Fiona’s story

“If I didn’t have personal insurance, I wouldn’t have been able to walk up the aisle on my wedding day”

Just two months before her wedding, Fiona (24), was diagnosed with a cyst inside her hip joint which fractured the bone, leaving her unable to walk without pain and discomfort. After several specialist visits she was told that she would need surgery to repair the fracture and stabilise the joint.

The danger of her situation was that at any time, the small fracture in her hip could increase – causing a full hip fracture and the need for a total hip replacement.

Because Fiona had health insurance, she was able to have the surgery within weeks of her diagnosis – meaning just enough recovery time to be able to walk unassisted down the aisle on her wedding day.

With the operation costing $17,000, she would not have been able to afford to go privately, especially as she and her fiancé were saving hard to pay for their wedding. Waiting in the public health system would most probably have meant that she would not have had her surgery before her wedding and would have been on crutches on her wedding day.

“Needing surgery came as a big shock to me. I’m only 24 and in great health so was pretty overwhelmed when they told me the news. Not having to worry about medical bills gave me such comfort – being unwell is stressful enough without worrying about money”

This case study is taken from a real claims situation. Names and some details have been changed to protect privacy.

A disastrous event like a health problem, a car accident, or a death in your family could wipe out everything you’ve worked for. That’s where your insurance comes in; a policy that pays a certain amount so your family can maintain their lifestyle if something happens to you.

In most cases insurance is not for you… it’s for those you leave behind. I’m going to focus on three the most critical types of insurance: Health Insurance, Disability Insurance and Life Insurance.

5 reasons to get personal insurance:

1) You have a mortgage, car loan or other debts, and don’t want to leave this burden on your family.

2) Avoid long delays in waiting for treatment in the public health system.

3) You have a family who is dependant on you, and if the accident happens you want to provide for their living costs, education, etc.

4) Access to the latest medical procedures and technology.

5) The real costs of health care are high.

#1 Health Insurance

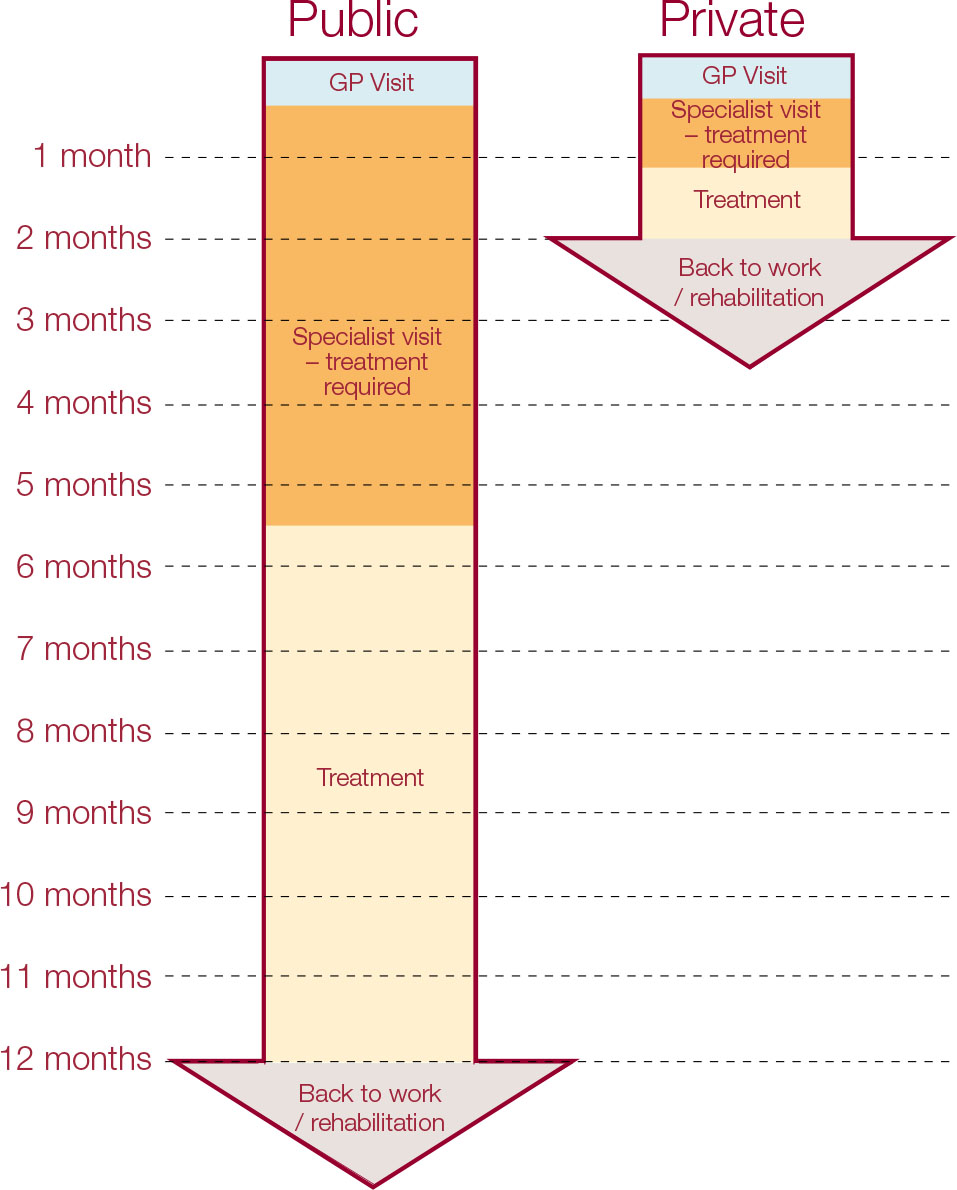

While most countries do have a public health system, you are not always guaranteed fast access to treatment and choice of quality medical products. This means you may be waiting for months in pain for a specialist consultation and further treatment. Your conditions could even worsen.

Public health care VS private health care (1)

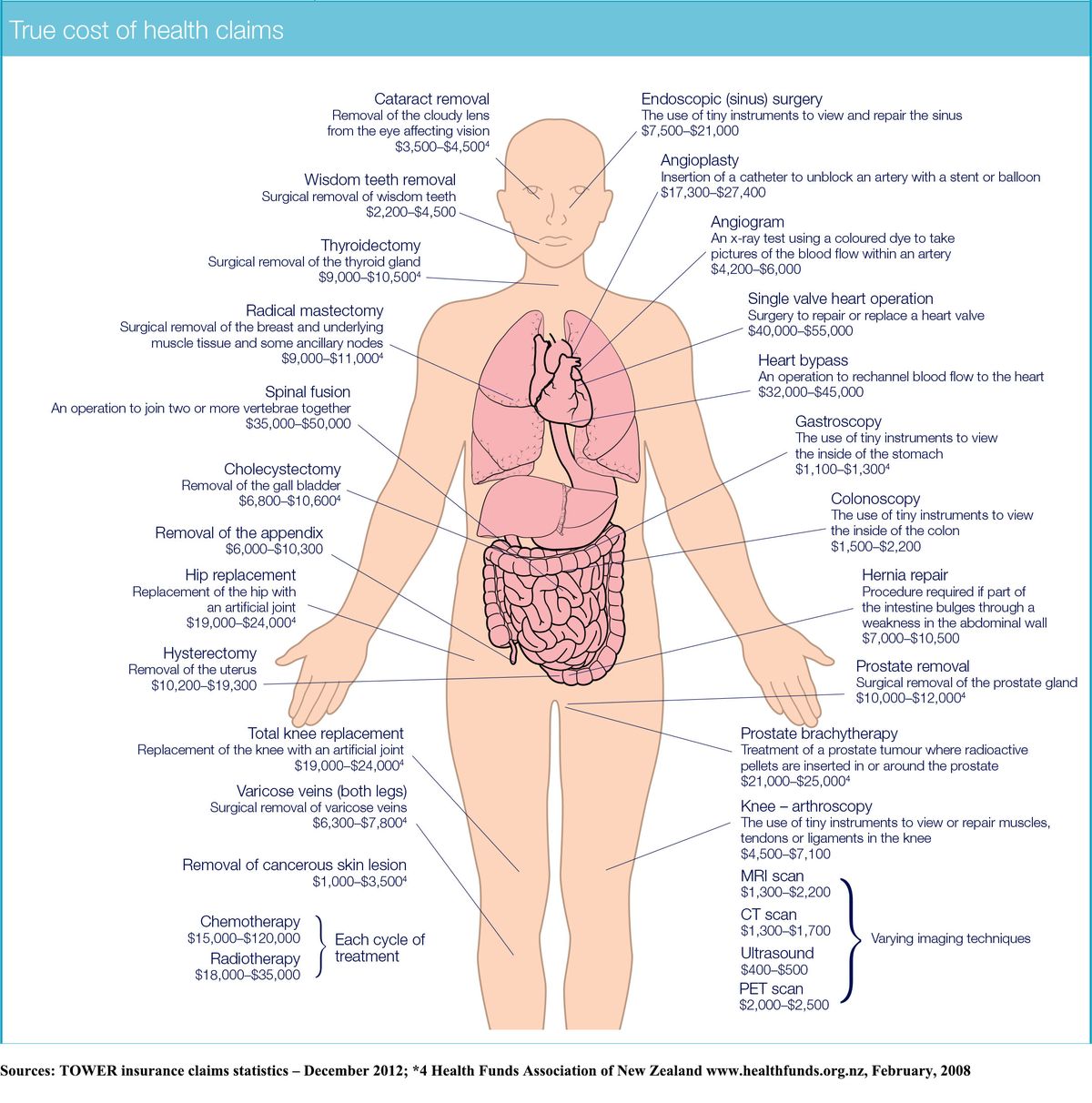

The reality is that while you may be in good health now, there is 52% chance of you having one of the major operations between the ages of 30 and 65. Many people do not realise the actual cost of private hospital treatment today. These costs are usually higher than most car or home and content claims (click on the below image to view details).

#2 Disability Insurance

Disability insurance provides a percentage of replacement income if you’re unable to work due to a disability, illness, or accident. Remember that health insurance only addresses your medical bills; it doesn’t pay your living expenses, like housing or food, if you can’t earn money for an extended period of time.

According to information on disabilitycanhappen.org, you have a one in four chance of becoming disabled during your working years. You’re more likely to suffer a disability than you are to die before the age of 65! And when a long-term disability occurs, the average absence from work is 2½ years.

At the time of the 2006 census 17 percent of New Zealanders (660,300) lived with a disability. Accidents, illness or injuries were the most common cause of disability for adults aged 15 to 44 years. (1)

The following table shows the current Invalid’s Benefit rates as at April 2013. Could you afford to live on this? (2)

| Category | Net rate after tax |

| Single, 18+ years ………………………… | $257.75 |

| Married, civil union or de facto couple (with or without children) | BOTH $429.58 EACH $214.79 |

| Sole parent ……………………………….. | $338.60 |

Sources:

(1) 2006 Disability Survey, Statistics New Zealand

(2) The Invalid’s Benefit is a weekly payment which helps people who are severely limited in how much work they can do because they have an ongoing sickness, injury or disability. The net rates are after tax at ‘M’. Work and Income NZ.

#3 Life Insurance

Life insurance is critical when your death would create a financial hardship for those you leave behind, such as a spouse or children. If you’re single, or no one depends on your income, you either need a very small policy for your funeral expenses or none at all.

You should never buy life insurance on children, because they’re the ones meant to benefit from insurance proceeds. A good rule of thumb is to purchase a policy that’s 10 times your income.

New Zealand life insurance stats

» On average there is one death in New Zealand every 19 minutes (75 a day or 27,375 every year). (1)

» Cancer was the leading cause of death for both males and females in New Zealand in 2009 with 8,437 people having cancer recorded as the underlying cause of death. (2)

» Stroke is the third largest killer in New Zealand (about 2,000 people every year).(3)

Think you are too young for a stroke? Think again. In a 2011 study, Canadian researchers studied 84 young men and 84 young women ages 18-35 who had no cardiovascular risk factors or family history of premature heart disease. They identified premature and hidden hardening of the arteries (atherosclerosis) in about 80 percent of the subjects. It significantly increases the risk of heart disease, stroke, and death. (4)

Sources:

(1) Statistics New Zealand, Population Clock (live update)

(2) Ministry of Health 2012; Cancer: New registration and deaths 2009

(3) The Stroke Foundation of New Zealand, 2012

(4) Stroke at young age (by At Life Line Screening)

Why aren’t we insured? I believe that we have got our priorities wrong. According to a Ministry of Transport survey in 2012, 92 percent of vehicle owners had some form of motor vehicle insurance. However according to 2010 survey only 32 percent of New Zealanders had health insurance, the Health Funds Association of New Zealand says. Motor vehicles rarely bring any direct income. In fact, people are the main source of earnings therefore they must be insured without a doubt.

In some cases insurance premium could be as low as $15 a month. Managing different types of insurance is easy because most of them can be passed on to a third party, like an insurance broker.

To sum it up, you need 3 types of personal insurance: Health Insurance, Disability Insurance and Life Insurance. Think of it as an investment in peace of mind and happy future of your loved ones.

Contact a local insurance broker who can save you time and money by comparing all available insurance policies. You work hard to build wealth and have a comfortable life, so write it down and do it this week.

Do you think everyone should have personal insurance? Have you had to use personal insurance? Share your experience in the comments box below.

If you liked the post, please share it with your friends.