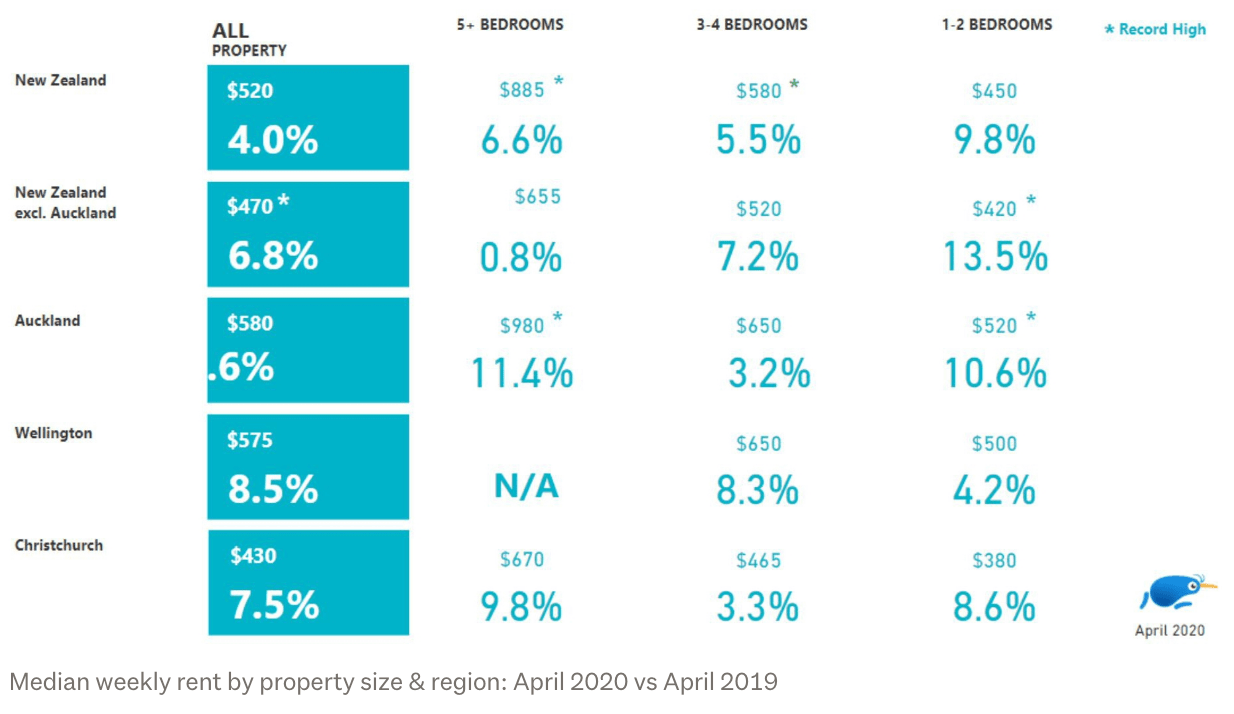

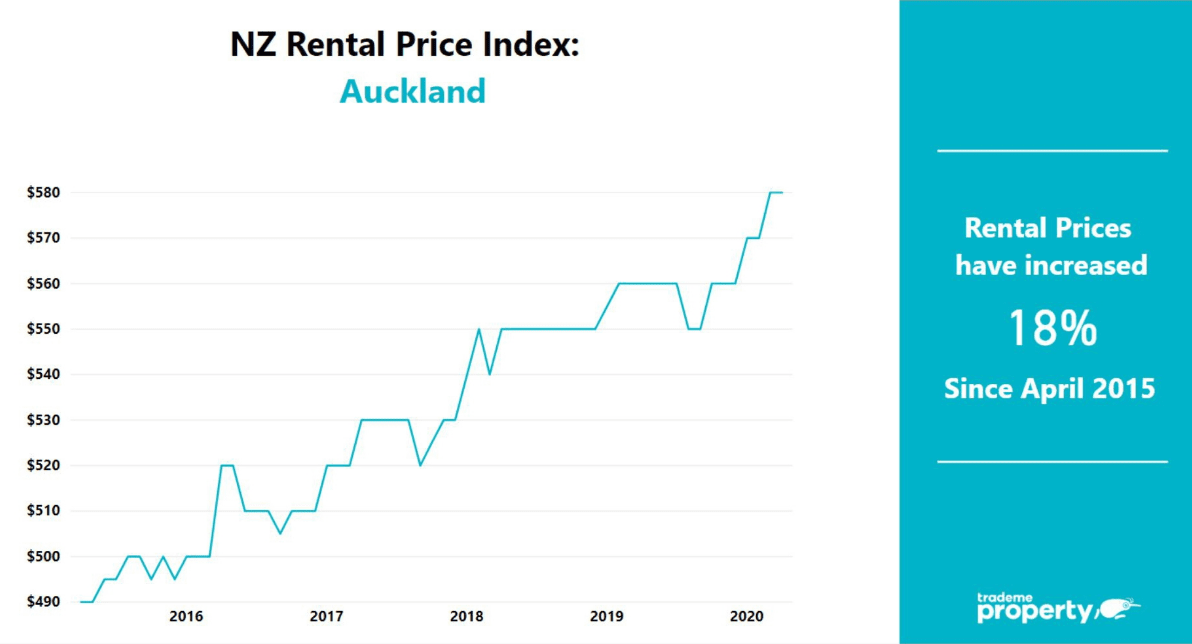

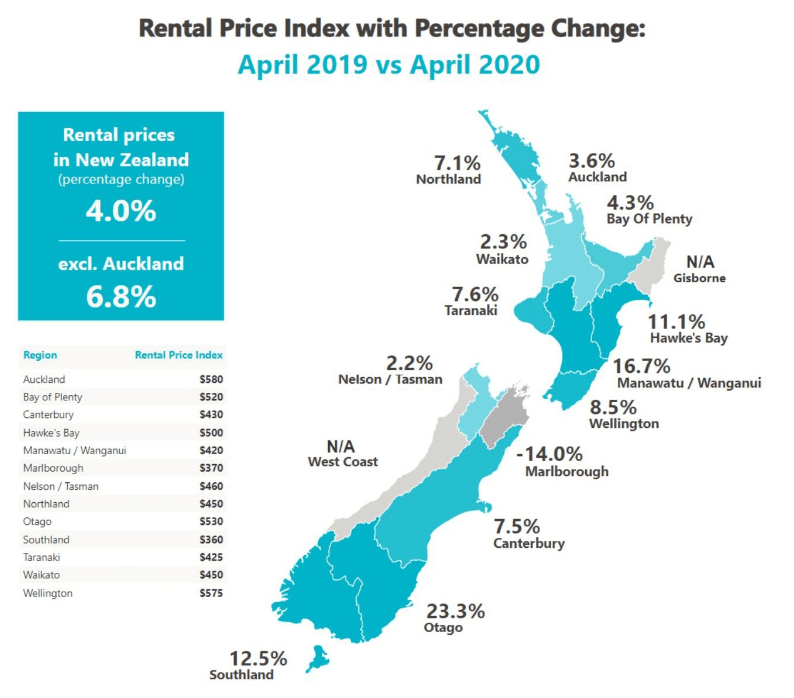

(4-min read) After modest growth over the last few months, Auckland rent prices slowed in April. The median weekly rent in Auckland was flat on the month prior, remaining at $580. When compared to this time last year, we have seen a 4% increase, when the median rent was $560 per week.

Supply and demand were both down in the Auckland region. The number of enquiries on rental properties across Auckland was down 54 per cent on April 2019.

The number of properties available to rent in Auckland was down 31 percent when compared to the same month last year.

The median weekly rent for small (1-2 bedrooms) and large houses reached record-breaking highs, both up 11 per cent from this time last year, at $520 and $980 respectively.

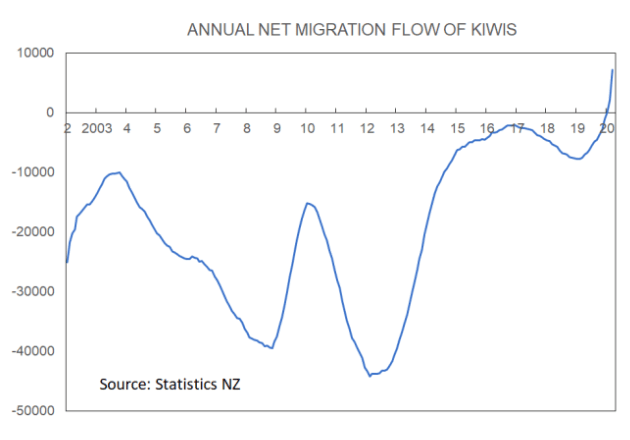

What about a big migration shock as a potential source of big downward pressure on prices? Let’s run some numbers. Treasury were expecting that in the coming year the net migration flow for New Zealand would have been around 45,000. Now Treasury think the number will be close to 4,000.

So, the population will grow 41,000 less than expected. However, during the March quarter of this year we saw a surge in the annual net migration inflow. It hit 67,000 in the year to March – some 22,000 above Treasury expectations.

This came about to a large degree because during the March quarter there was a net gain to our population from more Kiwis arriving than leaving of 6,000. In the March quarter of last year there was a net loss of 2,000.

In fact, in the year to March the net Kiwi migration gain was the highest on record at 7,100. The average for this measure since 2001 has been an annual loss of 19,000 Kiwis.

There is no brain drain. No-one is talking in terms of “this country is stuffed and I’m out of here man”. But back to the numbers. With the net migration flow about 22,000 more than expected, a year from now the migration gain won’t be 41,000 less than Treasury projected but about 19,000.

I was actually expecting a weaker net gain of around 40,000 a year from now rather than Treasury’s 45,000 so my calculated net population missing amount is even less.

At an average household occupancy rate for NZ of about 2.8 that means around 7,000 fewer houses needed than would otherwise be the case.

So, all you need is a decline in house construction in the coming year of 7,000 to offset the migration loss. The construction decline is likely to exceed that, with the Fletcher Building Chief Executive picking a 30% decline in house building to an annual 25,000 consents. A decline of some 13,000.

Therefore, in 12-18 months’ time there is a risk that whatever you calculate the housing shortage to be now, it could be bigger then. What happens after that depends upon how quickly our borders open and how long house construction falls away. These are things we can barely guess at this far out.

Picking likely price changes on the basis of calculations of housing shortages rarely yields accurate forecasts. But there is relevance in this regard. For now, talk of shortages is off the table. But that talk will return.

It took about four years to come back after the GFC when we went into that event with worsening shortages. I suspect the time for that concern returning will be less than half that four years this time around.

Oh, and will the government’s plan to build an extra 8,000 state houses have much impact? No. That goal is stretched over four years and includes purchase of some existing properties.

Plus, the government told us last week that they still working on their progressive home ownership model. This would give more people access to home ownership. That is, higher housing demand.

For your guide, and not suggesting at all that our markets are correlated, in China average house prices across the 70 biggest cities rose by 0.7% in April to sit 5.3% ahead of a year earlier. No crash.

Source: Trade Me Property and Tony Alexander

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.