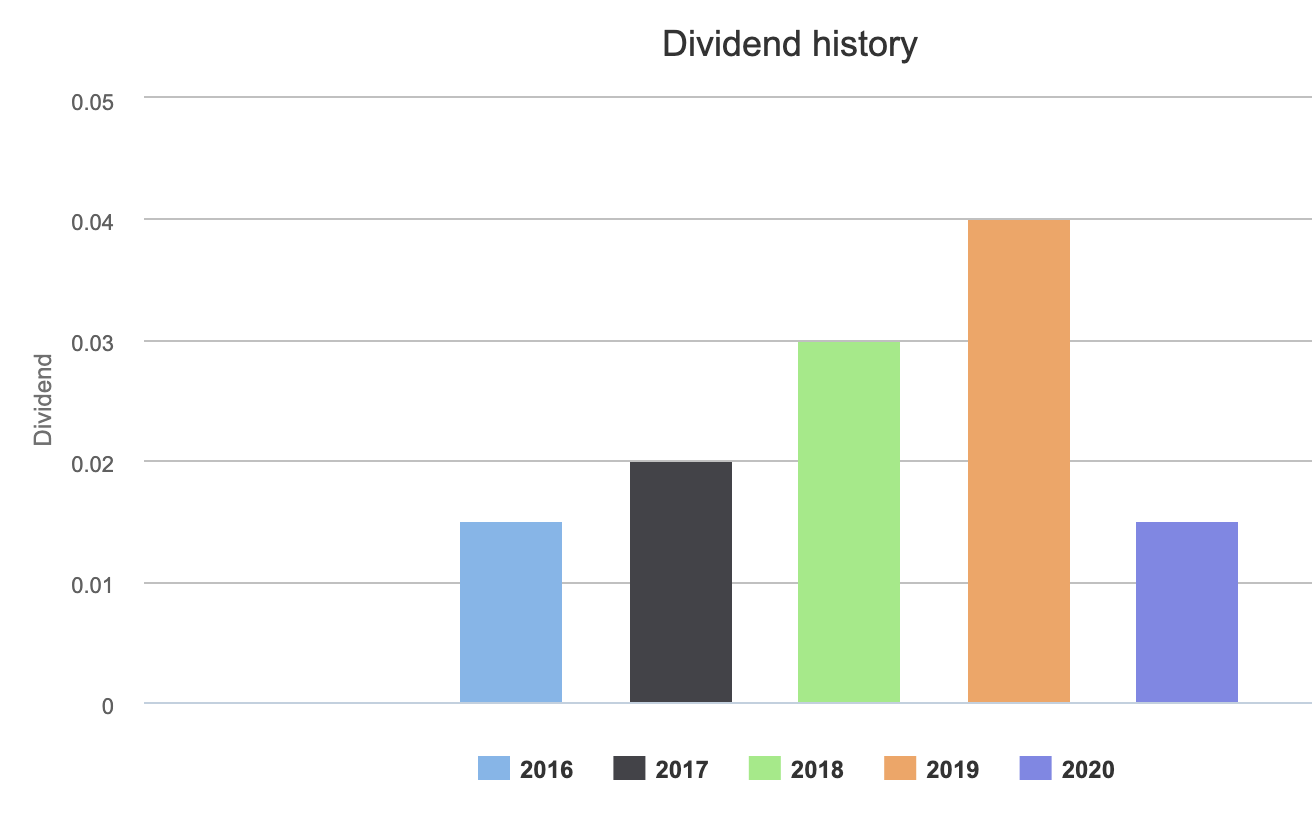

– Do they pay a dividend?

Yes, 2-3% which is standard for this sort of company

This is just a simple example but the sort of questions you should be asking.

P.S. I research and interview economists, NZ investors and successful companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.