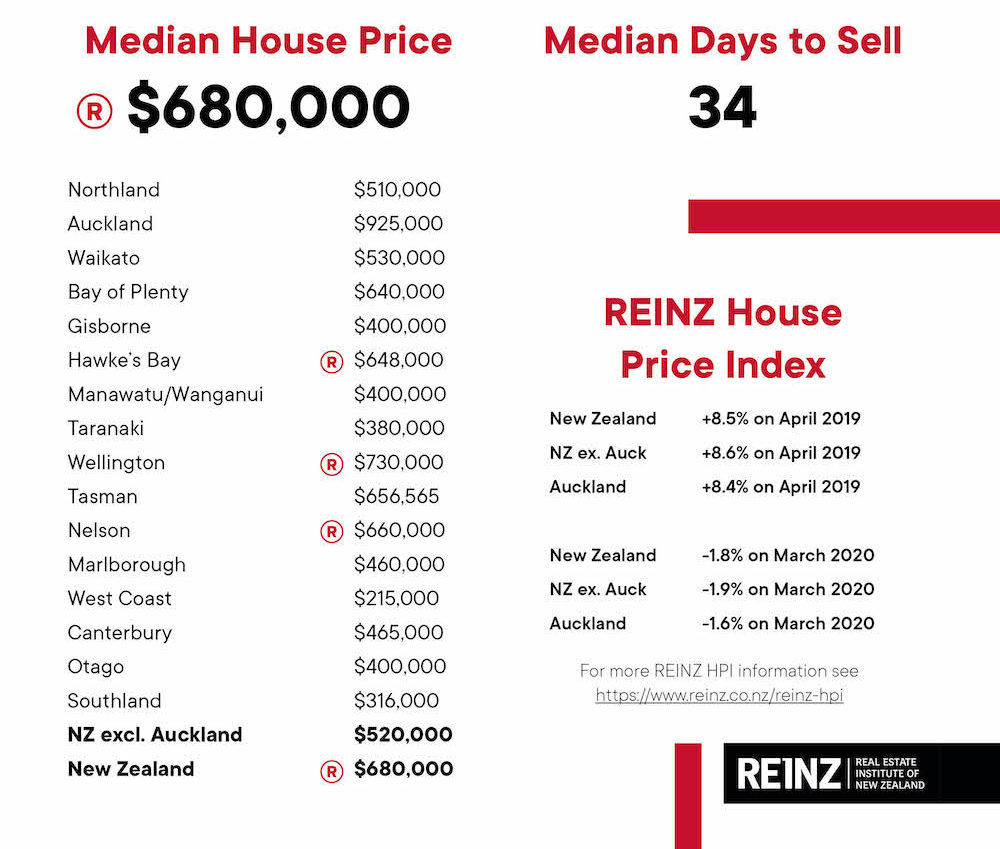

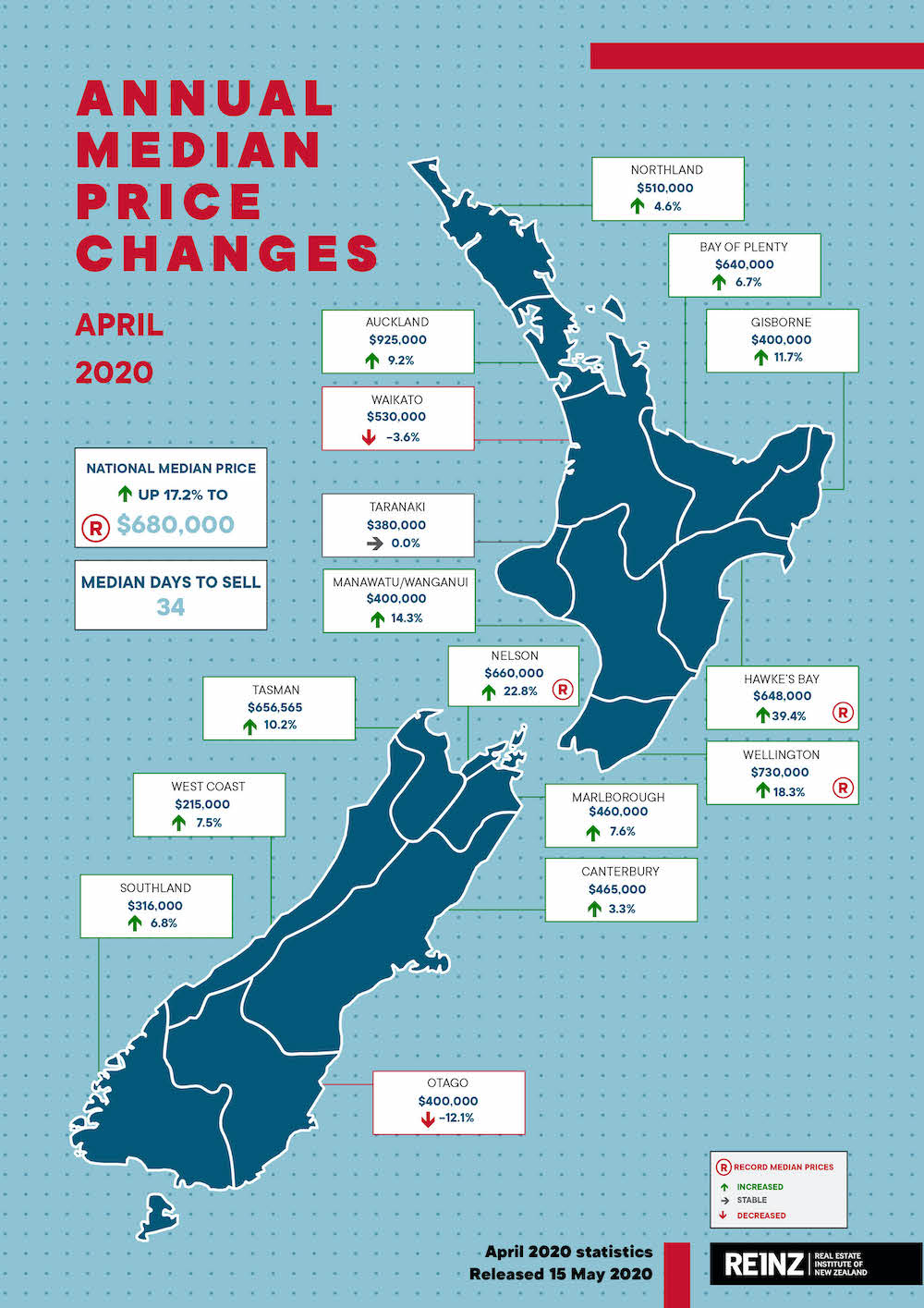

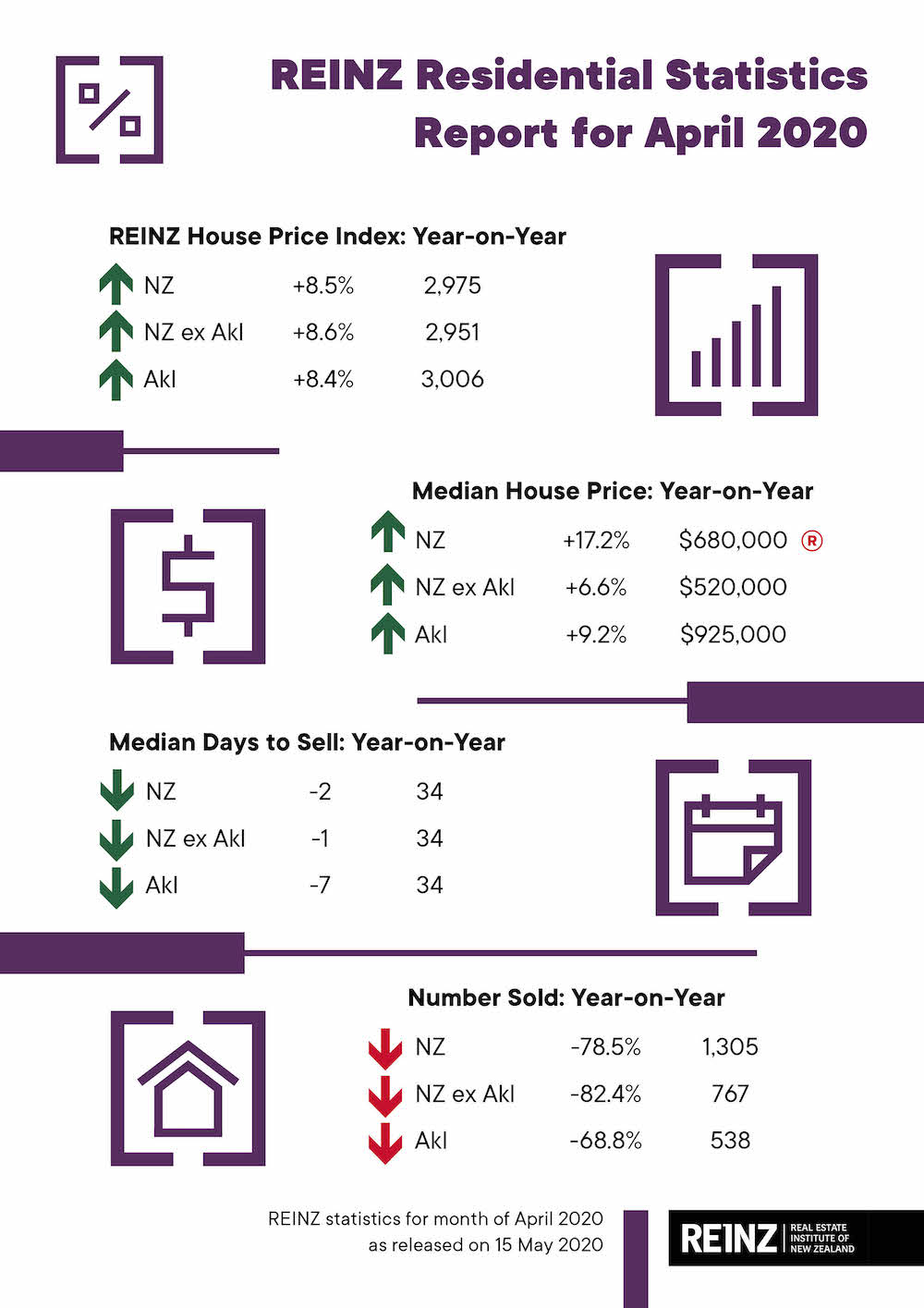

(3-min read) In Auckland, median house prices increased by 9.2% to $925,000 (April 2020) up from $847,000 in April 2019 – the second highest price on record.

Auckland saw the median number of days to sell a property fall by 7 days from 41 to 34 year-on-year – the lowest days to sell for the month of April in 4 years.

The Auckland region appeared to be the least impacted by COVID-19 when it came to sales volumes, with a 68.8% drop in the number of properties sold. Most of the sales occurred in Auckland City (172,) followed by North Shore City (102) and Manukau City (92).

“Key to moving forward and helping the market to recover will be the number of new listings coming onto the market during May and consumer confidence levels – particularly in relation to ongoing employment and people’s ability to access finance.

Lastly, we’ll be looking at metrics such as the sales price to CV ratio, percentage of auctions and median number of days to sell.

Talking to our members around the country, there are good levels of activity starting to occur with both first time buyers and investors active in the market which is a positive sign. We expect this to pick up as we move into Level 2,” she continues

“However, we caution over being too optimistic until we get a few more months’ data, as many of the sales in April will have been negotiated during March, so it’s likely to be another month or so until we really see the full impact of the lockdown,” warns Bindi Norwell, CEO, Real Estate Institute of New Zealand (REINZ).

Summary of the recent real estate survey by Tony Alexander (independent economist):

• There is notably continued good demand for properties in the lower priced brackets. But at the top end buyers have pulled back.

• There is very little evidence of prices declining more than 5%.

• Many buyers say they intend making a purchase but will wait to see what happens when the 12-week wage subsidy ends, then what happens when six-month mortgage deferrals end as well.

• Listings were in short supply ahead of lockdown and remain so. Vendors not needing to sell are pulling back from the market.

Some key quotes:

• “Sellers are realistic and expect to get less than before covid-19 but will not slash their price and instead have indicated they will hold if need be.”

• “Very little enquiry for off-the-plan apartments.”

• “FOMO for first home buyers in popular suburbs – not so much in more expensive neighbourhoods.”

• “At the moment I am seeing bargain hunters, or wait and see buyers. Vendors are sticking to their price for now.”

• “There is still a shortage of listings right across the board as there was pre-lockdown.”

• “No one has come in yet wanting to sell due to Covid-19. One common theme coming through is that this is a better way to produce a return on cash than selling up to put into shares or the bank. So, no one is really selling because the rental market is shaky, rather keeping the asset as the other options are not better.”

• “Increased inquiry from Kiwis living overseas.”

• “Mortgage-free older people thinking about downsizing have completely put plans on the backburner, happy to wait until safer times to venture out into the public domain.”

After the GFC in 2008 Auckland House Prices Eventually Doubled. Is the Same Thing Going to Happen?

No. Auckland average prices rose 96% between 2012 and late-2016. But there was extra special upward pressure from factors including these.

• Average floating mortgage rates falling from 10.6% to 6.5%.

• Net migration flows going from -16,000 in 2011 to 64,000 mid-2016.

• House construction fell to its lowest level since the 1960 and the existing shortage became a lot worse.

• Catch-up spending by those who did not buy over 2007-08 because of high interest rates, and those who did not buy over 2009-11 as they incorrectly thought prices were going to fall sharply.

These things will not be repeated this time around.

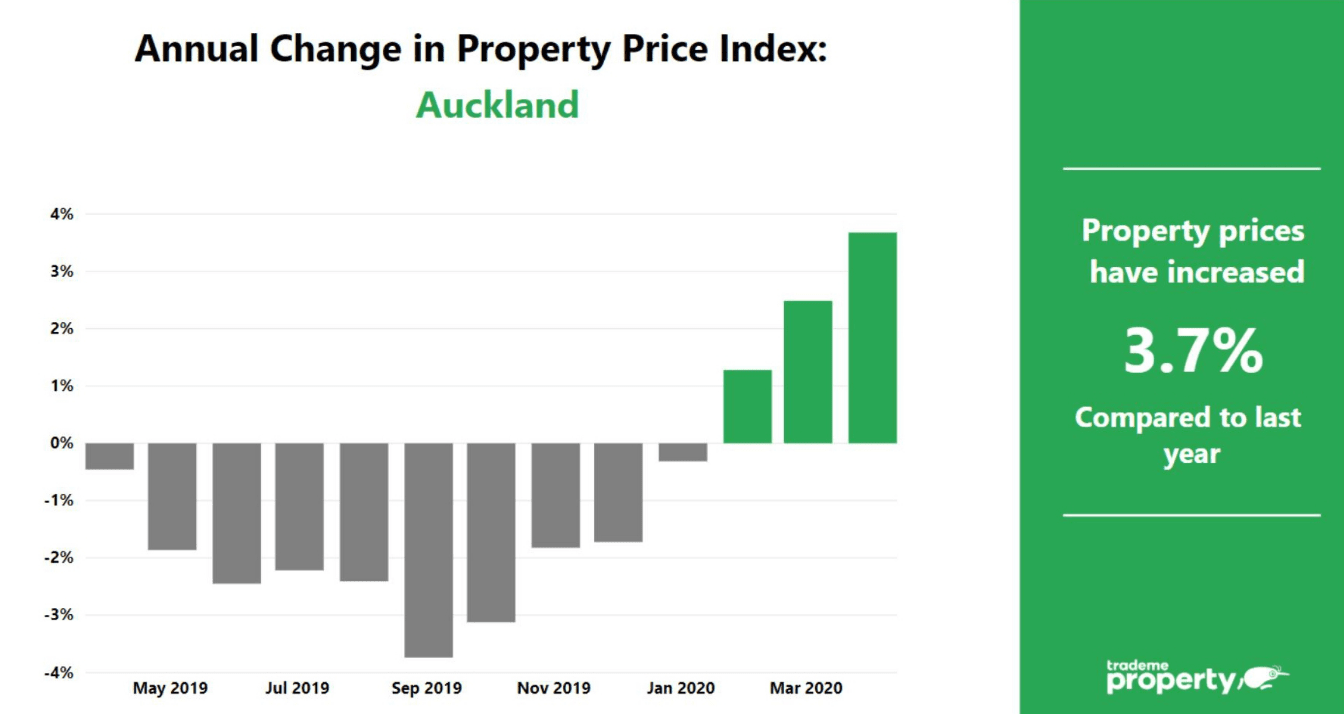

Trade Me Auckland Property Market April Results & Predictions

Head of Trade Me Property, Nigel Jeffries, said it was positive to see the market demand and supply beginning to bounce back as we exit lockdown. “With listings already starting to rebound under level 3, we’re expecting there will be a boost of activity in the property market over the next few months which traditionally has been a quieter period of the year.

“We’re starting to see signs that activity is returning and we’re expecting a stronger winter period than usual.”

Looking ahead, Mr Jeffries said seeing real estate markets in other countries rebound after a period of lockdown was promising.

“The pattern we have seen around the world resembles a tick shape recovery. We’ve seen a severe, immediate drop, which lasts three to four weeks, and is followed by a gradual recovery.”

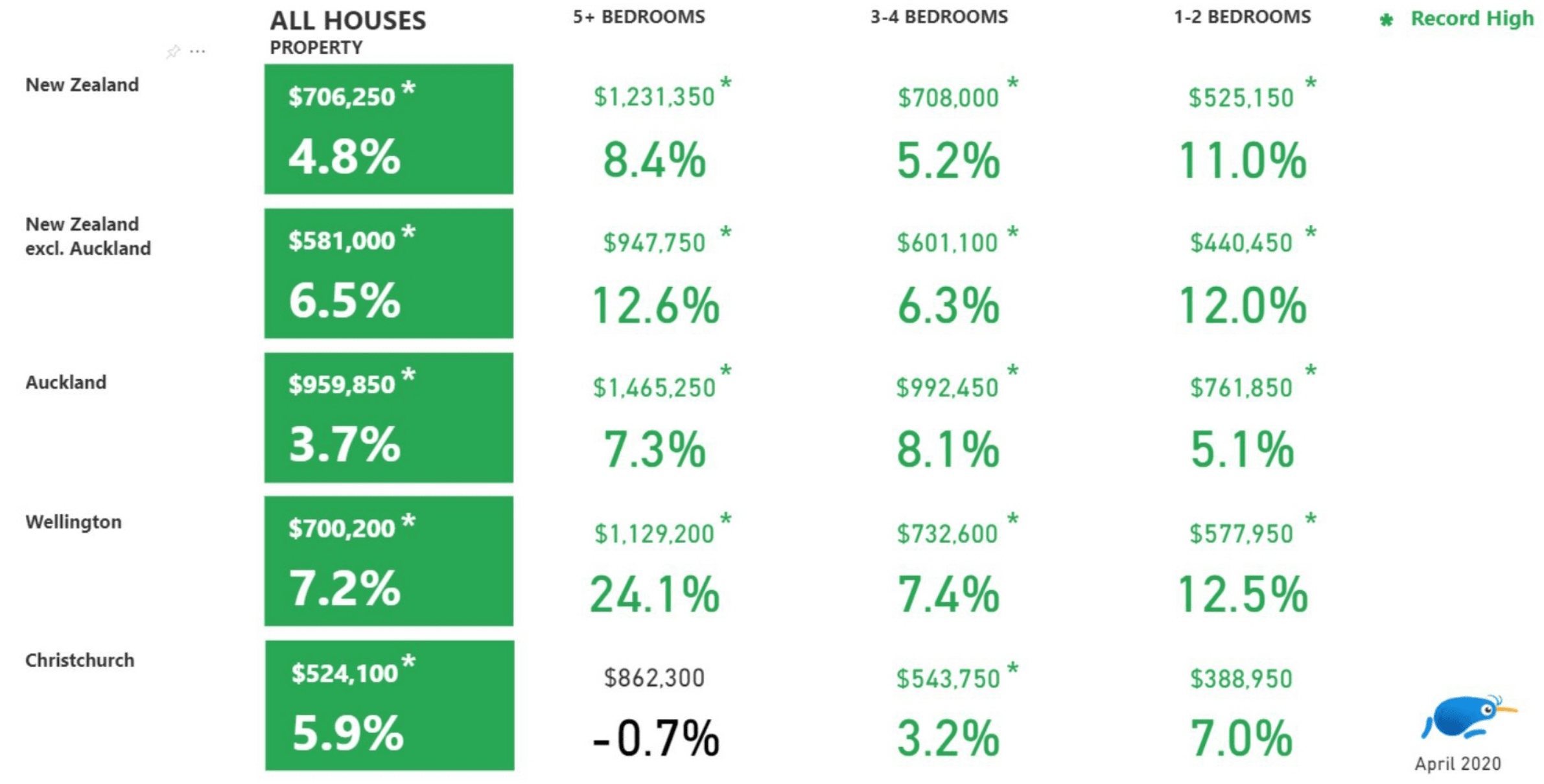

Head of Trade Me Property, Nigel Jeffries, said the average asking price for properties in the Auckland region reached $959,850 in April, up 4 per cent year-on-year.

“Auckland homeowners will be pleased to hear the region had another strong month, seeing the biggest year-on-year percentage increase Auckland has seen in over 12 months.”

“Unsurprisingly, supply took a hit in April, with alert level 4 putting many new listings on hold. The total number of properties available for sale in the Auckland region was down 45 per cent compared to the same month last year, and down 26 per cent compared to March.

“Auckland listing views were also down 23 per cent when compared with April last year, and 17 per cent from March.”

“The average asking price in Auckland City was $1,037,550, up 6 per cent from April last year – the biggest year-on-year growth the central city has seen in over a year.

“In Auckland, the average asking price for 1-2 bedroom houses saw a 5 per cent jump to $761,850 and 3-4 bedroom houses increased 8 per cent to $992,450 from April last year.

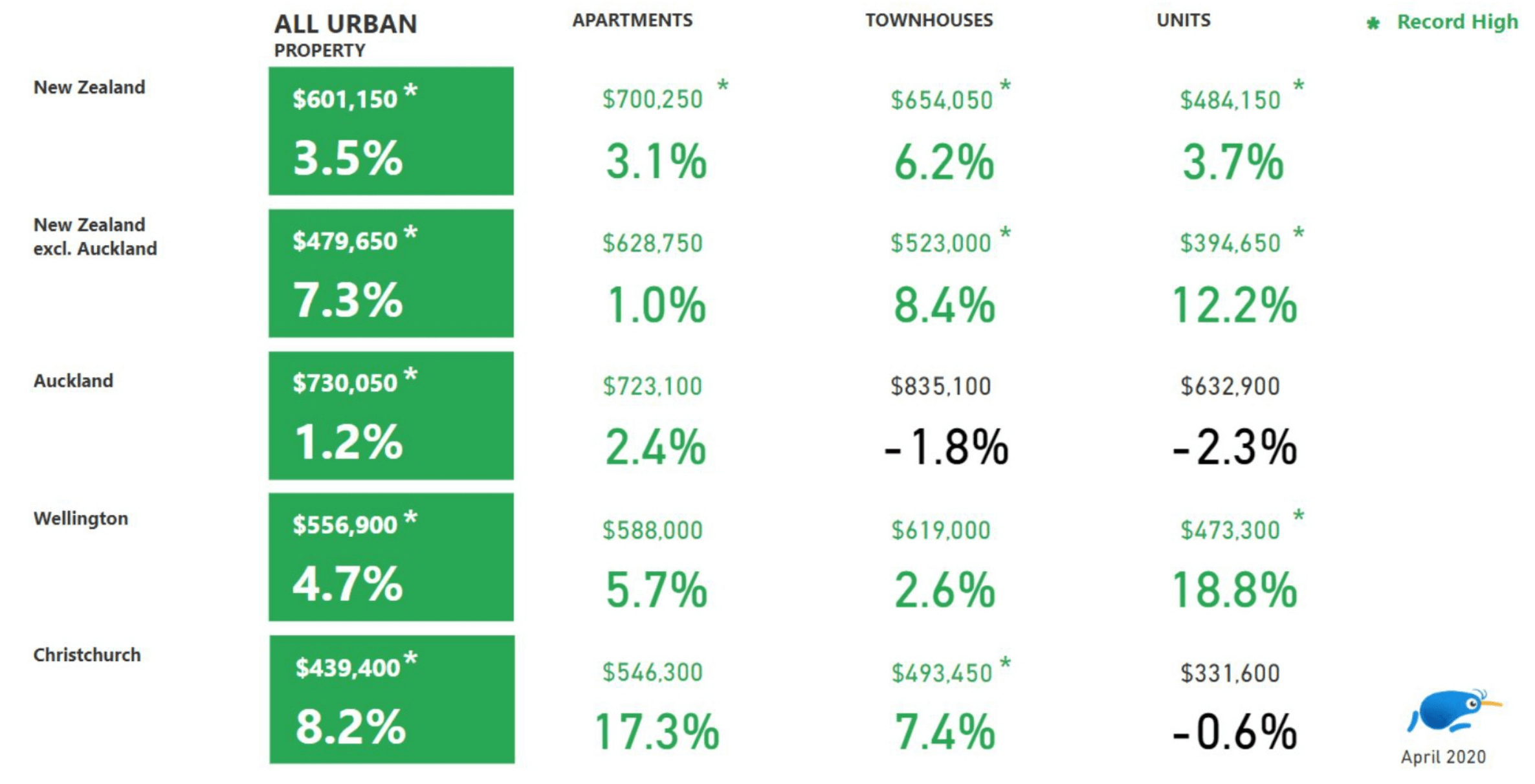

“Apartment prices in the city continued to rise, with the average asking price for an apartment reaching $723,100 in April, up 2 per cent year-on-year. nits and townhouses were down 2 per cent to $632,250 and $835,100 respectively.”

“All urban house types prices across all regions also reached new highs. “The average asking price for apartments reached a record $700,250, while townhouses hit $654,050 and units reached $484,150 for the first time.”

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.