(5-min read)

What a start to 2020 it has been. Some of the most extraordinary single-day stock price falls we’ve ever seen were then countered with some of the most terrific bounces of all time.

When we entered 2020, pundits on the TV were saying “this rally won’t last”. For once, they were right — even if they were right for the wrong reasons.

Suddenly, the market cratered in March 2020, and again pundits were saying “it’s got further to fall”.

But then, seemingly out of nowhere, the market staged the most dramatic recovery of the last decade. Between March 23 and June 10 — less than three months apart — NZX 50 went up 35%. The NASDAQ surged 44%. The S&P 500 bounced 43%.

Ignore the hype. Here’s how you take advantage of any market environment in 2020.

You could have taken advantage of opportunities earlier if you knew what to look for, or if you had analyst-grade tools to spot the weakness early. In the stock market, acting with conviction can be the difference between everything and nothing.

Below, we’ll show you how to target only the most attractive sectors and companies in the market.

But before we get to that, we want you to consider the latest acronym being ‘floated’ in the stock market.

She’s called TINA. Or rather, ‘it’ is known as TINA and it stands for There Is No Alternative (to the stock market).

Think about this:

– With interest rates near zero, money in the bank isn’t looking good, and

– With yields this low, the returns on bonds aren’t shaping up too kindly, and

– With unemployment recently spiking to record levels, is the housing market worth a roll of the dice?

Chances are, the more you think about, the more likely you will be considering that most investors have only a couple choices: commodities (e.g. gold) or stocks.

Some pundits say — based on historical evidence — gold might be a decent addition for a small part of a diversified portfolio since it tends to move the opposite way to uncertainty in the stock market (i.e. when stocks fall, gold can sometimes rise).

But even if the price of gold goes up, the shiny metal doesn’t pay any income, as a share does with its dividend.

In his 2018 annual letter to shareholders, Warren Buffett, the world’s greatest investor, compared buying 3.25 ounces of gold to the stock market over 77 years.

He found that the gold would be worth, “less than 1% of what would have been realized from a simple unmanaged investment in American business.”

The simple reality is that the best types of long-term investments tend to pay a reliable income stream and can achieve compound growth over time. To that end, there’s been no better example than the stock market. Buffett is a stock market investor who achieved over 2,000,000% returns (~20% per year) for his investors, between 1965 and 2019.

Can this rally continue?

The stock market legend Ben Graham summed it up best over 50 years ago when he said, ‘in the short run, the market is a voting machine. But in the long run, the market is a weighing machine’.

What he meant was, trying to guess what happens to the stock market in the short term (less than 12 months) is a fool’s errand. It’s completely random. Indeed, no-one knows for certain what happens next in the stock market, especially under the cloud of COVID-19.

That said, you’ve already met TINA, and ‘she’ tells us that there is no alternative to the stock market.

Now consider that not only do the alternatives appear pretty grim, one of the great things about the stock market is that there are over 10,000 stocks to choose from right now. And that’s just on the US market!

On 17/04/2019, the NZX (New Zealand market) had a total of 169 listed companies with a combined market capitalisation of NZD$147.8 billion.

Let’s see what it can do for investors right now…

A 3-part game plan – the smart investors are doing right now

The most important thing every investor needs to do right now is… drum roll… stick to their process. Indeed, a well-defined investment process is the reason experts get paid ‘the big bucks’.

But before you go thinking you need some specialist training or knowledge — think again. The simplest investment processes/strategies are often the most effective.

In 2013, the renowned financial columnist and author, Jason Zweig, wrote: “By building a checklist — a standardized set of questions you must answer before you commit to any investment decision — you can reduce the risk of making costly errors. The best way to do that is by looking at your past mistakes.”

“Checklists help fix one of the biggest flaws in the way investors make decisions: inconsistency.” – Jason Zweig

If you have a plan, stick to it. Regardless of what the market is doing. If you don’t have a plan, come back to that.

But right now, without further ado, here’s our 3-part game plan…

1. Know your downside

Again, we’ll draw on the wisdom of a great thinker and investor. Charlie Munger is one half of the investing duo at Warren Buffett’s Berkshire Hathaway (NYSE: BRK).

Here’s one of Munger’s great quotes about investing:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Meaning, instead of trying to ‘swing for the fences’ during market volatility, the most important part of successful investing is to avoid losing money. In one word: risk.

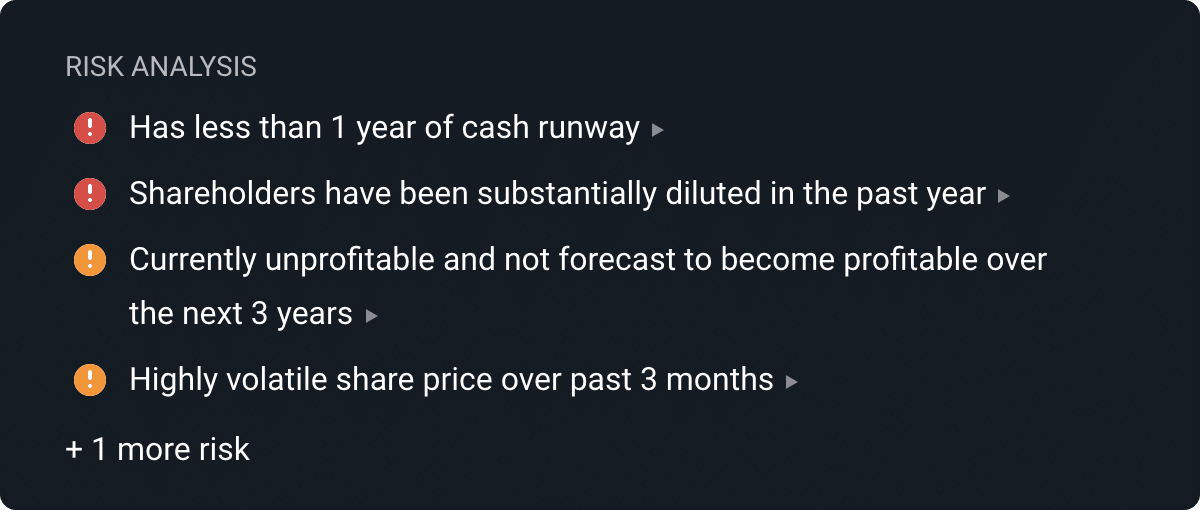

Before you buy anything — especially a stock — you should be aware of the key risks.

I use the Simply Wall St platform which produces a consistent but detailed report on 14 key risk measures. This is NOT a promo of their service because I genuinely think everyone must use some kind of tool.

You can register for FREE before you invest your hard earned cash in any company.

It helps to avoid costly mistakes and gathers the information from multiple sources. For example, are analysts forecasting revenue to fall? There’s a reason some stocks will never recover.

Have insiders (the CEO, board, executives, etc.) been selling? Talk about potential red flags…

The image above, taken from a Simply Wall St analysis of Hertz, shows a simplified version of our detailed risk analysis. We all know where Hertz is today…

2. Follow the cash

The third part in our process is arguably the most important: cash flow valuations.

If price is what you pay, valuation is what you get.

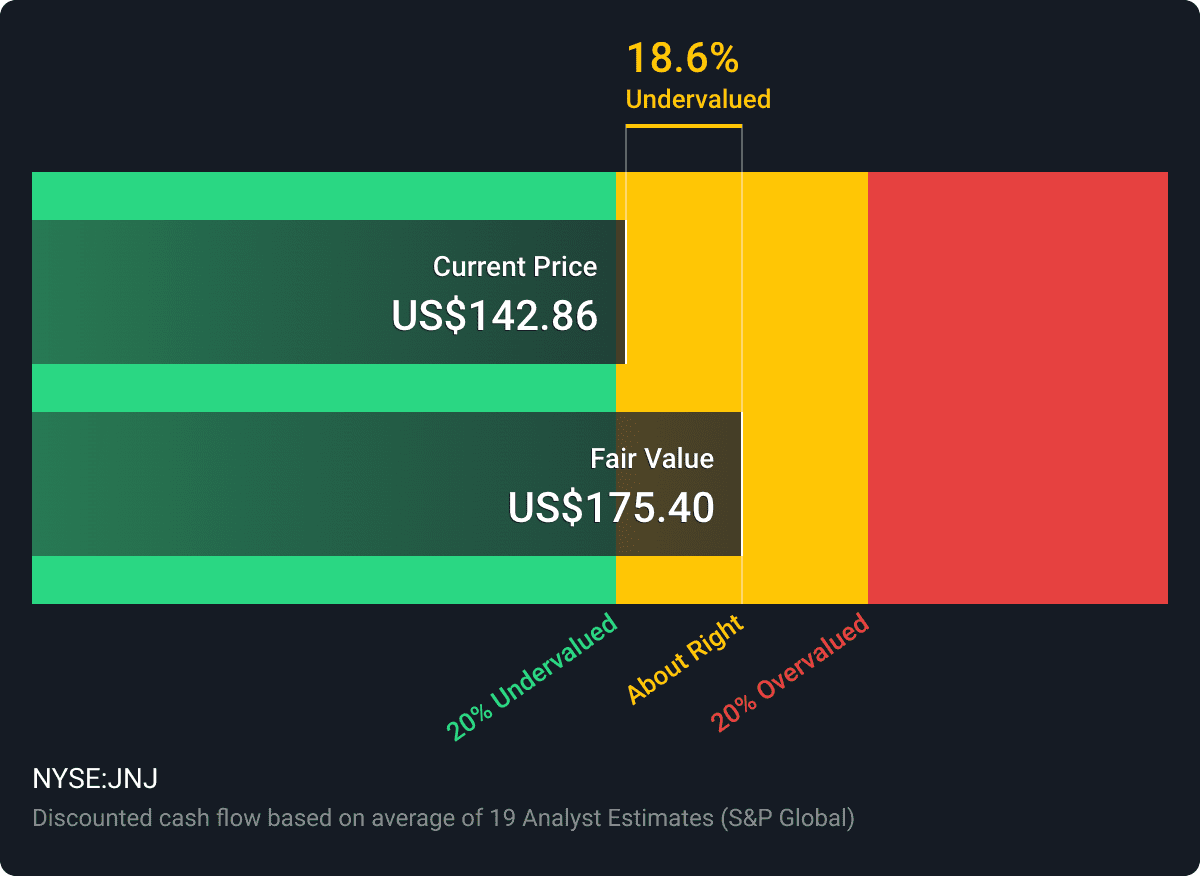

Everyone knows they should buy stocks when they are undervalued, not overvalued. But how do you really know if a company’s stock is undervalued?

On Wall St, the most rigorous analysis a professional analyst will conduct is a Discounted Cash Flow (DCF) analysis (note: for bank stocks they would likely use a Dividend Discount Model or DDM).

A DCF sums up the cold hard cash a company is expected to generate in the future and converts it back to today’s dollars, so you can compare it to the stock price.

Every six hours they are analyzing the valuations of tech stocks, industrials, financials and more, most often using professional analyst forecasts of the future cash flows a company is expected to generate.

The platform takes the output of the estimated “intrinsic valuation” and compares it to the current stock price for you.

Meaning, the platform does all of the heavy number crunching so you don’t have to. They use industry-standard modelling techniques to estimate valuations. All of the models are open source on GitHub, so anyone can verify our work.

3. Don’t forget the dividends

Finally, investors shouldn’t forget the importance of dividends. Good cash flow can drive very generous dividend income throughout a market crash. And when interest rates are at record lows this focus becomes even more important.

One of the great things you can do is use the Stock Screener tool to start sifting through the Dividend Rock Stars stock list. These companies have a history of paying reliable and growing dividends.

In summary, here’s the simple stock market investing for you in 2020:

1. Find free tools and analytics to check on the risks and valuation of the company’s stock.

2. Use screening and pre-built filters to identify exactly what you’re looking for (cash flow, strong track record, financial health, etc.).

3. Create your personal checklist that follows your strategy and minimises mistakes. Even the greatest investors forget important details but you don’t have to make the same mistake!

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.