(2-minute read)

Historically, debt providers to the airline industry have been rewarded for their capital, usually invested with the security of a very mobile aircraft asset to back it.

On average during previous business cycles, the airline industry has been able to generate enough revenue to pay its suppliers’ bills and service its debt.

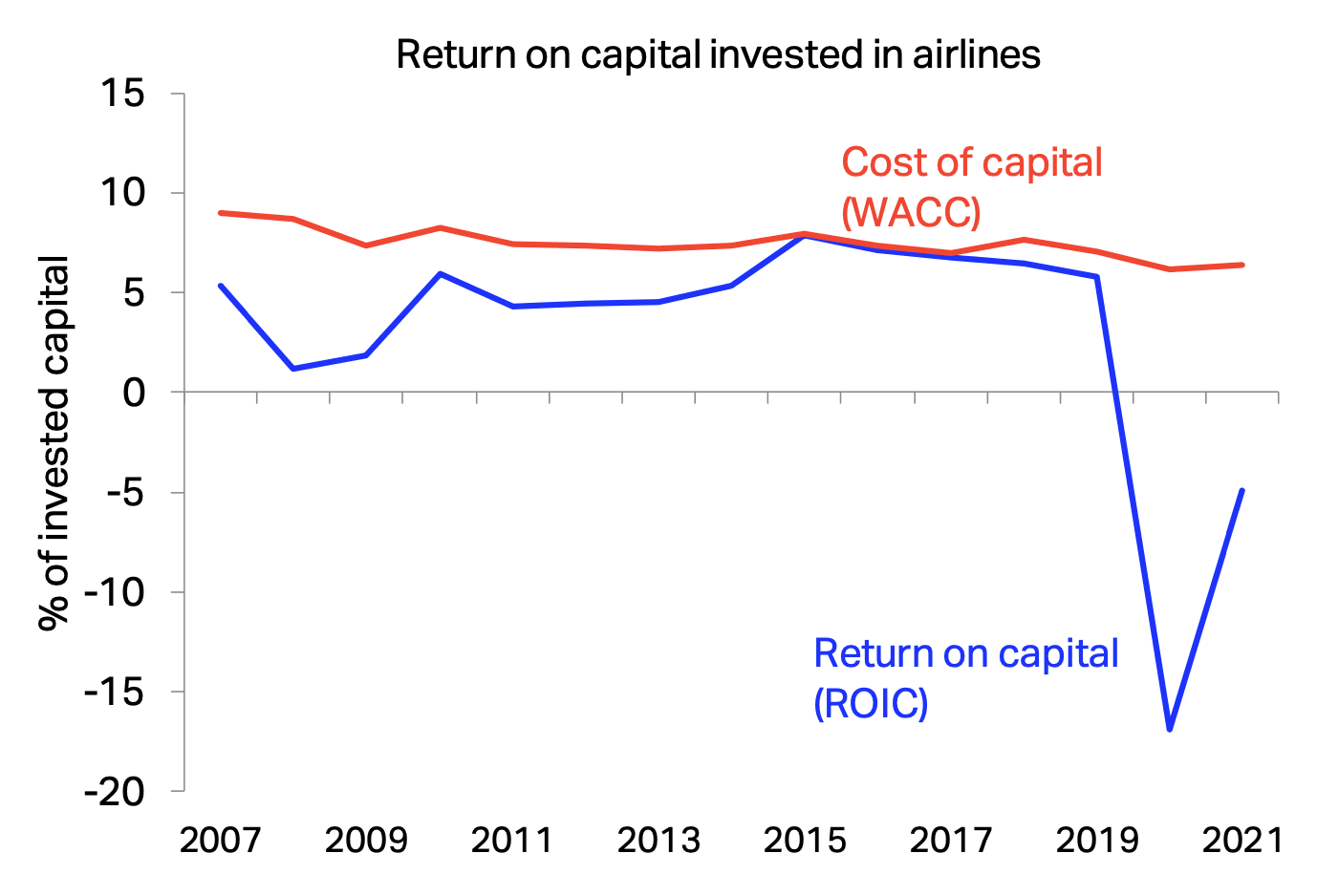

On the other hand, even prior to the COVID-19 crisis, equity owners had not been rewarded adequately for risking their capital in all regions.

In normal times, investors should expect to earn at least the return generated by assets of a similar risk profile; the weighted average cost of capital (WACC).

Such has been the intensity of competition, and the challenges to doing business, that average airline returns have rarely been as high as the industry’s cost of capital.

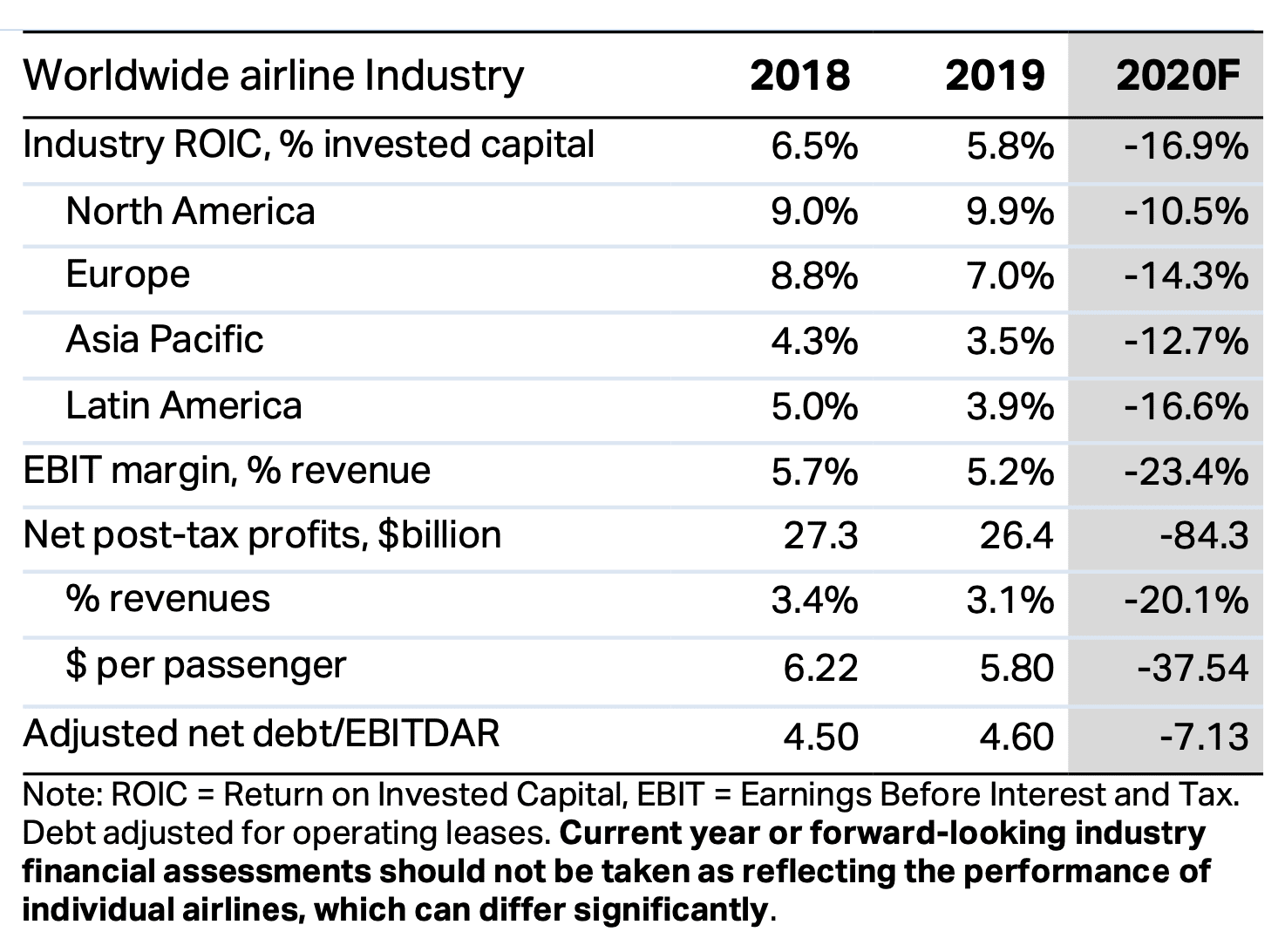

That said, for North America and Europe in the last four years, equity investors have received a return above the cost of capital.

In North America, structural improvements combined with low fuel prices boosted the return on invested capital (ROIC) above the cost of capital, creating value for investors.

In Europe, although rising competition put pressure on yields, airlines overall created value for investors by managing their costs effectively and focusing on ancillaries as an additional source of revenue.

On the other hand, airlines in the Asia Pacific and Latin America regions have consistently generated below- WACC returns.

The highly competitive nature of the market in Asia Pacific has prevented airlines from fully reflecting the increase in costs resulting in narrower operating margins.

The situation has changed considerably this year. With the impact of the pandemic, all regions are facing negative ROIC outcomes and we forecast the industry to generate an overall ROIC of –16.9%.

Next year, we expect to see a moderate improvement stemming from the gradual recovery in demand conditions. Nonetheless, the return to investors is still expected to remain in negative territory.

SOURCE: The International Air Transport Association (IATA)

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.