(4-minute read)

Two-thirds of NZ real estate agents are expecting residential property prices to fall by up to 10%, according to a survey by property data company CoreLogic.

However, an independent economist Tony Alexander explained 10 factors that will keep the Auckland property prices stable. Here is a quick recap:

1. Record low interest rates

Investors are actively looking for returns better than what they can get on bank term deposits, of which they have too many having saved up extra money during lockdown.

The COVID-19 crisis has not slashed willingness to take risks and invest. The opposite is happening with young people in particular flocking into the sharemarket. This investing attitude will likely naturally roll over into property investment also.

2. Money saved not travelling overseas

Kiwis were set to make over 3.2 million trips overseas this year. Now they won’t. Where will the saved billions of dollars go? Some will go on domestic holidays, some into savings, some on electronics, and some might go toward financing a real estate purchase.

These lump sums can go a long way toward building a deposit for a property whether to live in oneself or as an investment.

3. Money printing

Overseas experience post-GFC and as admitted by the Reserve Bank, quantitative easing places upward pressure on asset prices.

The Government’s massive fiscal support package will help mitigate though not fully offset the weakness in our economy coming from Covid-19 effects.

4. Migration not collapsing

Not only was there a net inward migration boom of Kiwis just ahead of lockdown, our compatriots continue to flood back in.

This raises the question, with 33,000 extra people beyond estimates in the country in April, and the net 2020 flow likely to be well above zero, could Covid-19 actually boost net flows for calendar 2020 above what they would otherwise have been?

There’s a million Kiwis overseas, and many of them are going to look to come back.

New Zealand’s housing minister, Megan Wood, said: “While the system was manageable under level-4 (restrictions), when there were only small numbers of New Zealanders returning home, it is now a system under stress, with arrivals increasing by 73% last week, compared to the beginning of April.”

5. Falling construction

Building businesses are currently busy finishing jobs. But with banks pulling back from funding property development the rate of growth in housing supply will slow over the next couple of years.

6. Low debt growth

We went into this crisis with low growth in risky bank mortgage lending. LVRs were in place from 2013, and banks have been applying high test interest rates for calculating debt servicing ability.

Housing debt grew by 90 percent in the five years leading into the late-2008 GFC. Growth for the past five years has been just 41 percent.

7. Job losses of renters

The majority (not all) of people losing employment during this crisis work in the generally low-paying sectors of hospitality, tourism, entertainment, and retailing. Most will not own property.

In addition, whereas in the GFC 4% of jobs in NZ were held by migrants on temporary work visas, the proportion this crisis is 8%. They are not property owners and many will find they have to leave New Zealand.

During recessions people tend to move from the regions to the big cities looking for work.

8. Working from home

This boosts housing demand because it is easier to remodel one’s own house to accommodate working remotely than to expect a landlord to do it.

9. Temporary downturn – a “new” factor

The health-induced recession of 2020 involves a temporary cessation of some economic activity, not decimation of our economic base.

Standard and Poor’s estimate that whereas three years after the GFC our economy was 10% smaller than it would otherwise have been, this time they think the decline will be just 3%. Three years after the GFC NZ average house prices were exactly the same (on average as in 2008).

With far less economic destruction this time the implication for where New Zealand house prices will be in three years from now is fairly clear.

10. Listings shortage

We went into this crisis with only 19,000 properties listed for sale compared with 46,000 heading into the GFC. There is a long queue of frustrated buyers hoping that the Covid-19 downturn will bring forth sellers so they can finally secure a property.

The State of the Auckland Property Rental Market (May 2020)

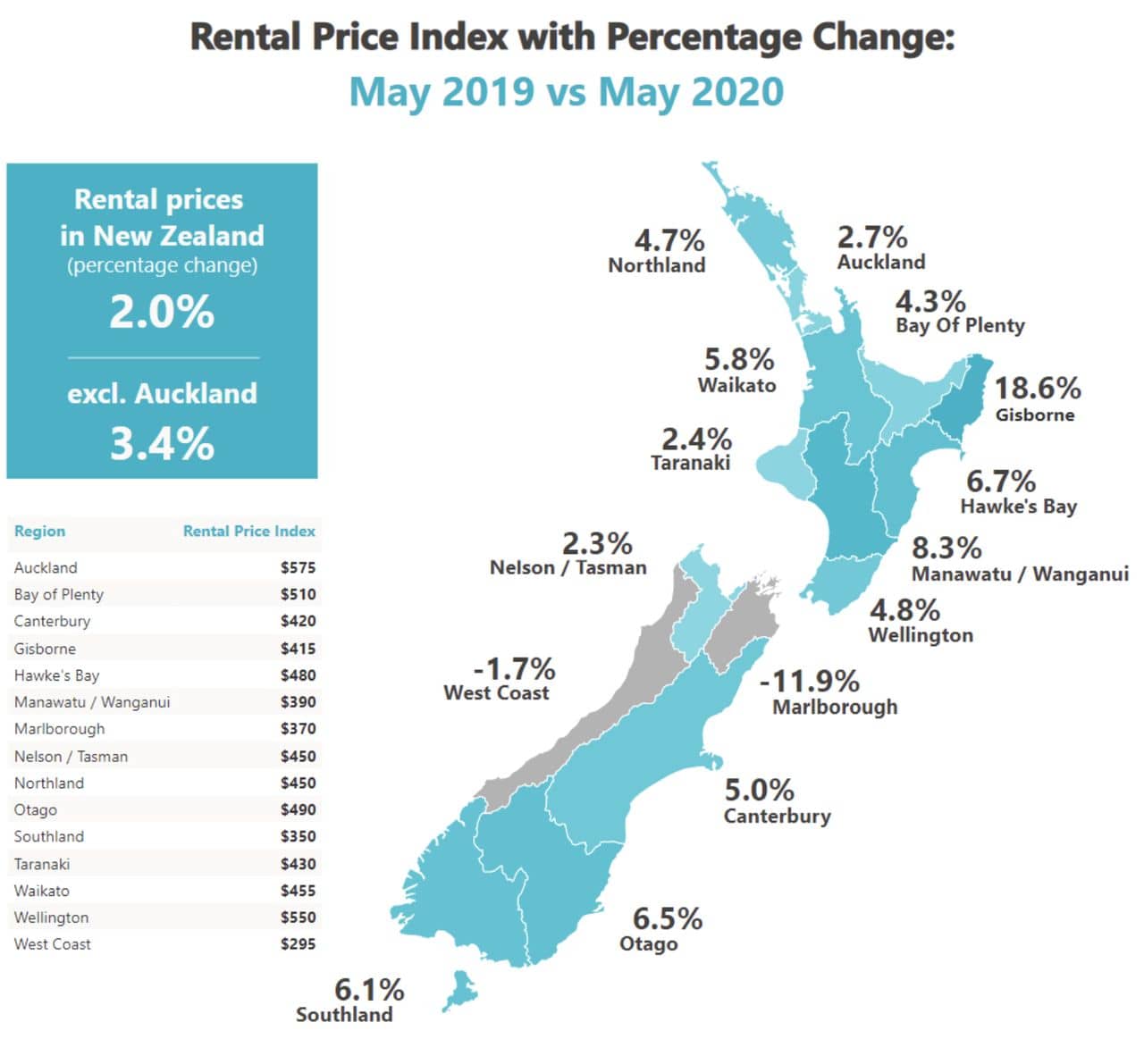

New Zealand’s rental market has begun to find it’s rhythm again after activity returned to pre-COVID-19 levels in May, according to the latest Trade Me Rental Price Index.

Trade Me Property spokesperson Aaron Clancy said the rental market was returning to normal in May, following a slow few months since lockdown began. “The number of properties available to rent in May was up 56 per cent in April 2020, and 3 per cent on the same time last year.”

“As we entered level 2 and Kiwis returned to their new normal in May, we saw both supply and demand for rentals bounce back after a turbulent few months. So far it looks like both tenants and landlords have confidence in the market.”

Mr Clancy said demand for rental properties across the country was up 120 per cent in April, and stagnant in May last year.

“Over the coming months we expect to see higher demand for rentals than we usually would over winter. Lockdown likely made some tenants rethink their current rental and, anecdotally, we’re hearing that a lot of Kiwis have returned from overseas and are looking for somewhere to live.”

“We expect that this could add pressure to the market and make it harder for tenants to secure the property they want.”

Median Weekly Rent Sees Growth.

Mr Clancy said the Government’s move to freeze residential rent increases for six months from March had not stopped the national median weekly rent from increasing in May.

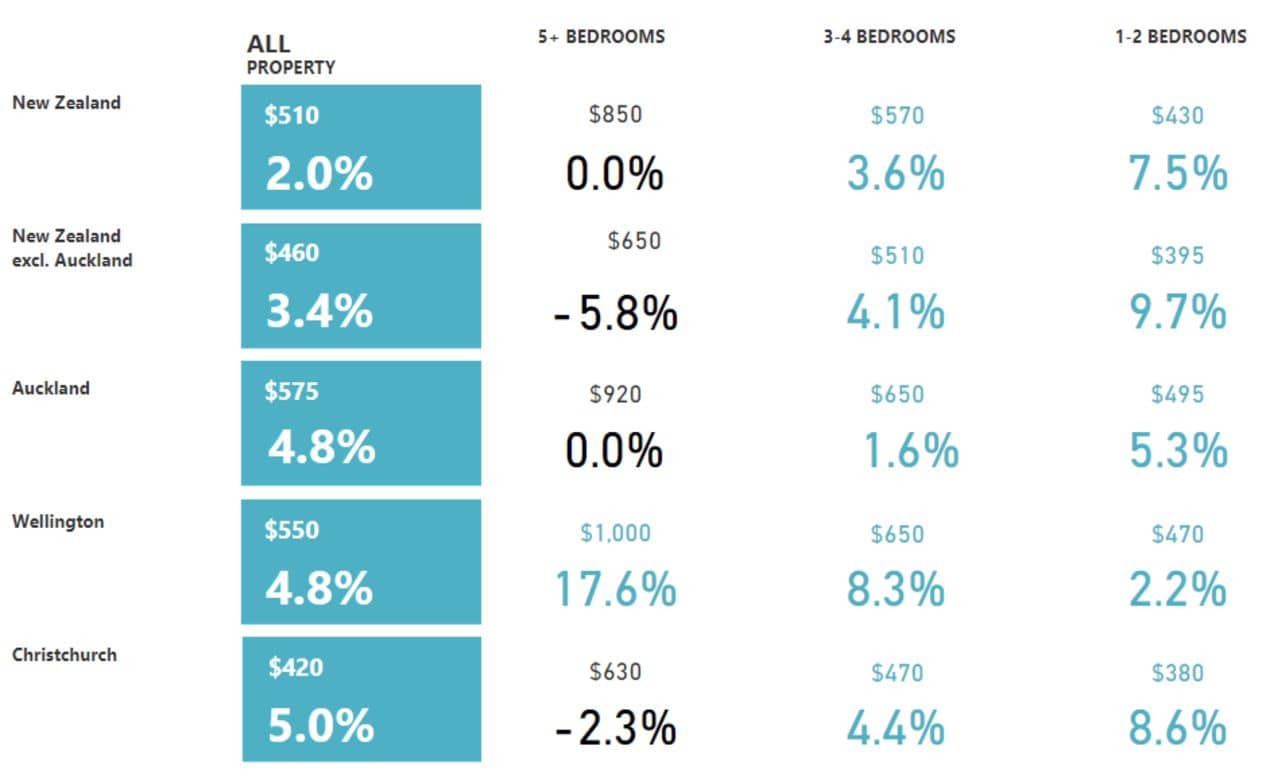

The median weekly rent in Auckland City stayed flat versus April, at $575. “This is a modest 2.7 per cent increase when compared to May 2019, when the median rent was $560 per week.”

“The number of enquiries on rental properties across Auckland was up 1 per cent in May 2019, while the number of properties available to rent was stable year-on-year.”

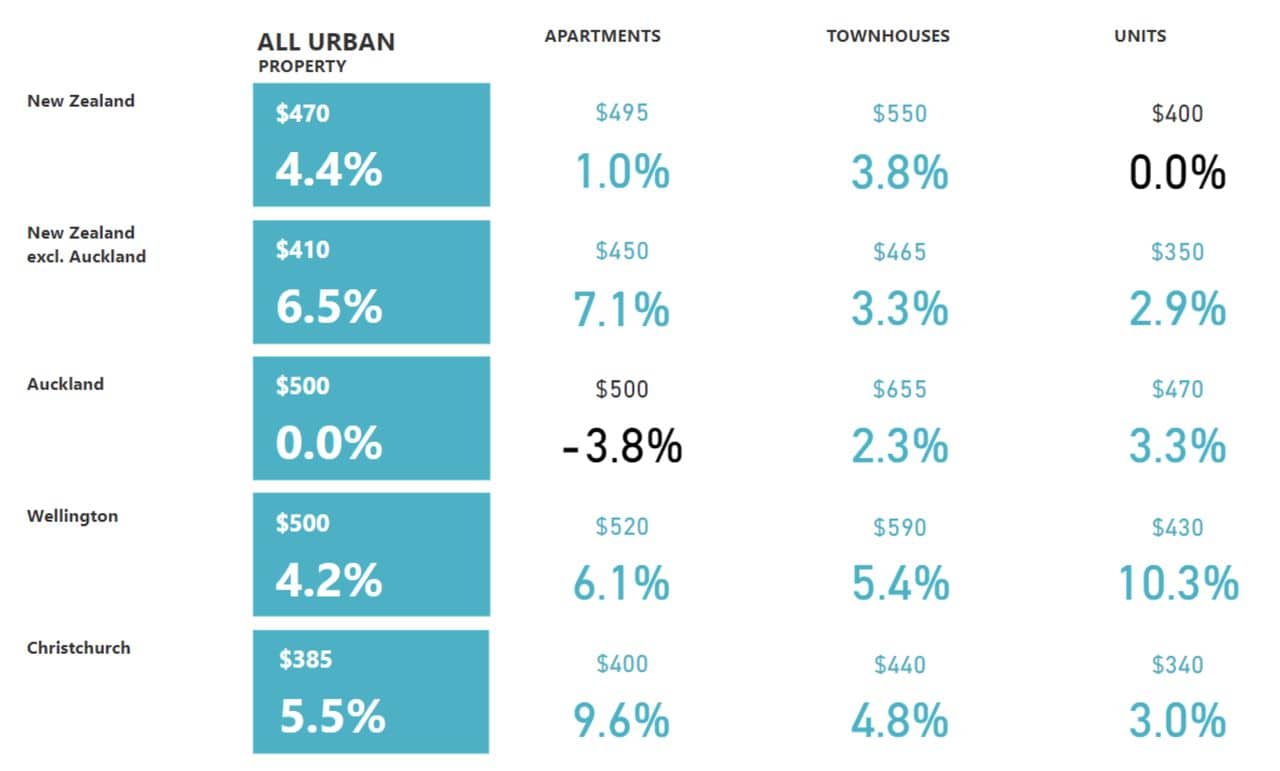

Units were the only house type to remain flat compared to May 2019 while the median weekly rent for apartments in Auckland was down 3.8% year-on-year.

SOURCE: TradeMe & Tony Alexander

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.