(9-min watch) The market was heartened by Prime Minister Jacinda Ardern’s update in the battle against the virus outbreak. There were 5 encouraging signs and we will discuss them now.

1/ Easing level 3 in Auckland and level 2 for the rest of the country will support stocks such as Auckland International Airport, Air New Zealand, Tourism Holdings, Vista Group, SkyCity and the listed retailers.

2/ Record-low interest rates have been encouraging the flow of cash into the share market with investors seeing it as one of the few options for a return on capital.

Baby boomers or bank savers are forced out of term deposits, out of fixed interest investments and get into other assets.

The Reserve Bank said it is ready to introduce negative rates if more easing is required. ANZ Bank today joined ASB Bank in saying it expects the central bank to cut the official cash rate by 0.5% to minus 0.25% in April.

3/ The headline figures in the results are not fantastic but operationally the NZX-listed businesses are doing better than expected and the reporting season has been welcomed so far.

4/ Finance Minister Grant Robertson announced the Government is extending the wage subsidy scheme to September 14 at a cost of $510m and covering 470,000 jobs. The Government is also simplifying the leave scheme for workers told to self-isolate at home and still receive the wage subsidy.

5/ The Government has agreed in-principle to extend the mortgage deferral scheme to March 31 next year. The scheme to support households was due to expire on September 27.

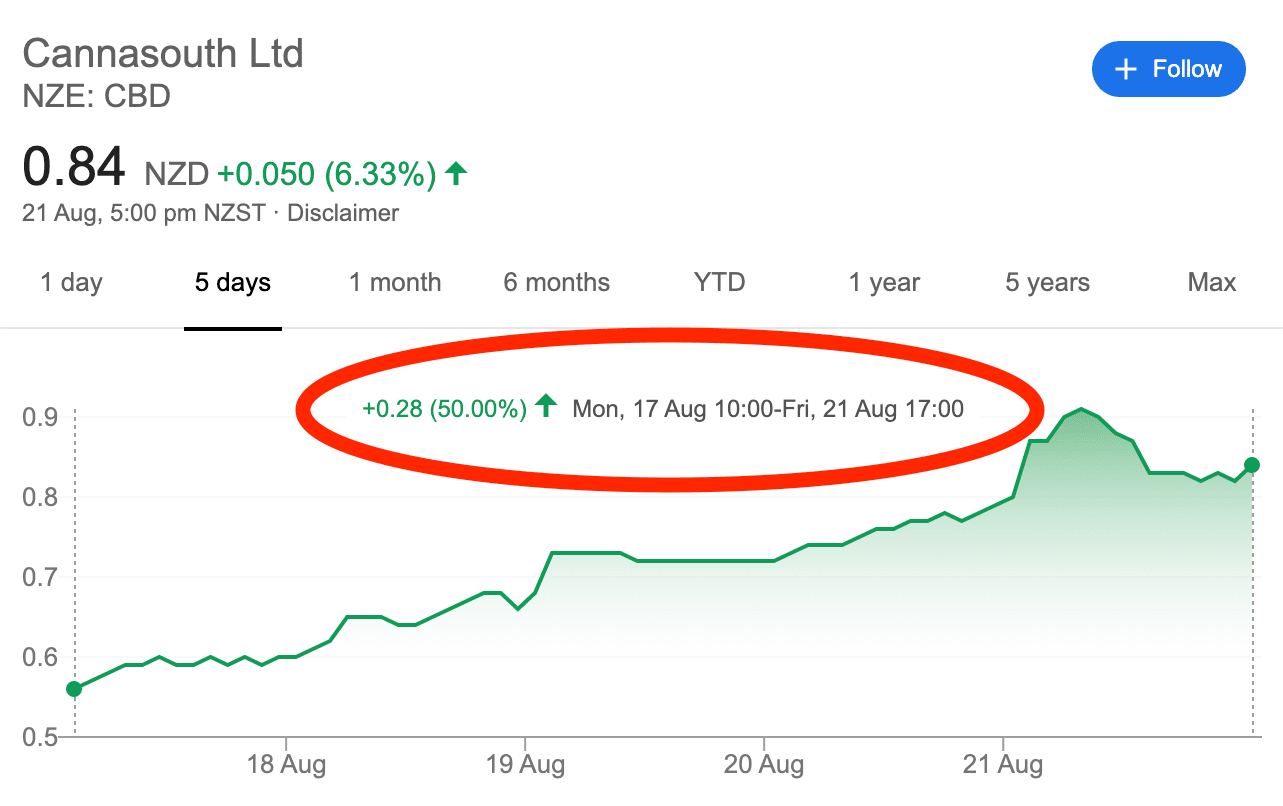

Medicinal cannabis stock Cannasouth jumped 50% over the last week.

This was despite getting a ‘’please explain’’ from the NZX for the rapid rise this week, to which the company stated it had not breached disclosure rules.

The stock has been rising in anticipation of the recreational cannabis referendum and a growing medicinal cannabis industry.

Do you think now is a good time to invest in Cannasouth or should we stay away? Let me know in the comments below.

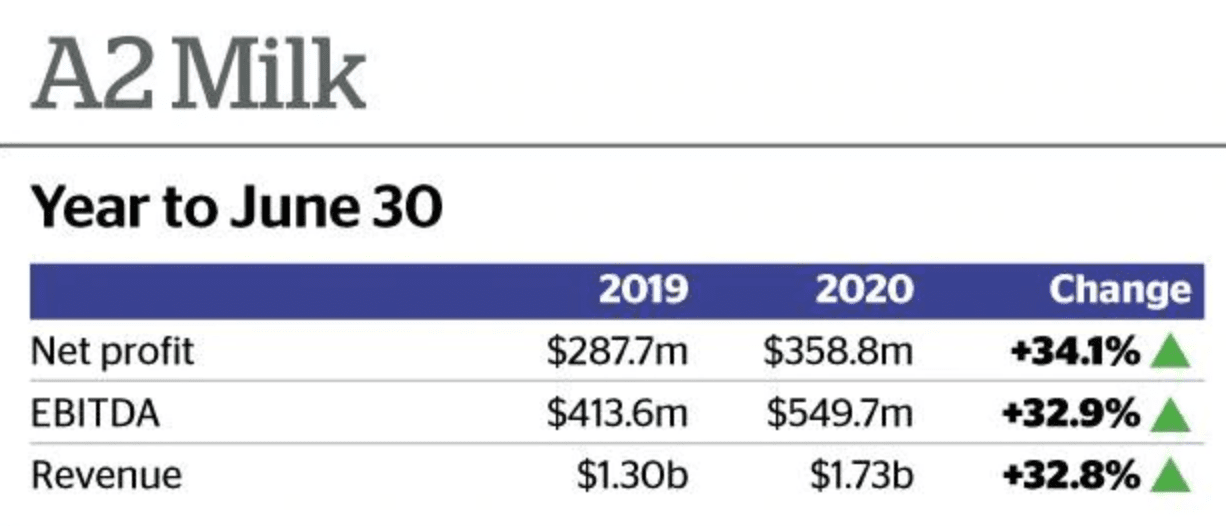

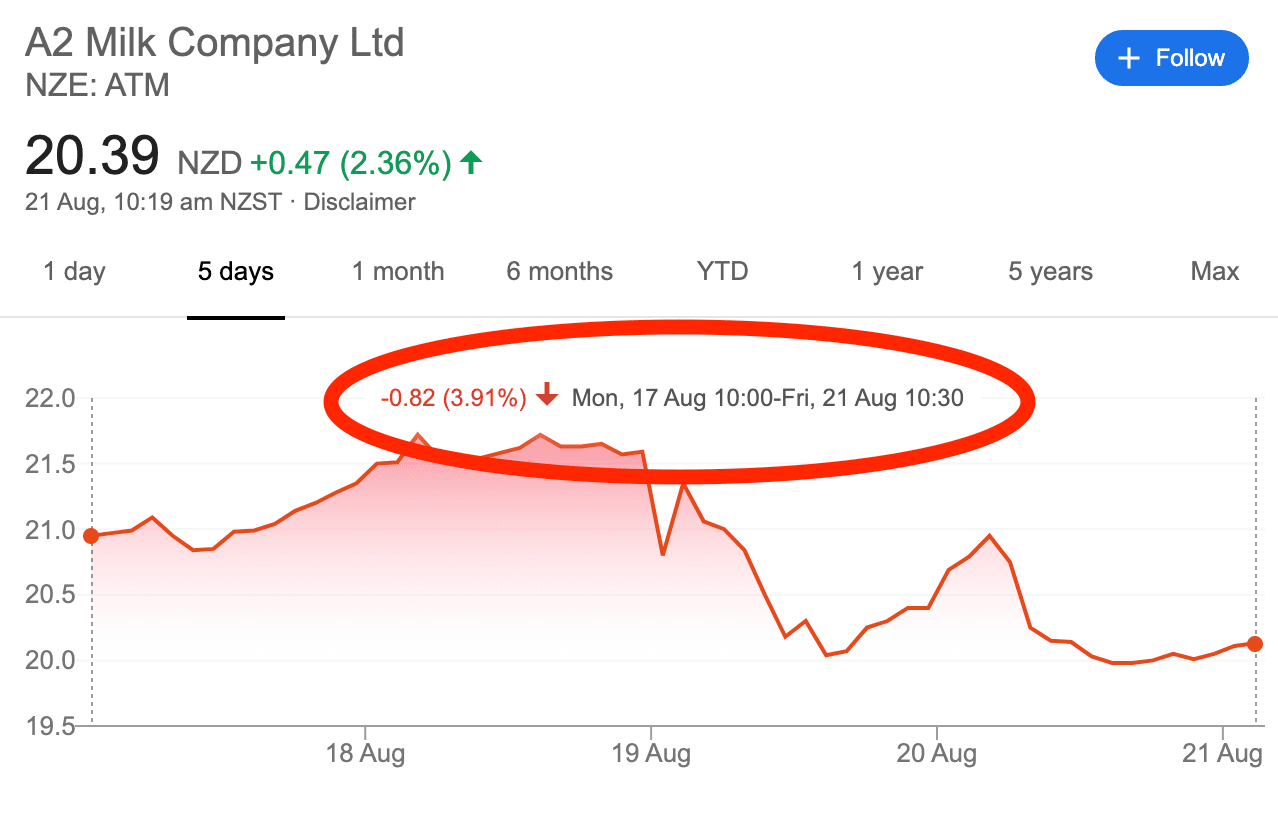

a2 Milk For the year ending June, the company reported a 34% increase in net profit to $385m on revenue of $1.7 billion, up 33%.

a2 Milk doubled sales in China to $337m and expanded distribution to 19,000 stores. The China label now makes up a quarter of a2 Milk’s global infant formula business.

The share price declined 3.3% because the numbers were in line with the middle of the company’s guidance range, but the expectation had been for the result to be at the top of the range.

When you are priced for perfection anything less is going to see your share price come back.

However, the stock recovered a bit after announcing it was looking to buy 75% of Mataura Valley Milk for approximately $270 million to add in-house manufacturing capability.

China Animal Husbandry Group will retain the remaining 25% shareholding.

Hallenstein Glasson. On the flipside, people expected the worst with Hallenstein Glasson and it wasn’t. It coped well, paying a good dividend and we see a lift in their share price.

It jumped 31% after the clothing retailer said online channels helped to keep annual sales stable through the pandemic lockdowns. Online sales grew 80%.

Overall sales increased 0.1% despite the interruption from pandemic lockdowns, profit declined just 6% to 27m and the retailer declared an interim dividend of 15 cents per share.

It is an example of retail business rolling with the punches and finding new ways to reach their customers. In a yield-starved market that dividend starts to look pretty attractive.

*** Metro Performance Glass shares jumped 19% after the company said its Australian business was profitable in the four months through July.

What do you think about it? Tag me on your favourite social media (Facebook / Instagram / LinkedIn / Twitter).

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Subscribe now so you do not miss the next video

➔ Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.