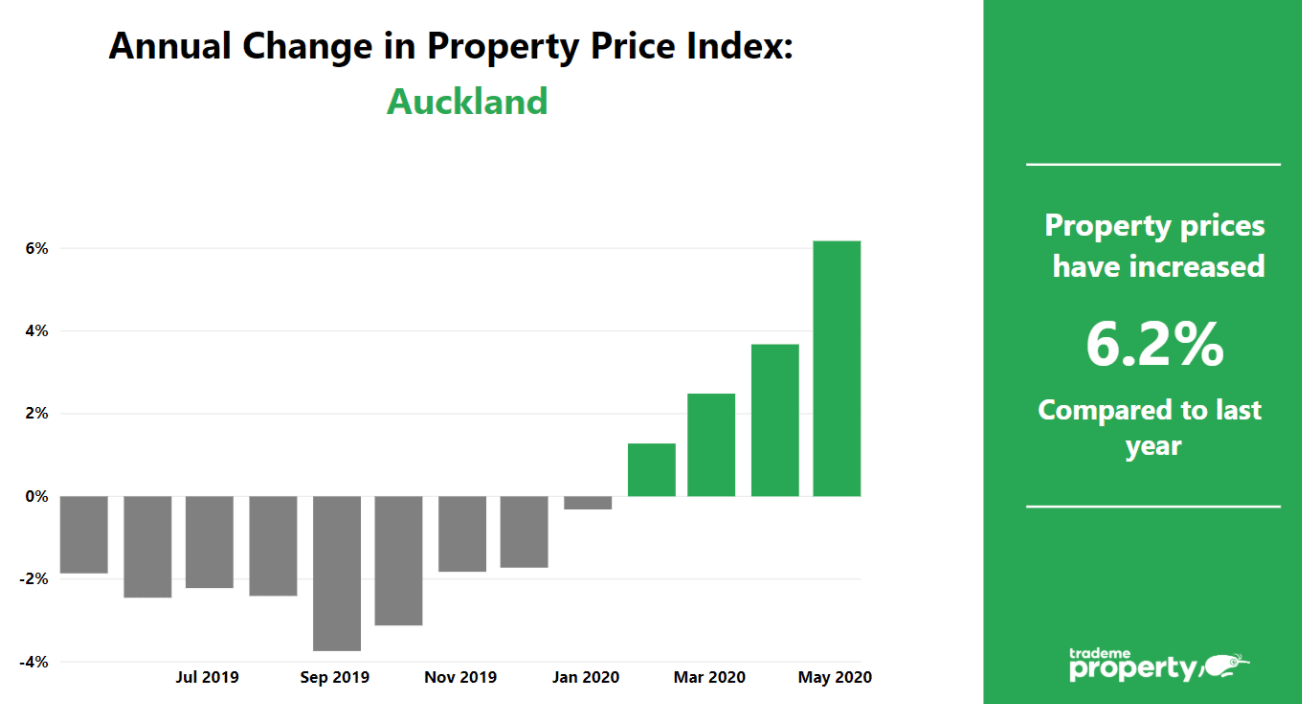

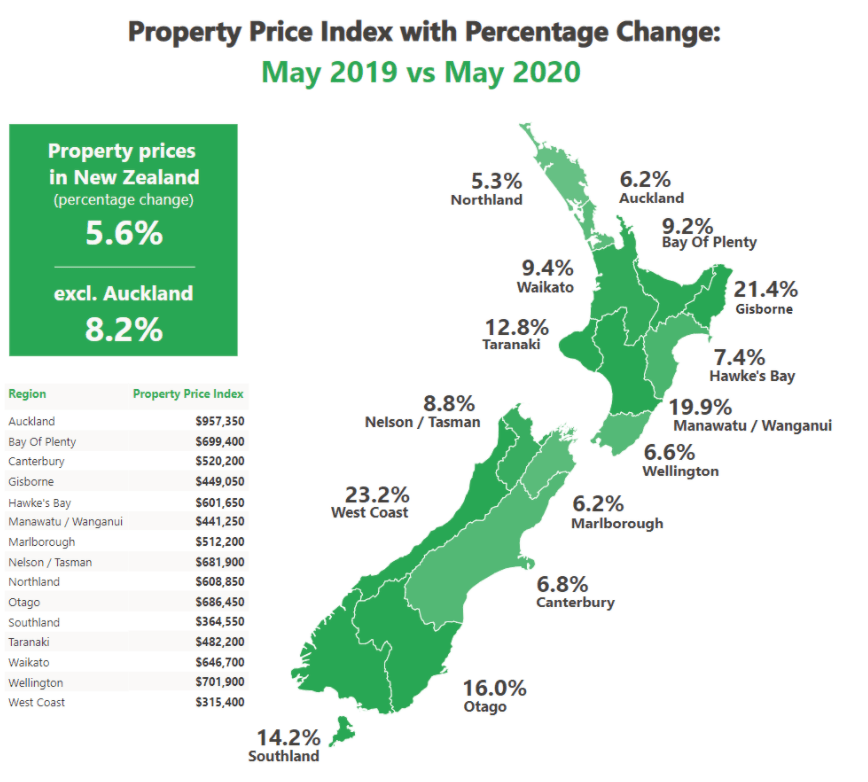

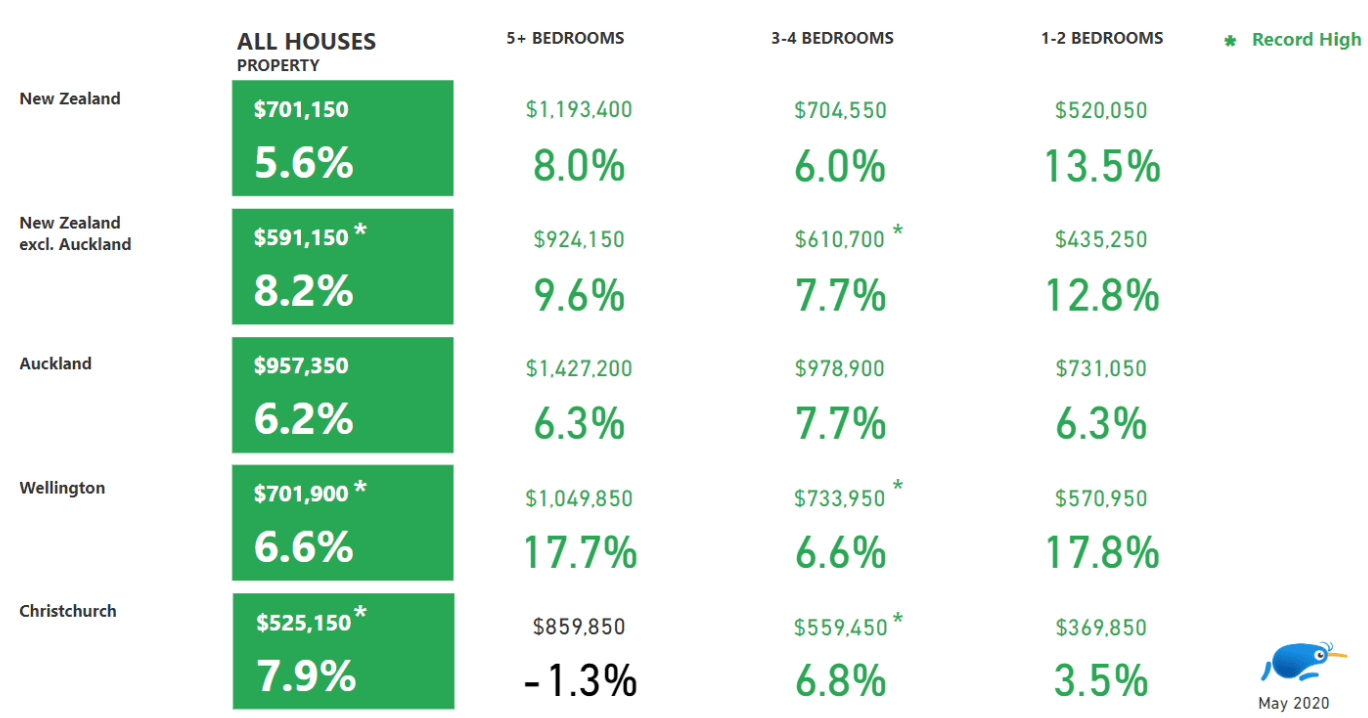

“The average asking price in the Auckland region was up 6 per cent when compared to the same month last year, to $957,350.” said Trade Me Property spokesperson, Aaron Clancy.

“The total number of properties available for sale in the Auckland region was down 29 per cent compared to May last year, but up 22 per cent compared to April.”

Demand for listings in Auckland was up last month, reflecting the national trend.

“The number of views on Auckland properties for sale rose a substantial 63 per cent in May when compared with last year, and 114 per cent when compared to April.

“The average asking price for a house in Auckland City was $1,025,050, up 7 per cent when compared to May 2019.

Demand for listings in Auckland was up last month, reflecting the national trend.

“The number of views on Auckland properties for sale rose a substantial 63 per cent in May when compared with last year, and 114 per cent when compared to April.

“The average asking price for a house in Auckland City was $1,025,050, up 7 per cent when compared to May 2019.

Forward-Looking Data from Trade Me and Loan Market Mortgage Advisers

Trade Me Property is seeing a stark contrast between la June’s buyer engagement on site and this year’s, with email enquiries and Watchlist adds, a key sign of buyer interest, well up.

Email enquiries to agents and private sellers, over a two week period from 25 May to 8 June 2020, compared with 2019 at the same time, were up 140% up in Auckland.

Over the same period, (25 May to 8 June 2020 vs 2019) Trade Me Property Watchlist Adds have risen this year with a 44% jump in Auckland.

REINZ and economist Tony Alexander’s real estate survey of agents around the country, published on 10 June, found that interest was especially strong among first home buyers. The survey also noted that property appraisals were going up and a net 18% felt that prices were rising.

Mr Alexander says 19,000 properties are listed for sale around New Zealand currently, compared to 58,000 when the country was heading into the 2009 Global Financial Crisis.

Agents in the survey said buyers were concerned that there were not enough listings available – 50% of respondents saying this was a main concern of buyers.

“Buyers are still there… and are revealing themselves to be more confident,” says Mr Alexander, after seeing share markets rally and job numbers go up again.

Johnny Sinclair, Bayleys’ national director residential, agreed with the survey’s findings, adding that sales are happening at all levels, although there is particular interest in the sub $1 million price bracket.

At the higher end, a Bayleys salesperson on the North Shore has seen four deals in the last six weeks go through of properties in the $3 million to $6 million price range, and these were listings that had been on the market for the past six to 12 months.

“Vendors don’t have their heads in the clouds. It’s a perfect storm for us at the moment, buyers are prepared to meet the market as well,” he says.

Will All This Buyer Intention Remain?

The market would normally be quieter by late June going into wintry July and August. But given the current level of buyer interest and the fact that people will not be flying off to sunny climes overseas, the activity is likely to continue, says Tommy’s senior agent, Nicki Cruickshank.

“Every June/July most people with any money go away, now none of these people can go anywhere,” says Ms Cruickshank.

Gower Buchanan, managing director of the Ray White Damerell Group, is seeing multiple offers on homes being sold by his agents in the Ponsonby, Grey Lynn, Mt Albert and Birkenhead markets.

With the election coming up there will usually be a decrease in activity, he says.

But between now and end of July/August there will be plenty of activity, he believes. “People are in a hurry to strike,” he says.

Mortgage Pre-approvals Another Key Signal

Mr Buchanan’s confidence is buoyed by the news from Loan Market mortgage advisers, that it is seeing mortgage pre-approvals significantly rise on this time last year.

Tracey Warner, a Loan Market mortgage adviser, is heartened by what she is seeing.

“Our pre-approval pipeline has returned to similar levels it sat at pre-Covid in March, which shows a strong and active pipeline,” she says.

Meanwhile looking at June 2019 compared with June 2020, pre-approvals at the end of May 2019 sat at $900 million, compared with $1.2 billion for the end of May 2020. Loan Market, the largest mortgage advisory group in New Zealand with 150 advisers, has a 20% share of the advisory marketplace.

Ms Warner adds that she has also seen more enquiries on open bridging finance as people try to move from one home to the next.

Source: Trade Me