(9-minute read)

We continue to expect the unemployment rate to creep towards 9%, but the impact on housing is likely to be reduced.

The impact of the lockdown is far greater than any other economic event since the Great Depression. But it lasted only 6 weeks.

Unlike previous recessions, the impact on the financial system was limited. Banks are lending, and the appetite to do so remains strong.

If all goes well (big if), a 5-6% dip in house prices would represent a very mild reaction to such a dramatic economic upheaval.

There are 3 strong foundations supporting the housing market:

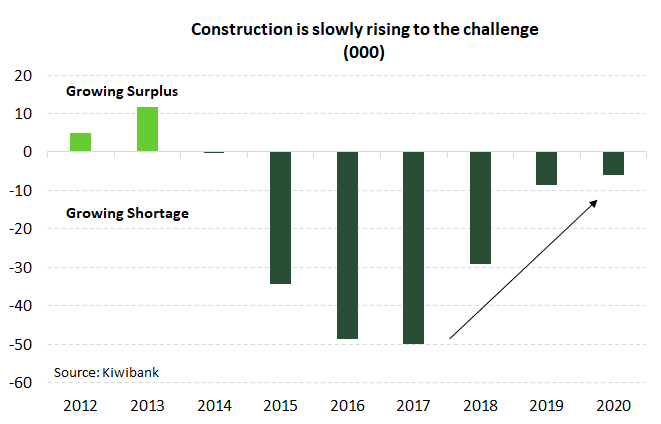

1. The housing market has a chronic shortage (see below chart)

2. Mortgage rates are at record lows;

3. Population growth will continue, after the disruption.

“Millennials are battling baby boomers at auction sites in Auckland for tiny pieces of this city, while everyone else shakes their heads in disbelief at the property prices (post lockdown, mid global pandemic).

It still takes 2 hours to get anywhere when it rains…” Namrata Heble, Business Manager

“Houses in Akl market are still selling, but only to those with high incomes.

The rest of us spend an hour in a traffic jam next to a car that has more power going to its speakers than its wheels.” Ged Curtain, Senior Commercial Manager

Auckland is the gateway to the North. But the drawbridge has been raised. Auckland’s rebound is showing less vigour.

Prices are slowly trekking higher, but with a long shelf-life.

Nonetheless, Auckland’s housing market is heating up into spring.

Take for example the 40% year-on-year spike in listings on realestate.co.nz, Barfoot’s highest sales performance in July for five years, and the recent 300-person viewing party for a brick-and-tile granny’s flat.

You’ll only find more Jaffas in a Cadbury sack, or rolling down Baldwin street.

Record low interest rates and loosened LVRs are pulling more first home buyers, and investors, off the sidelines – as intended.

Our Housing Shortage Persists…

In August 2018, we identified a staggering shortage of 100,000 dwellings. We re-ran the model in 2019, and given StatsNZ’s population estimates, we found a significant worsening to 130,000.

The migration boom had continued. And the shortage had worsened. The shortage ballooned despite the industry’s best efforts to boost supply.

The construction sector was firing on all cylinders at the time. Solving NZ’s chronic shortage of affordable dwellings seemed even more difficult with(out) Kiwibuild.

So Where Do We Sit Now?

Well, with the stroke of a pen, StatsNZ made some rather large revisions to population estimates that should have been clear from the 2018 census.

Basically, our “team of 5 million” took longer to get to 5 million.

The ‘revised’ population estimates are 50,000 short of the numbers we used this time last year.

And an economic model is only as good as the data you pump through it.

- Despite the debacle that was our census, NZ still has a chronic housing shortage. We (re)estimate the shortage to be 80,000 and growing.

- The supply of homes has increased sharply. But we’re still falling short. And the prolonged impacts of Covid-19 cast a long shadow over the construction industry into 2021. Commercial property looks likely to bear the brunt of the adjustment.

- With housing in such short supply, our projected house price falls should meet strong resistance.

…but Perhaps Not for Much Longer

The construction sector has geared up to build the houses we need. And the start of the year we were finally building enough homes to offset growth in demand.

NZ looked set to start addressing the housing shortage that had built up since 2015. Then along came Covid-19, lockdowns, and a bubble of 5 million.

And then there’s the flood of Airbnbs reluctantly hitting the market. The outlook for construction activity has been upended.

But there’s a glimmer of hope for the residential construction sector. It turns out that the “Building Together” Budget involves actual building.

A $5bn housing spend was stipulated in the May Budget.

Over the next five years, the Government aims to build 8,000 new state homes.

The investment is on top of the 6,400 homes already promised which are currently “in the pipeline”.

The package should encourage employee retention and provide companies with some certainty planning ahead. Well, that’s the intent.

The project however is showing some semblance to its (disappointing) older brother, Kiwibuild.

But with a more realistic target, and some slice of the $1.6bn trades training funding pie, Kiwibuild Jr. could stimulate the weakened sector and reduce our housing shortage.

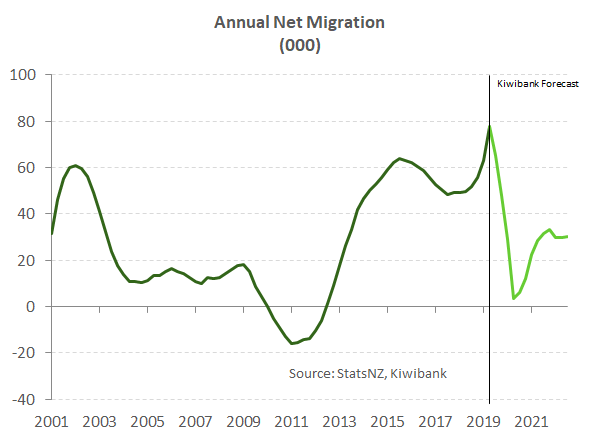

NZ’s population growth surged 2%yoy in the first quarter of the year.

That’s a rate of population growth we haven’t seen since late 2016 – at the height of the last migration boom.

Net migration was the main driver, hitting a new record high of almost 85,000 people in the year ending March.

Kiwis returned home in droves as NZ headed into lockdown.

The typical net outflow of Kiwis reversed into a rapid inflow. But there was another element contributing to the jump in net migration.

StatsNZ noted a significant number of short-term arrivals stayed in the country as Covid-19 engulfed the world.

Leaving NZ became difficult, given a lack of departing flights. And some visitors may have decided to stay put until things blew over (and they’re still waiting).

However, the surge in population growth is not expected to be sustained, in the near-term at least. Net migration is falling fast.

The closure of our borders to all but NZ citizens and residents, has seen the cross-border flow of people evaporate.

We are set to see annual net migration plunge from here, while our borders remain closed.

We are forecasting annual net migration to fade to a paltry 3,500 by March next year.

With the number of Covid-19 cases rising at a frightening pace outside NZ, the prospect of our borders opening anytime soon looks remote.

We are assuming that NZ will re-open borders around the middle of next year. But we understand the significant degree of uncertainty around the timing of open borders.

And we could be in a situation of restricted international movement for years to come. Falling net migration is expected to see housing demand ease into 2021.

So long as the building sector can keep the current pace of building, NZ’s housing shortage will fall next year.

We must bear in mind that migration data is subject to significant revisions. Because StatsNZ uses the so called 12/16-month rule.

A long-term arrival is someone who spends 12 of the next 16 months in NZ. And a long-term departure is someone 12 of the next 16 months living abroad.

These numbers can be thrown around as people change their mind.

At present, the significant number of short-term arrivals staying in NZ, could easily become outflows in coming months.

Future updates to net migration figures will probably be thrown around somewhat.

An outflow of Kiwis is unlikely at present. Labour markets around the globe have been ravaged by Covid-19.

Likely putting off even the most intrepid Kiwi intending on an OE.

And the willingness of Kiwis to move overseas must have been reduced by the virus itself.

But for those brave enough to leave God’s country, key long-term destinations have fewer restrictions on Kiwis.

So you’re a Kiwi human rights lawyer, and you actually want to move to Amsterdam? Come on in. You don’t have to isolate. Tell us how you guys did it?

When our borders are reopened, we expect to see a lift in both Kiwis heading offshore, and migrants knocking down the door.

The Covid-19 pandemic has strengthened Kiwi.inc.

Our reputation as a must-see country has gone from strength to strength. And there’s been a spike in foreigners wishing to move to NZ as a result.

Longer term, NZ as a destination, either a tourist destination or final destination, should see net migration remain supportive of economic activity and housing.

A Lack of Job Security Will Weigh on Demand for Housing

Slowing population growth won’t be the only element sapping housing demand over the second half of the year.

NZ’s labour market has come under the strain of Covid-19 and the associated lockdown.

Jobs have been shed and the unemployment rate is heading for the highest rate in around 30 years.

Job security is an important driver of confidence among individuals to buy and invest in housing – typically the largest financial decision someone will make in their lifetime.

And job security is likely to come under renewed threat for many.

According to the latest unemployment rate at least, the labour market has so far weathered the Covid-19 crisis unscathed.

If the headline number is to be believed, the unemployment rate fell to 4% in the June quarter.

Yes, NZ managed to come out of lockdown much sooner than many had thought possible.

But we can’t fathom that the unemployment rate would fall during the greatest economic crisis since the great depression.

And in reality, it didn’t. To be counted as unemployed someone must be actively seeking paid employment.

It was impossible to actively seek anything during lockdown.

Many people that would have usually been counted as unemployed in Q2 were classified as being outside the labour force.

Underlying data tells a more damaging story.

The total number of hours worked plunged over 10% in the second quarter.

And around 650k people were either away from jobs, worked fewer hours than they wanted, or were less active over the quarter.

NZ’s labour market clearly isn’t unscathed, and the June quarter is far from the low point in the current crisis.

Cushioning the blow to the labour market has been policy such as the Government’s wage subsidy.

We expect to see further job losses as some firms still face difficulty retaining staff post subsidy.

Another concern for the labour market is NZ’s closed border. Short-term visitor arrivals into NZ look like an increasingly distant prospect.

And once NZ’s sugar rush of post lockdown spending wears off, firms reliant on international visitors will be exposed once again.

There are rising cases in some of our key trading partners such as Australia and the European Union.

We are expecting another round of job losses over the second half of 2020.

And an unemployment rate that will peak over 9% in the final quarter of the year.

For the housing market, a rising unemployment rate doesn’t bode well for housing demand and house price growth.

Covid-Caused Commercial Construction Conundrum

The Covid-induced lockdown has accelerated the trend toward a more digitized world. Our spending data has shown a structural break higher in online shopping.

We were already moving towards the convenience (and greater choices) of online shopping, but being stuck at home for 6 weeks sped up the move.

Many consumers tested online shopping for the first time, and had a good experience.

More importantly, we shopped more online as we worked from home. And now many businesses are taking the opportunity to rethink their workspaces.

Many service-based businesses, including accountants, lawyers, bankers, and any sales force, are embracing the ability of staff to work more from home.

Scheduling staff days in, and out, of the office is enabling many businesses to reduce floor space.

It’s a productivity push that is helping many firms cut costs on costly overheads, and actually boost output.

Studies have found that employees working from home spend more time on their computers.

In Auckland’s case, cutting 2 hours of infuriating time spent in traffic, brings a valued lift in workplace well-being. It’s the way of the future.

But what does that mean for commercial property? A shift to working from home will change the nature of many places of work.

If a large share of the workforce continues to work from home, office space in our largest centres will be freed up, helping to boost productivity.

Businesses may find more resources to invest in the next opportunity.

On the flipside however, the commercial property sector will likely face the challenge of reduced demand.

We expect to see a continued increase in available office space (leases) into 2021.

We are already hearing anecdotes of commercial property projects being shelved, or even converted into residential projects.

Construction is running at high capacity, finishing off existing projects, but there’s likely to be a significant drop in commercial space into 2021.

NZIER’s latest Quarterly Survey of Business Opinion noted similar observations.

Architects are feeling uninspired and their pencils remain sharp as they expect fewer visits to their loft office.

Many industries may grab onto opportunities made available by disruptions to global supply chains.

The inevitable reallocation of resources towards more productive firms and processes will have benefits.

The faster adoption of productivity enhancing technologies such as AI and automation seem obvious.

Source: Jarrod Kerr, Chief Economist, KiwiBank

What do you think about it? Tag me on your favourite social media (Facebook / Instagram / LinkedIn / Twitter).

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.