(3-minute read)

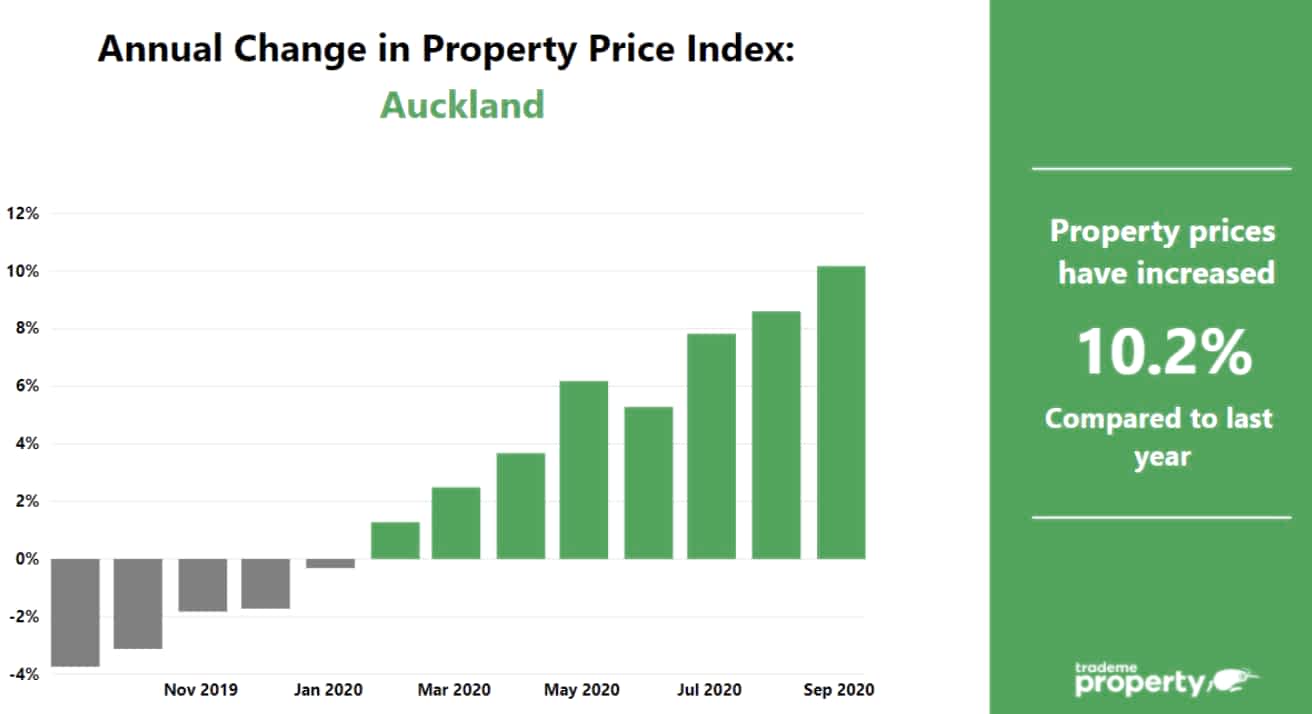

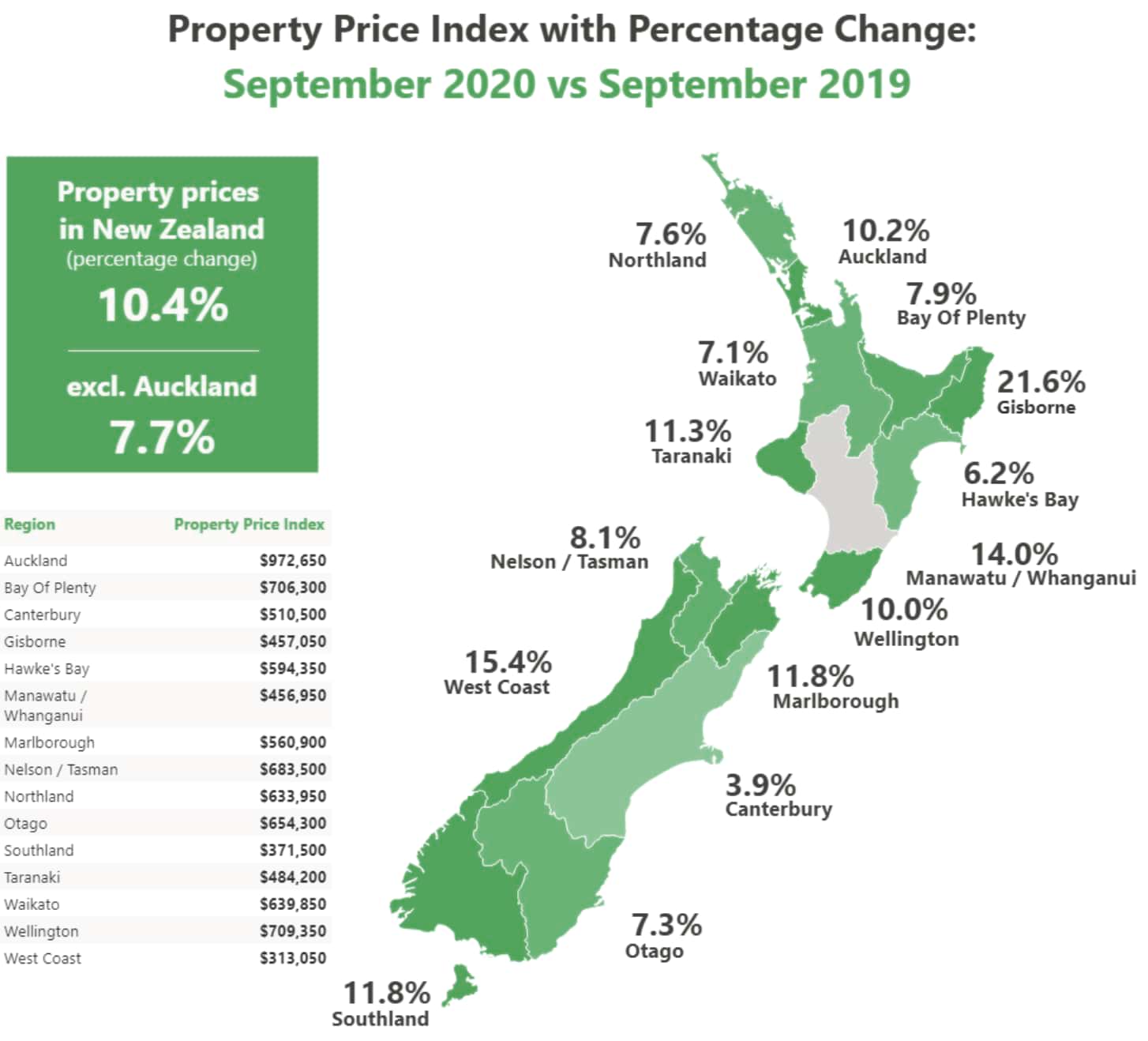

For the first time since early 2017, the average asking price in the Auckland region experienced double-digit annual percentage growth to reach a new record at $972,650 (September 2020).

This marks a 10% increase when compared with this time last year when prices were at $882,850 – that’s a $90,000 increase.

Auckland saw listing views climb by 24% when compared with this time last year according to the latest Trade Me Property Price Index.

During 2018 and 2019 we saw the Auckland market cool off as prices remained flat or dipped slightly year-on-year. However, since the lockdown lifted the market appears to be back in action with prices climbing steadily.

It’s a very good time to sell your property if you are living in Auckland with demand and prices remaining high.

Taking a closer look at the region, North Shore city was the most expensive district, with an average asking price of $1,183,850.

The next most expensive spot was Auckland city with an average asking price of $1,168,800, followed by Waiheke Island with an average asking price of $1,098,550.

The most popular house in Auckland was a three bedroom house in Onehunga with an asking price of $800,000. It was watchlisted 490 times in the first two days onsite.

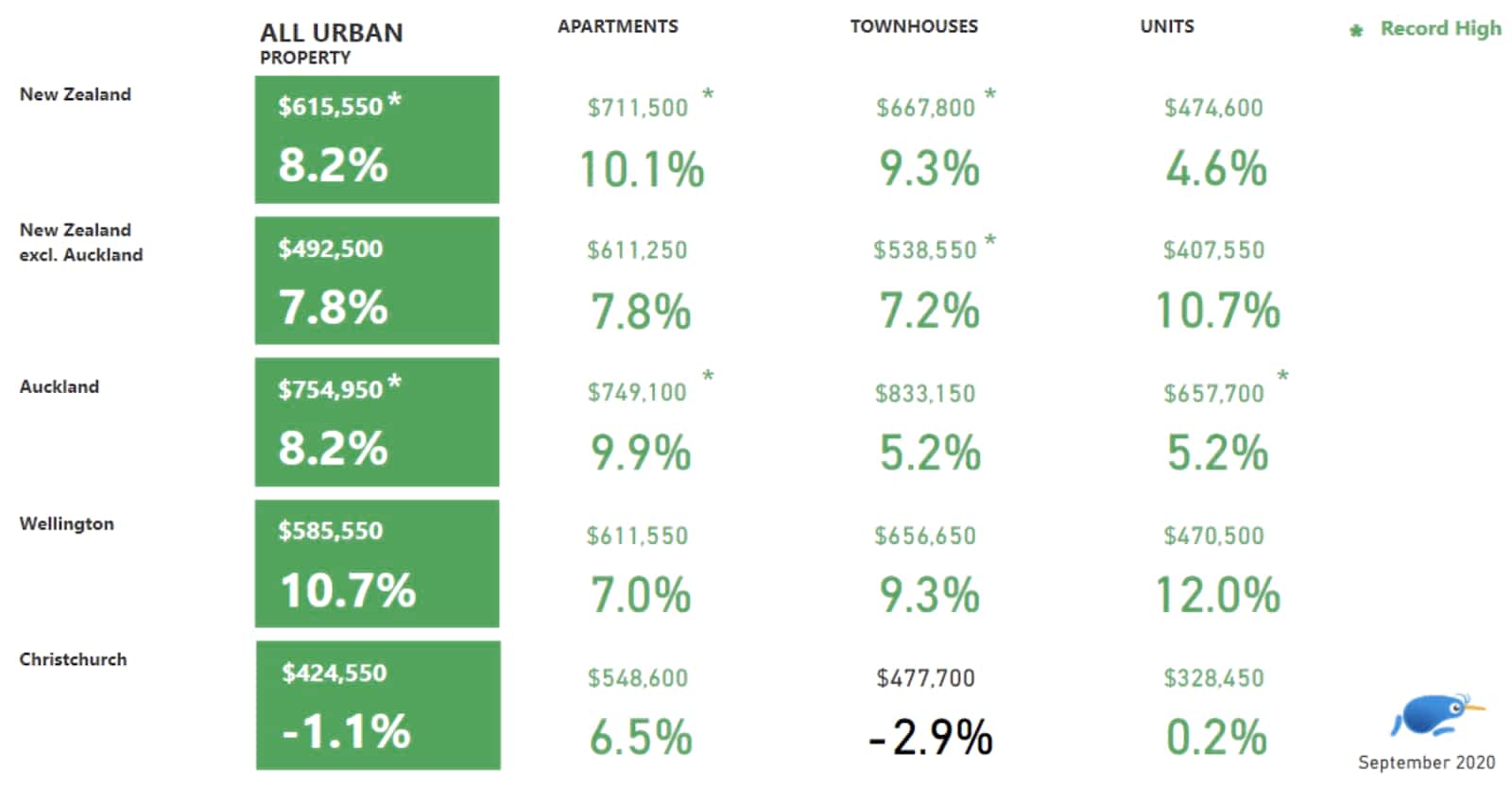

Apartment Prices Reach New Heights

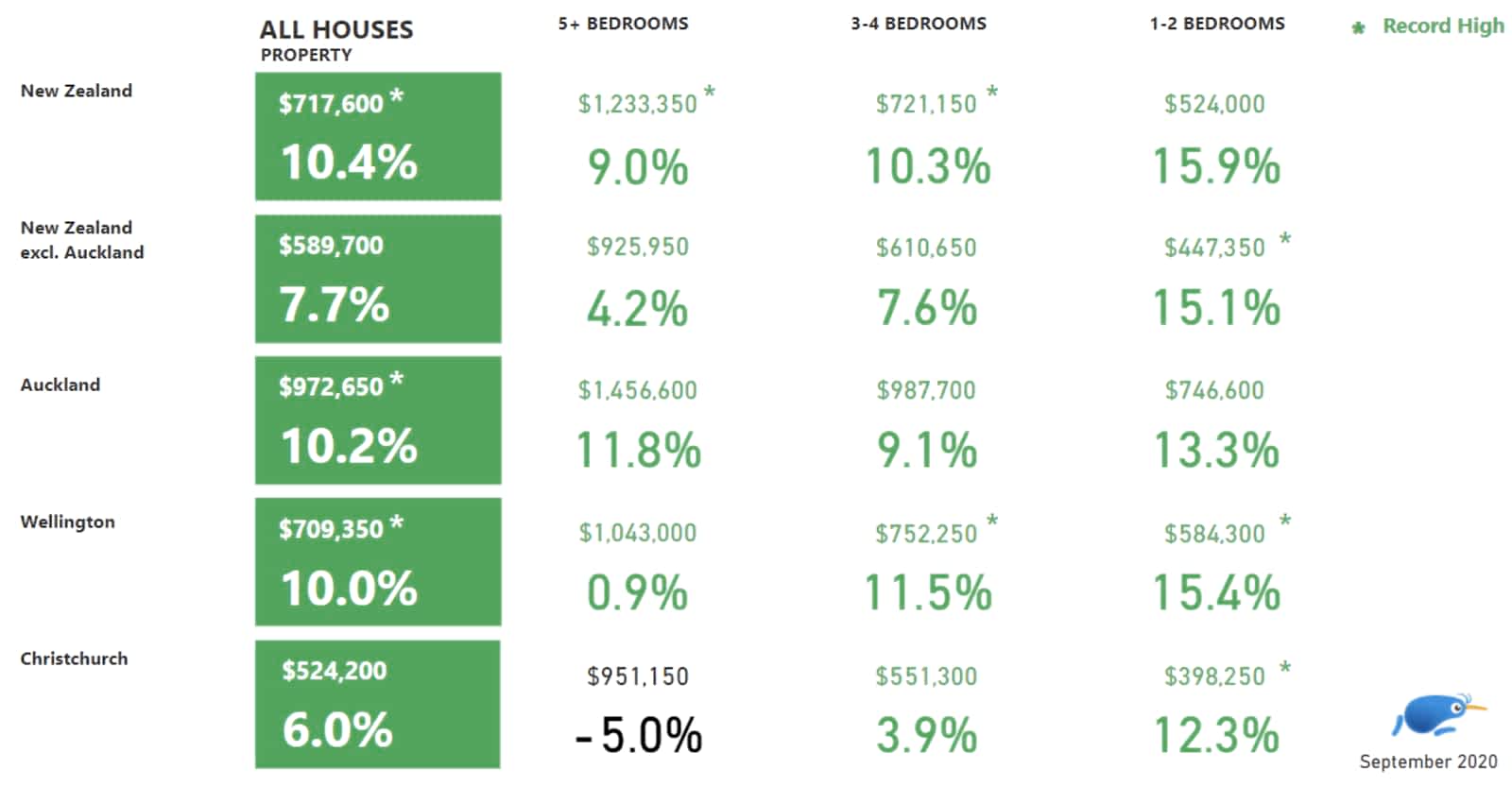

Both medium (3-4 bedrooms) and large houses (5+ bedrooms) had a record-breaking month in September.

The national average asking price for large houses reached an all-time high of $1,233,350, while the average asking price for medium houses was $721,150.

Barry Thom, co-founder of UP Real Estate, says that September sales volumes have taken 2020 to the agency’s best year since it started 27 years ago. Seller confidence is a big part of this.

As we move further into Spring and the warmer weather, it is likely that this momentum will continue through until at least the end of the year.

Auctions have remained a popular method of sale, with good levels of competition and approximately 80% clearance rates.

First time buyers are extremely motivated to buy, particularly with the lack of LVRs and low interest rates; however, we are still hearing reports that it is not easy to secure finance from the banks and this is acting as a barrier for some potential purchasers.

Investors appear to be expanding their portfolios as they are still actively purchasing in the market, but not selling.

In Auckland, the number of properties sold in September increased by 53.2% year-on-year (from 1,867 to 2,861) – the highest in 52 months and the highest annual increase in sales volumes in 11 years.

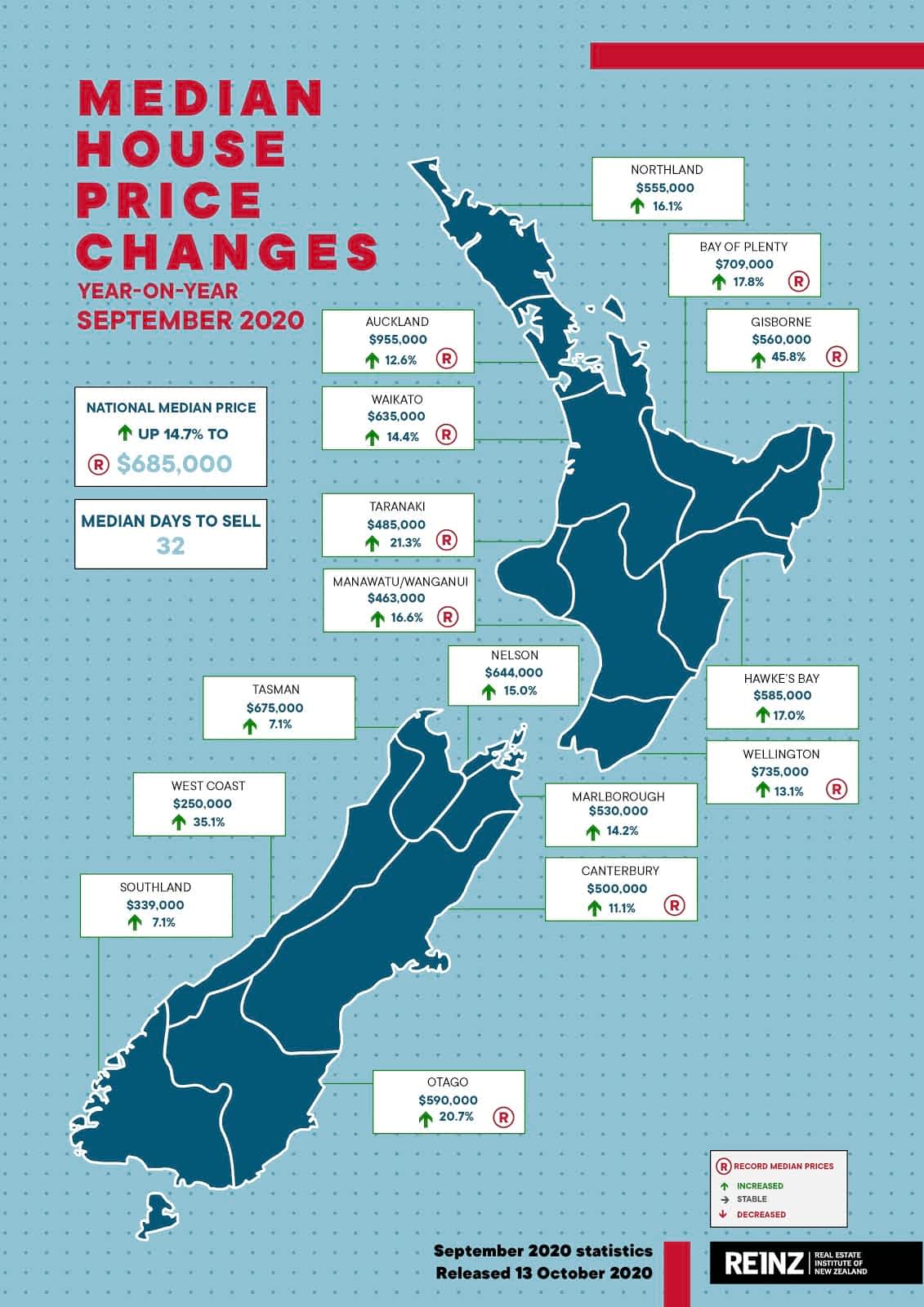

The median house price increased by 12.6% from $848,000 at the same time last year to $955,000 a new record high, and up from $949,500 in August this year (a 0.6% increase).

The median number of days to sell a property decrease by 3 days from 39 to 36 year-on-year, the lowest for the month of September in 4 years.

Auckland had the second highest percentage of auctions in New Zealand with 27.9% of properties (799 properties) sold under the hammer up from 25.9% at the same time last year (483 properties).

Source: Trade Me, Real Estate Institute of New Zealand (REINZ)

What do you think about it? Tag me on your favourite social media (Facebook / Instagram / LinkedIn / Twitter).

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.