(3-minute read)

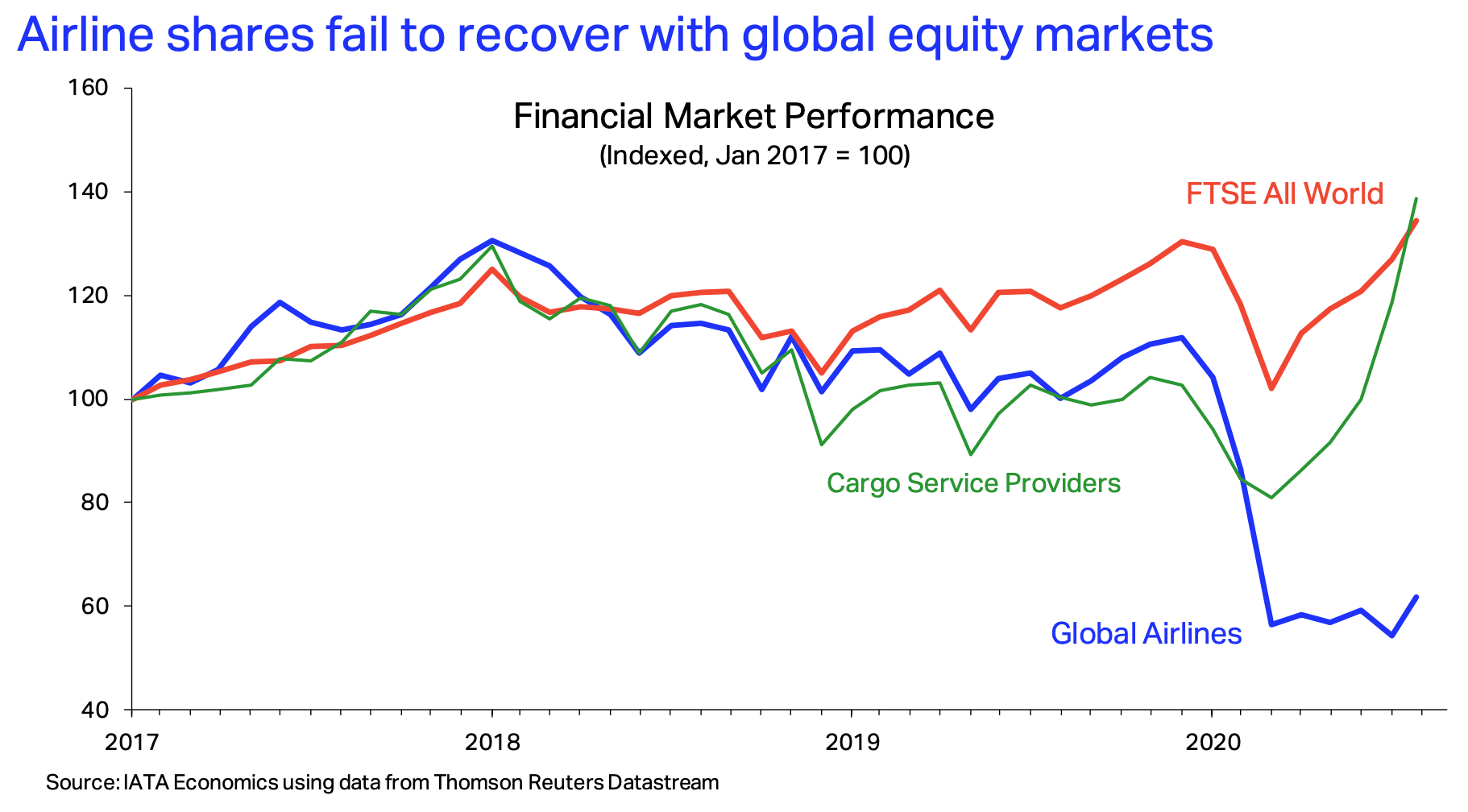

Airline share prices, on average, have barely risen from the low they reached in March this year, yet overall equity markets have recently fully recovered pre-COVID-19 levels, as shown in the chart.

Why has there been this tremendous divergence? Equity markets are forward-looking, with prices that reflect market expectations of future corporate financial performance.

It seems that while financial markets are bullish about a recovery in the global economy, they are exceptionally gloomy about prospects for the airline industry.

Airline shares reacted strongly to COVID-19 pandemic since the airline industry has been one of the most exposed industries to global travel restrictions.

The airline index initially lost twice more value than the global equity markets (50% vs 22% at the lowest point in March compared to year-end 2019).

However, global equity markets quickly rebounded upon reopening of the economies as economic activity bottomed out following the ease of lock-down restrictions that started late April.

Positive readings of high frequency data such as retail sales and business confidence further supported the return to normal expectations that is reflected in global equity market performance.

Cargo service providers’ shares (green line) rebounded as well, indicating the importance of cargo business for airlines in the coming period.

Although economic recovery was the key driver of the companies’ earnings, the optimism following the ease of lock-down restrictions has not been reflected in airline shares.

The problem has been that borders for the most part have remained closed to air travel.

So, the outlook for airlines remains uncertain as traveler’s confidence is weak.

The clarity on quarantine measures will be crucial to ensure the traveler’s confidence to travel internationally.

In the meantime, the cargo business could be supportive (but not big enough to be sufficient) for airlines revenue generation.

Another big hit to Air NZ in the past couple of weeks with flights cancelled and NZ largest city unable to fly.

The words of former Chair of Air New Zealand (AIR) John Palmer in the 2003 annual review post Ansett, “I have come to believe that the only real competitive advantage that a company can have in the airline industry is the ability to prepare for and manage change” are ringing ever true 17 years later.

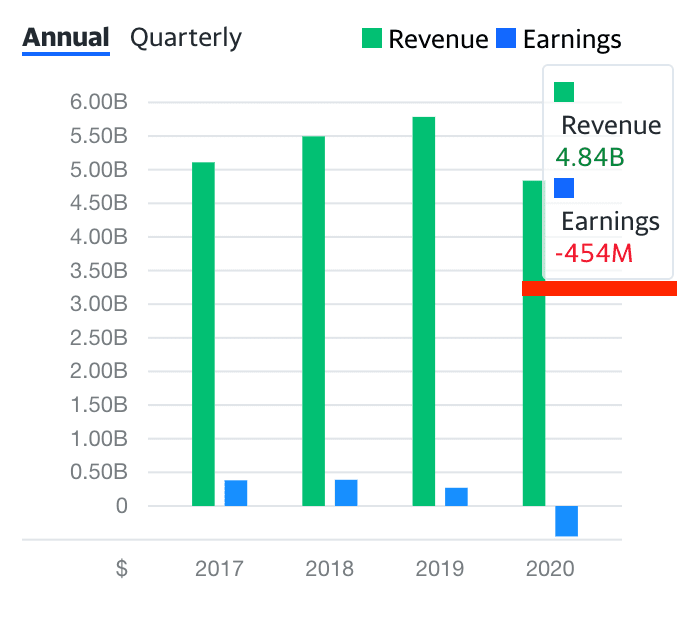

While Air NZ’s balance sheet remains strong, the company’s recent earnings guidance of a PBT loss of up to -NZ$318m in 2H20 is going to cut deep.

Retail investors flocked to buy Air NZ post the government announced a $900 million lending facility, but Forsyth Barr research team estimate Air NZ’s Net Asset Value as now at ~NZ$1.06 per share, a massive fall from pre-covid and significantly lower than it’s current $1.38 share price.

Air New Zealand says it is within days of tapping into the $900m backup loan from the Government as its cash reserves have plunged by about the same amount since the beginning of the year.

However, it is coy on any future equity raising, noted by analysts at Jarden who said there was no update on its capital structure, other than noting it is engaging constructively with the Crown.

Jarden – which dropped its 12-month share price target to 80c – estimates the airline may need $1 billion of additional equity to recapitalise its balance sheet.

Recapitalisation was a necessary minimum first step in building confidence in the recovery of the airline’s investment case.

The big risks ahead of the airline were uncertainty over a transtasman bubble, the scale of competition once markets re-open, rising fuel prices, foreign exchange exposure and the consumer environment.

”We continue to view AIR as having a heavily skewed risk/reward at the current share price with operating losses expected to increase significantly in FY21 and the requirement for additional equity likely to drive material shareholder dilution. As such we retain our Underperform rating.”

Source: IATA, Forsyth Barr, NZ Herald

What do you think about it? Tag me on your favourite social media (Facebook / Instagram / LinkedIn / Twitter).

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.