(2-minute read)

A few short months ago most of us had never heard of COVID-19, now it’s at the forefront of everyone’s mind.

Beyond the health impacts, it’s been big news for the New Zealand share market and markets around the world.

We’ve seen record retail participation and trading levels – with comparatively good resilience in the NZX 50. In this article we’ve highlighted some interesting stats.

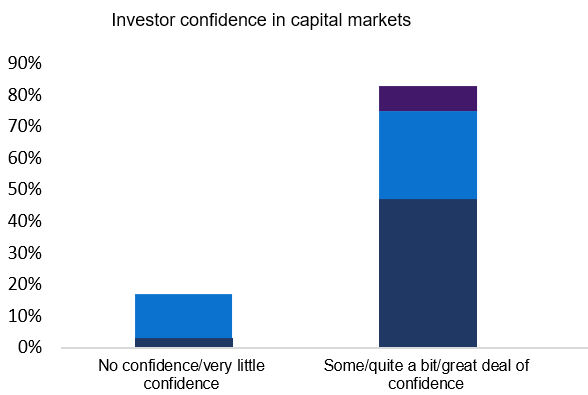

Strong investor confidence

While there’s been a huge amount of volatility through 2020 it’s great to see that Kiwi investors remain bullish.

In Chartered Accountants Australia and New Zealand’s June survey, 83% of respondents said they were confident (some/quite a bit/great deal), almost unchanged from the 85% reported at the same time last year.

The NZX 50 has proven its resilience through the COVID-19 market correction and recovery.

By 30 June 2020 the New Zealand market had already recovered more than 34% from the low-point of March 2020 and outperformed the S&P 500 year-to-date (NZX 50 down 1.44% YTD vs S&P 500 down 4.04% YTD).

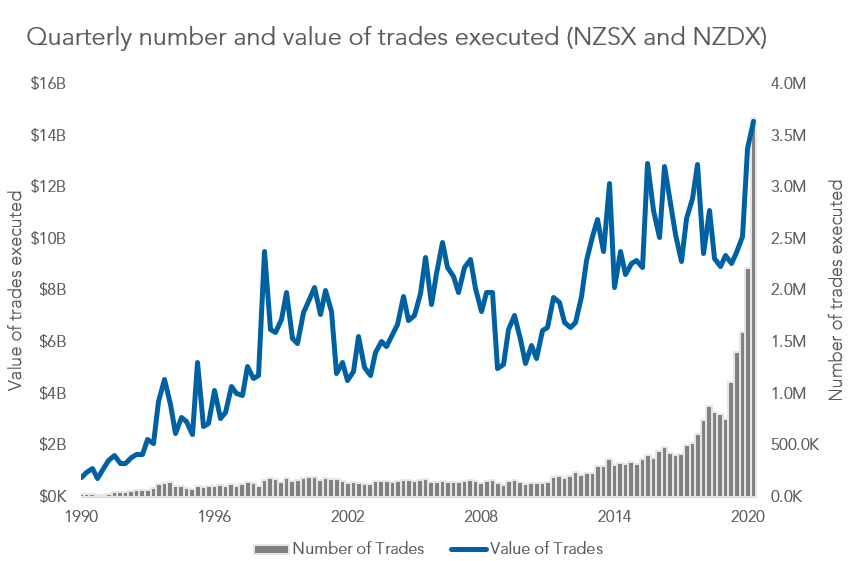

Record trade numbers

A record $13.5 billion and $14.5 billion was traded in the first and second quarters of 2020, with Q2 smashing five previous records – with over 3.7 million trades.

As at 30 June 2020, nearly 6 million trades had been processed, a significant increase from the whole of 2019, of less than 5 million.

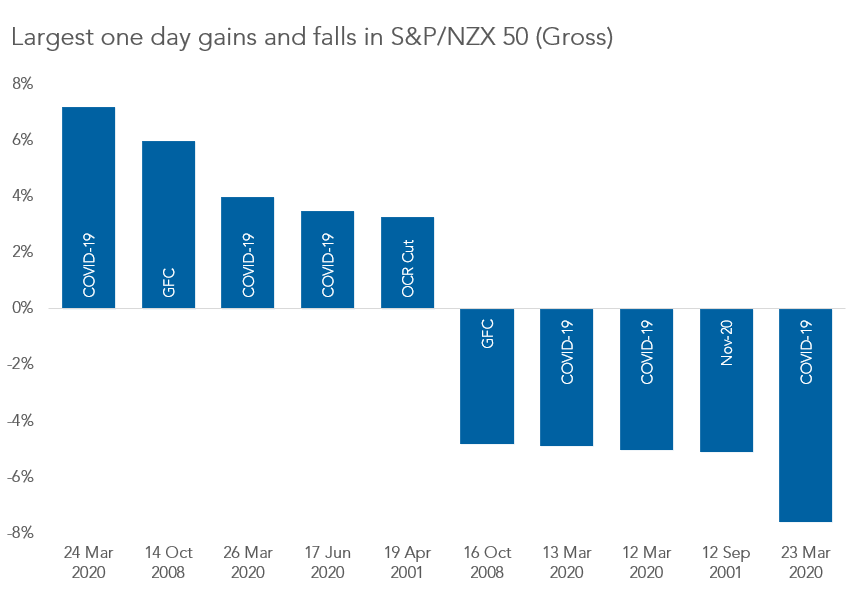

Some big ups and downs

Experiencing the highest period of volatility ever recorded, the first half of 2020 saw six of the top ten largest one-day gains and five of the top ten falls – with the biggest gain recorded at 7.2% and the biggest fall at 7.5%.

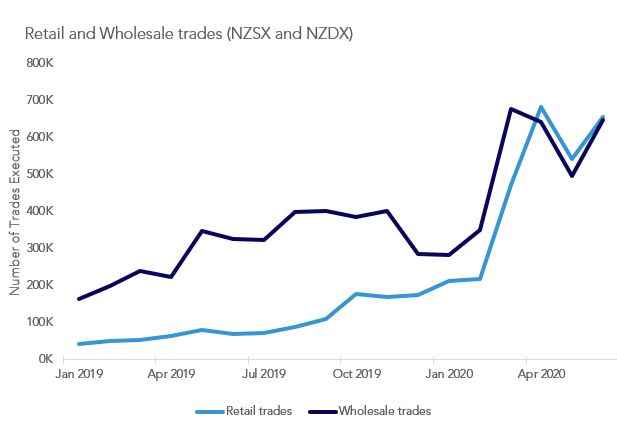

The rise of retail investors

Over the second quarter of 2020, we’ve seen a jump in the number of retail investors participating in the market.

In April, for the first time ever, there were more retail trades than wholesale (1.9 million vs 1.8 million).

What do you think about it? Tag me on your favourite social media.

Source: NZX

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.