(4-minute read)

Pushpay provides a donor management system, including donor tools, finance tools and a custom community app, to the faith sector, non-profit organisations and education providers in the US, Canada, Australia and New Zealand.

The company’s solutions simplify engagement, payments and administration, enabling Customers to increase participation and build stronger relationships with their communities.

Performance

Bruce Gordon, CEO and Executive Director said, “We are pleased to present a strong result for the year ended 31 March 2020. Pushpay has delivered solid revenue growth, expanding operating margins, EBITDAF growth and operating cash flow improvements over the period.”

“Our results are a reflection of our innovative products, the dedication of our teams in the US and New Zealand, and our culture of continuous improvement.

Over the year, we made significant progress toward our strategic goal of becoming the preferred provider of mission-critical software to the US faith sector.”

Pushpay has a strong track record of delivering on guidance. Since initially listing in August 2014, Pushpay has met or exceeded all guidance provided to the market.

Revenue growth

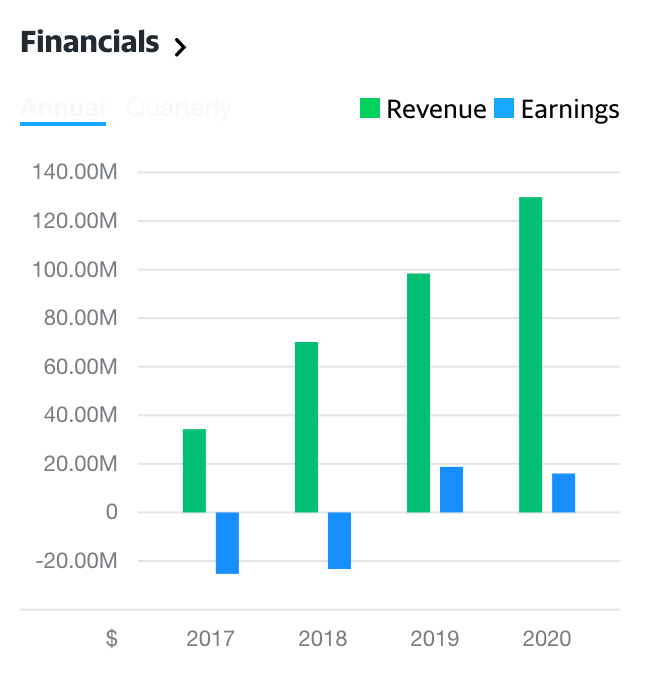

Pushpay increased its total revenue for the year ended 31 March 2020 by US$31.4 million from US$98.4 million to US$129.8 million, an increase of 32%.

Operating revenue for the year ended 31 March 2020 increased by US$31.6 million from US$95.9 million to US$127.5 million, an increase of 33%.

Excluding the acquisition of the ownership interests in Church Community Builder and associated costs and impacts, Pushpay increased operating revenue by US$27.2 million from US$95.9 million to US$123.1 million, an increase of 28%.

These results were attained through the targeted implementation of our strategy, growing team capabilities and expertise, and responsible investment into product design and development.

We expect to see continued revenue growth as the business executes on its strategy, achieves increased efficiencies and gains further market share in the US faith sector.

EBIDAF

Pushpay increased its EBITDAF for the year ended 31 March 2020 by US$23.5 million from US$1.6 million to US$25.1 million, an increase of 1,506%.

Pushpay released initial EBITDAF guidance on 8 May 2019, of US$17.5 million to US$19.5 million.

Over the financial year Pushpay increased guidance on three occasions, most recently on 18 March 2020 to US$25.0 million to US$27.0 million, excluding the acquisition of the ownership interests in Church Community Builder and associated costs and impacts.

Excluding the acquisition of the ownership interests in Church Community Builder and associated costs and impacts, Pushpay increased EBITDAF by US$26.2 million from US$1.6 million to US$27.8 million, an increase of 1,677%.

NPAT

NPAT declined by US$2.8 million over the year ended 31 March 2020, from US$18.8 million to US$16.0 million, a decrease of 15%.

The previous financial year included a one-time benefit arising from previously unrecognised tax losses and deferred research and development expenditure of US$20.9 million, which contributed to the net gain of US$18.8 million.

COVID-19

While a number of organisations have temporarily closed their physical premises in response to COVID-19, Pushpay has seen a clear shift to digital whereby Customers are utilising its mobile first technology solutions to communicate with their congregations.

Over the last quarter of the financial year, the Company experienced an overall increase in demand for its services and remains well-equipped to support Customers to leverage digital technology and drive continued congregation participation through the use of its mobile app.

Due to the restrictions around in-person gatherings, Customers have been emphasising live streaming, digital giving and driving connection through their apps for continued engagement with their communities.

In terms of digital giving trends, Pushpay processing volume over the month of March was higher than the Company expected prior to COVID-19.

Pushpay expects the increase in digital giving as a proportion of total giving resulting from COVID-19, to outweigh any potential fall in total giving to the US faith sector.

The shares have traded through a range of NZ$2.56/NZ$7.84 over the past year.

Board Composition

The Board comprises an Independent Chair, 2 Independent Directors and 3 Non-Independent Directors including the CEO, 2 females and 4 males.

At recent ASMs NZSA has raised the issue of gender diversity so it is pleasing to see two women were appointed to the Board in the past year.

There have been several other changes to the Board, and these are set out in the Annual Report.

The large and medium church sector is a $1 billion revenue opportunity according to Pushpay’s management.

The company is aiming to approximately double its earnings before interest, tax, depreciation, amortisation and foreign currency (EBITDAF) in FY21. Pushpay profit margins could keep rising as it gets bigger over time.

The company will hold its Annual Shareholders Meeting 2pm Thursday 18 June 2020. Due to the Covid-19 restrictions this was notified as a virtual meeting. You can join the meeting at https://www.virtualmeeting.co.nz/agm/PPH20/register

Source: NZ Shareholders Association (NZSA) / NZX

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.