Not a single region in the country experienced an increase in the number of properties sold during August 2017 (compared to the same time last year).

This phenomenon that has only happened three times in the last seven years, according to the latest data from the Real Institute of New Zealand (REINZ) – source of the most complete and accurate real estate data in New Zealand.

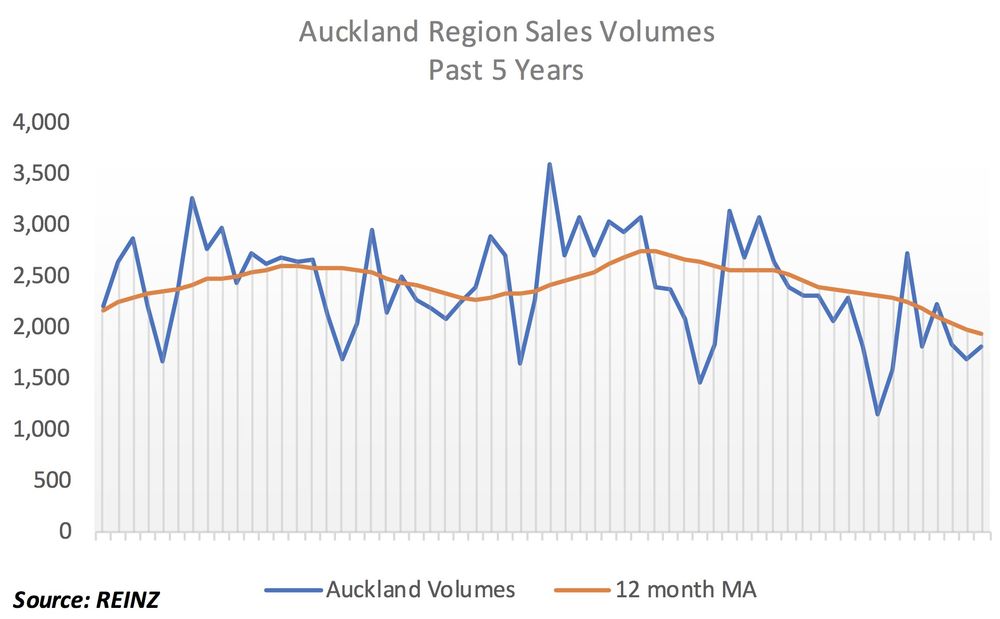

Overall, the number of properties sold across the country fell by 20% during August (Auckland 21.5%), a reduction of 1,472 properties, when compared to the same time last year.

If you looked at the number of properties sold, without looking at the bigger picture, one might assume that the market was showing significant signs of slowing.

However, as prices are holding up, and even increasing, then it suggests that people may be holding off from selling their property unless it’s absolutely necessary,

“The slowdown in the housing market has been larger and more persistent than we’ve observed in the past when loan-to-value limits have been tightened (or when buyers may have been nervous about an election outcome).

We have long emphasised the role of interest rates in determining house prices; the rise in mortgage rates over the past year, following two years of steady declines, appears to have had a significant dampening effect on the housing market.

We can’t rule out a temporary post-election pickup in the housing market. But with sales continuing to decline, days-to-sell on the rise and the other inventory of unsold homes increasing, we expect that housing price growth will remain subdued for some time yet.“ Satish Ranchhod, Senior Economist, Westpac Bank

Residential prices increase

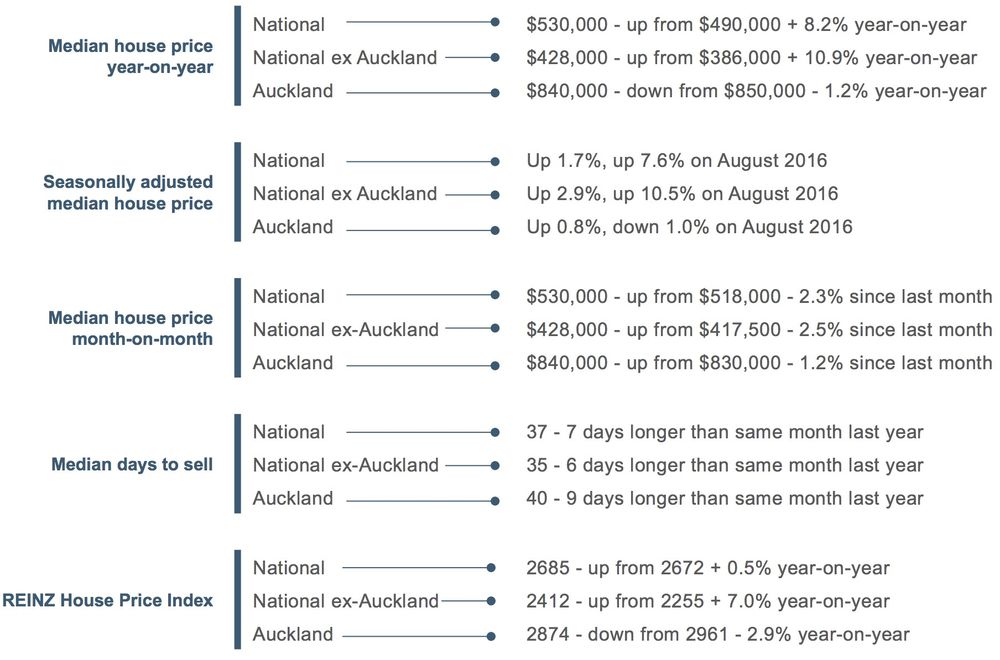

Residential property prices across New Zealand increased by 8.2% year-on-year to $530,000. Nationally, excluding Auckland, median prices increased 10.9% year-on-year and Auckland median prices decreased by 1.2% year-on-year.

However, on a month-on-month basis, Auckland’s median price increased by 1.2% or by $10,000.

REINZ House Price Index

The REINZ House Price Index, which measures the changing value of property in the market, showed Auckland dwelling values decreased by -2.9%.

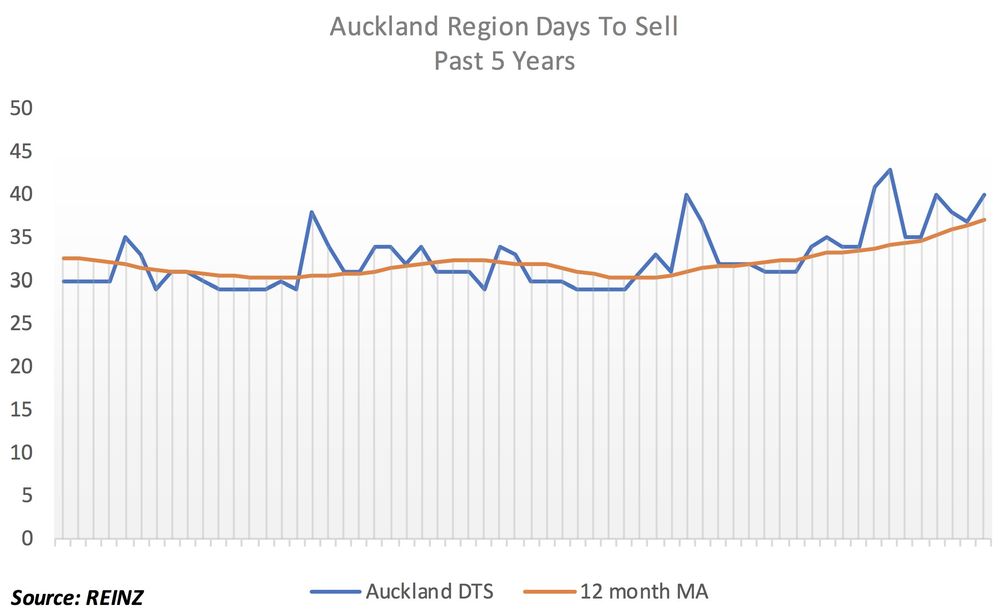

Days to sell

The median number of days to sell a property nationally increased by 7 days (from 30 to 37) when compared to August 2016.

Regionally, Waikato saw the biggest increase in the number of days to sell (up 11 days to 39), followed by Northland (up 10 days to 47), Taranaki (up 10 days to 45) and Auckland (up 9 days to 40).

Auctions

The number of properties sold by auction continues to decline across New Zealand with 799 auction sales in August – down 55% on the same time last year. Auctions now only represent 14% of all sales nationally.

In Auckland, which traditionally sees a large portion of sales sold by auction, only 418 (or 23%) of all properties sold in August were via auction – this is a decrease of 61% in comparison to August 2016.

Price Bands

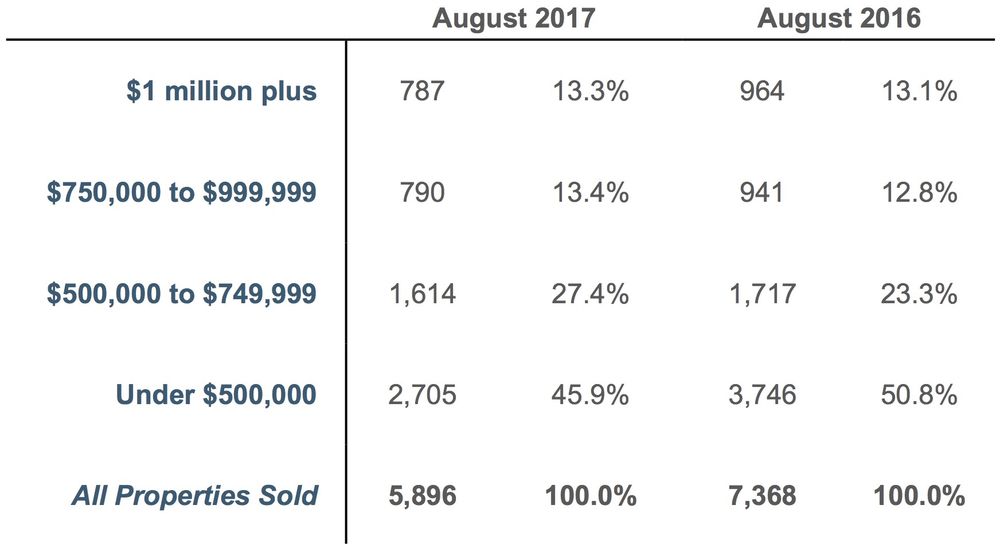

Between August 2016 and August 2017, the number of homes sold fell in every price bracket. The number of properties sold for more than $1million fell by 18% from 964 to 787 to equal 13% of all dwellings sold.

The number of dwellings sold for less than $500,000 fell by 38% from 3,746 to 2,705 to equal 46% of all homes sold across the country.

Inventory

The number of properties available for sale nationally increased by 0.4% (from 21,462 to 21,555) compared to 12 months ago, whereas the number of properties for sale in the Auckland region increased by 27.3% year on year (from 6,073 to 7,731).

Excluding Auckland, the number of properties for sale fell by 10.2% (from 15,389 to 13,825) highlighting the impact Auckland has on the overall picture.

Despite the decrease in the number of properties sold, overall, the market is in a strong position as listings remain low and demand for good properties remains high.

Agents across the country expect the market to pick up as we move into Spring and even more so once the election is over.

REINZ Regional Commentary – Auckland

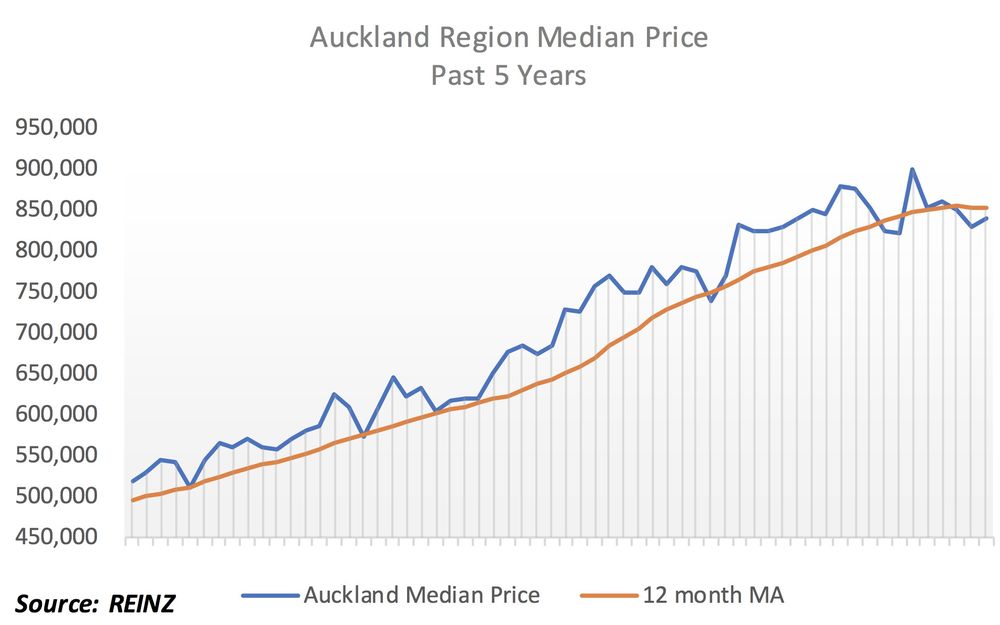

The Auckland market is stable but improving, with house prices in Auckland increasing $10,000 from July with much of this activity being driven by school zones, age of homes and location.

LVRs and the banks are still impacting the market and first home buyers, leading to a reduction in investors in the market.

Similarly, clients are still cautious as the political parties continue to announce their policies but post-election, the market is expected to lift.

Compared to August 2016 the median price decreased $10,000 (-1%). However, most of the TA’s within the region saw increases in their median price over the same time period with Franklin District leading the way with a 9% increase.

It was Manukau City and Waitakere City only that saw decreases in their median price since August 2016, the latter most significant at -5%. Compared to July 2017, the overall region median increased 1%.

The performance of the TA’s was largely positive with only Manukau City experiencing a decrease (-3%). On a seasonally adjusted basis, Auckland’s median price rose 1% compared to July, indicating that the median price increased a bit more than we’d expect in August.

Sales volume in the Auckland region increased 7% compared to July, with large boosts in sales numbers in Manukau and Waitakere (24% and 15% respectively).

Compared to August 2016 sales fell 22% with volume decreasing in all TA’s, most notably in Rodney (-30%), North Shore (-28%) and Auckland City (-26%).

On a seasonally adjusted basis, sales volumes rose 5% compared to July indicating that the increase in sales from July was a little greater than expected.

The number of days to sell eased by three days in August, from 37 days in July to 40 days in August. The number of days to sell eased by nine days compared to August 2016.

Over the past 10 years the average number of days to sell during August for Auckland has been 34 days. There are now 21 weeks of inventory in the Auckland region, an increase of 9 weeks compared to August 2016 (+74%).

The trend in the median price is now tapering off with the volume trend continuing to fall. The days to sell trend continues to ease. The House Price Index is remaining fairly steady in the short term but is decreasing from both three and 12 months ago.

NOTES:

The monthly REINZ residential sales reports remain the most recent, complete and accurate statistics on house prices and sales in New Zealand. They are based on actual sales reported by real estate agents.

These sales are taken as of the date that a transaction becomes unconditional, up to 5:00pm on the last business day of the month.

Other surveys of the residential property market are based on information from Territorial Authorities regarding settlement and the receipt of documents by the relevant Territorial Authority from a solicitor. As such, this information involves a lag of four to six weeks before the sale is recorded.

Source: REINZ

P.S. Do you know of other people that will find this article useful? Please share it on social media. Thank you!