(4-minute read)

Z Energy (Z) has reported a Historical Net Profit after Tax (HC NPAT) loss of $(88) million, compared with a profit of $186 million for the previous corresponding period (PCP).

The significant decrease in HC NPAT reflects several factors including lower retail fuel margins and reduced refining margins.

The loss includes non-cash impairment charges of $96 million, comprising the $35 million impairment of goodwill associated with the Flick investment as previously disclosed and a $61 million impairment of goodwill associated with the Caltex retail supply contracts.

The result also includes $33 million of Covid-19 related costs and provisions, an increase of $6m from the $27 million costs and provisions disclosed on 3 April 2020.

At an operating level, Replacement Cost EBITDAF1 (RC EBITDAF) was $366 million for the full year, in line with Z’s most recent guidance update, representing a decrease of $68 million (-15%) against the PCP.

The RC EBITDAF result includes the $33 million of Covid-19 related costs and provisions. Replacement Cost Net Profit After Tax (RC NPAT) was $44 million, down 75% from $178 million PCP after accounting for the non-cash impairment charges noted above.

Net operating cash flow for the year was $159 million, a decrease of 41% from $269 million over the PCP due to a decline in fuel margins and Z paying the Fixed Price Option (cash settlement) for the CY19 Emissions Trading Scheme (ETS) obligation in the first half of FY20.

Materially lower earnings impacted leverage ratios, which at the end of FY20 was 2.7x RC EBITDAF2 up from 2.4x at 1HFY20 and 2.1x at the end of March 2019. Debt repayments of $23 million were made during the year.

The Board has cancelled the final dividend for FY20, so the full dividend for the year comprises the 16.5cps interim dividend already paid.

Commenting on the results, Z’s Chief Executive Mike Bennetts said “The full year result highlights the competitive intensity of the retail fuel market in New Zealand and the severity of the low refining margins we saw in the last quarter.

The Covid-19 global pandemic is presenting numerous operational challenges, not least a material decline in demand for product.

Z continues to respond well to these challenges and has acted swiftly to reduce operating costs, increase cash flow and provide flexibility to the balance sheet that will position Z well for the expected improvement in post-Covid trading conditions.”

Risks & Challenges

The company continues to face difficulties with fluctuating oil prices, decreasing sales volumes and compressed margins. In addition, Covid-19 has resulted in lower sales volumes.

In mid-May the company raised $290 million via a share placement and $60 million via a share purchase plan. It intends paying down $180 million of debt to strengthen the balance sheet.

Directors fees and senior management salaries have been frozen and $8 million in staff bonuses cancelled. It plans on reducing contractors and employee costs by $14 million and operating expenses and distribution costs by $74 million to $96 million in the FY21 year.

Over the past two years competitors have opened 54 new retail outlets with 21 companies now supplying fuel to the market. The company’s retail fuel margin has dropped 59% since 2013, from 5.5 cents per litre to 2.3 cents per litre. Sales volumes for FY20 were down 7.3% at 3.8 billion litres.

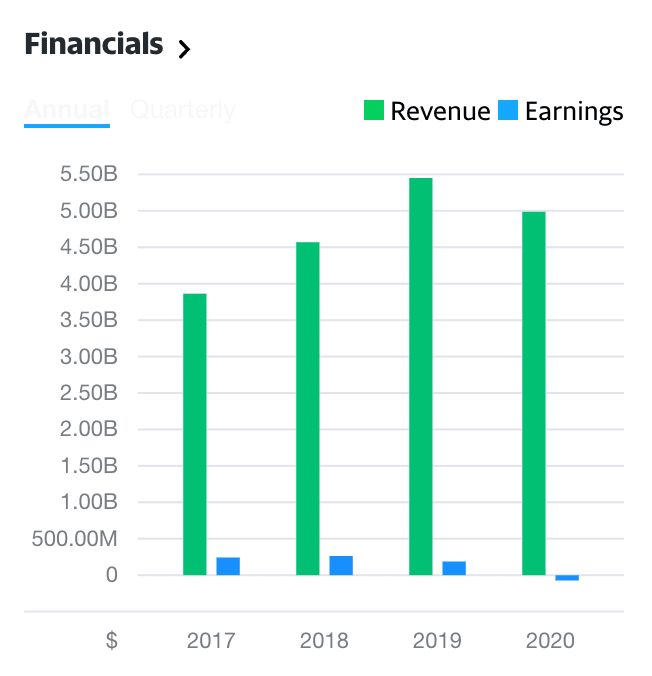

Revenue was down 9.2% at $4.9 billion resulting in a Net Loss after Tax of $88 million compared to a Net Profit after Tax of $186 million in FY19. The final dividend has been cancelled. The shares have traded through a range of $2.64/$6.82 over the past year.

The company will hold its Annual Shareholders Meeting 3.00pm Thursday 18 June 2020. Due to the Covid-19 restrictions this was notified as a virtual meeting.

You can join the meeting at; https://www.virtualmeeting.co.nz/z20

Source: NZ Shareholders Association and NZX

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.