🕑| 2-minute read

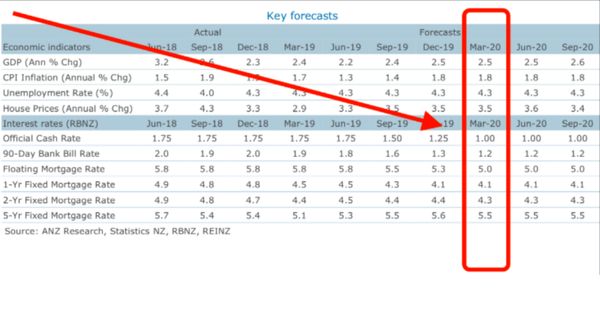

ANZ research team forecasts OCR will drop by nearly 40% (from 1.75 to 1.00).

I tend to agree because the Reserve Bank of New Zealand has signalled that the next move in the Official Cash Rate more likely to be down.

Short-term mortgage rates have already fallen recently.

Therefore, you may want to stay away from long-term loan contracts unless you want to be 100% sure about your repayments and will not regret the possible savings.

Should You Break Your Fixed-Term Home Loan & Save Money?

Think of a homeowner who entered a 2-year fixed-term home loan contract for $400,000 on 1 October 2018, at the average rate at the time (4.52%).

Six months later, on 1 April 2019, the homeowner has seen the minimum rate for a two-year term is at a much lower 3.99% and wants to switch.

Looking at savings alone, the homeowner would save $3141.54 in interest for the remaining 18 months of the term, by moving to this lower rate.

However, once you take into account break fees – which calculators available in the market show to be about $1800, it doesn’t look quite as attractive.

There would be a net saving of around $1341.54 after subtracting the break fee. Depending on the provider, you may also have to pay other administration costs.

Regardless of the amount you could save or lose by breaking your fixed rate home loan, you should always negotiate with home loan providers.

In the current competitive market, the lenders are more open to negotiation to keep existing customers and bring in new customers.

P.S. Do you know of other people that will find this article useful? Please share it on social media. Thank you!