(3-min read) Briscoes owns and operates 87 homeware and sporting goods stores across New Zealand under the Briscoes Homeware and Rebel Sports banners. The Managing Director Rod Duke purchased the company in March 1992, and it was listed on the NZX in 2001.

He continues to hold 77% of the shares. With Chair Dame Roseanne Meo who was appointed when the company listed, and Rod Duke’s management the company has continued to perform well in an increasingly crowded and difficult retail market.

The key to retail operations such as Briscoes is gross margins and stock turnover. Gross margins for the year were 39.4%, down from 40.09% the previous year, and stock turn was 4.69 times, down from 4.87 times. This meant the stock turned over every 11 weeks.

The company has an online platform which accounts for 11% of revenue up from 4% in 2016. First quarter 2020 sales to 26 April were $97 million compared to $150 million last year as a result of the Covid-19 Level 4 restrictions.

Until then sales had been up 4.2% on the same days last year. The company expects only a modest profit for the first half of the year.

In light of the current trading conditions the Board and senior management are taking a temporary 20% cut in their fees and salaries. The senior management have also agreed to a freeze on their salaries. Rod Duke is not taking his salary until at least the end of July 2020.

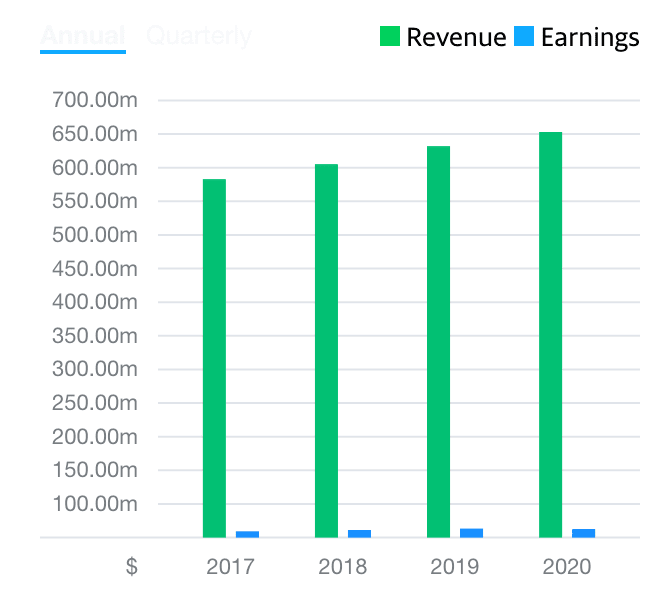

Revenue for the year to January 2020 was $653 million up 3.34%, EBIT was up 12.79% at $97 million whilst NPAT was down 1.3% at $62.5 million. NZ IRFS16 the new accounting standard for leases impacted NPAT $2.4 million.

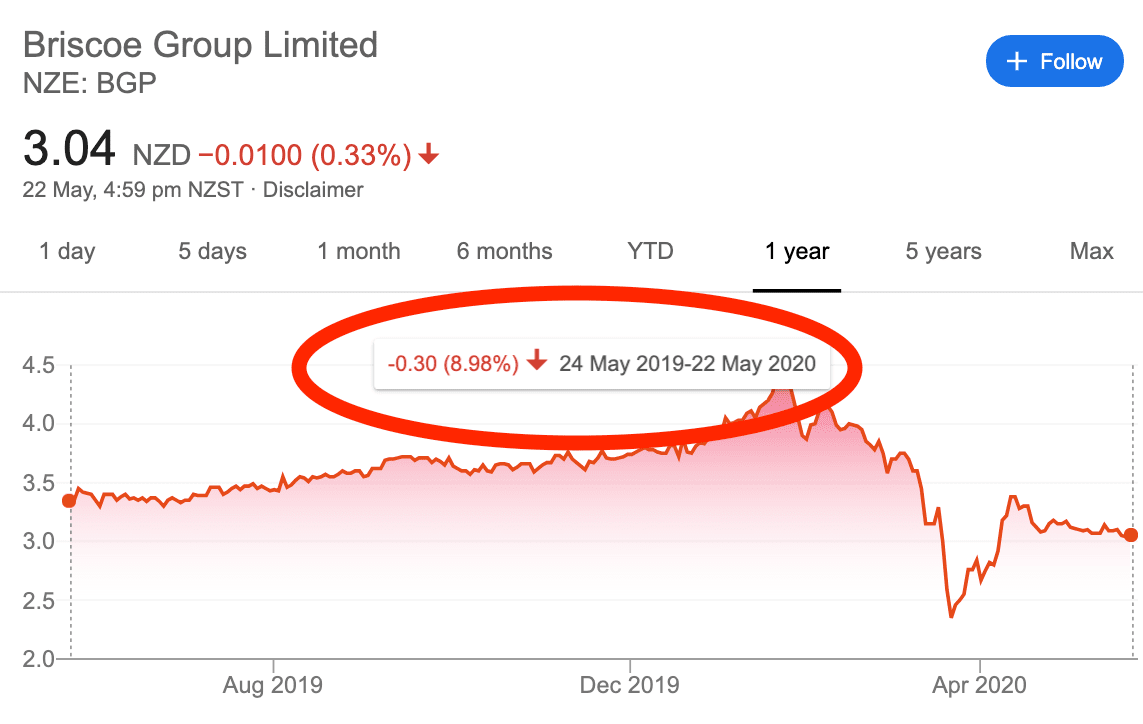

In March, the company announced it was cancelling the final dividend of 12.5 cents per share due to the impact of Covid-19 on sales. The shares are currently trading at $3.12 and have traded through a range of $4.48/$2.35 over the past year.

BGP has a shareholding in Kathmandu Holdings Ltd (KMD). At September last year this stood at 18.82% making BGP the second largest shareholder. In November 2019 KMD raised capital to purchase Rip Curl Ltd and BGP participated in that raising. In April 2020 KMD made a significant capital raising to strengthen its balance sheet. BGP decided not to participate and as a result its current holding in KMD is 6.77%.

Board Composition

The Board comprises an Independent Chair, 2 Independent Directors and the Managing Director, one female and 3 males. We consider the skill sets of the Board to be appropriate to the business.

Both the Chair and Managing Director are long serving members of the Board and both have fulfilled their obligations in an exemplary manner.

In previous Annual Reports the Managing Director has observed the difficulty in finding experienced executives and directors and we acknowledge this however good risk management requires Boards have a succession plan to ensure sustainability of the enterprise.

The company will hold its Annual Shareholders Meeting at 10.00am Friday 29 May 2020. Due to the Covid-19 restrictions this will be a virtual meeting. You can join the meeting at https://www.virtualmeeting.co.nz/agm/briscoe20/register

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.