If you have a stock that has all the following features, back up the truck and get as much as you can. Seriously, it’s almost impossible to find a stock with all ten hallmarks described in this chapter, but a stock with even half of them is a super solid choice.

1. The Company has Rising Profits / Earnings

Profit is the single most important financial element of a company. Without profit, a company can not pay shareholders any dividends or goes out of business.

I would stay away from speculative companies like Cannasouth (CBD:NZX) or UBER (UBER:NYSE) because it is a pure gamble. How do you know they will have enough money to withstand a crisis?

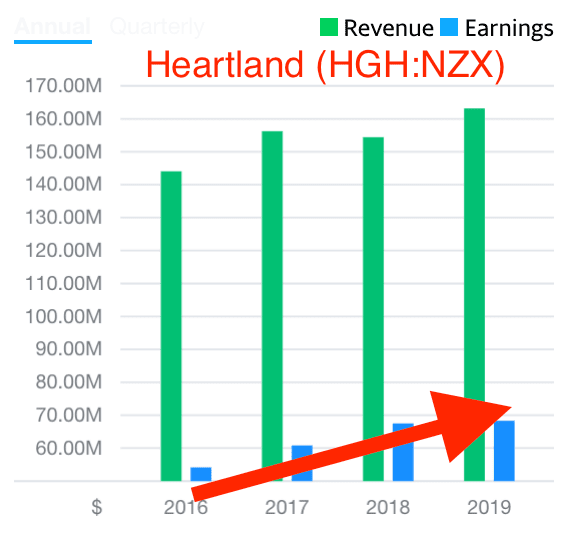

One good example is Heartland Group Holdings Limited (HGH:NZX).

2. The Company has Rising Sales / Revenue

Looking at the total sales of a company is referred to as analysing the top – line numbers. A company (or analysts) can play games with many numbers on an income statement; there are a dozen different ways to look at earnings. Earnings are the heart and soul of a company, but the top line gives you an unmistakable and clear number to look at.

The total sales (or gross sales or gross revenue) number for a company is harder to fudge.

Reviewing three years of sales gives you a good overall gauge of the company’s success.

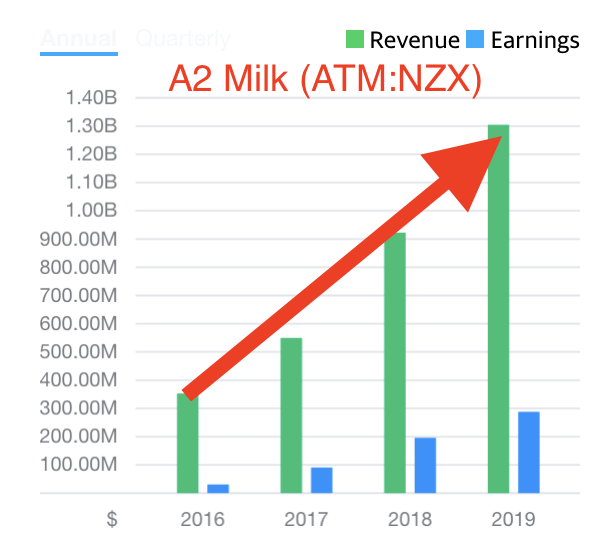

The a2 Milk Company Limited (ATM.NZ) has a steady revenue growth, therefore it is very popular.

3. The company has low liabilities

Too much debt will kill an otherwise good company. Debt can consume you, and as you read this, debt is consuming many countries across the globe.

Because a company with low debt has borrowing power, it can take advantage of opportunities such as taking over a rival or acquiring a company that offers an added technology to help propel current or future profit growth.

4. The Stock is at a Bargain Price

Price and value are two different concepts, and they aren’t interchangeable. A low price isn’t synonymous with getting a bargain. Just as you want the most for your money when you shop, you want to get the most for your money in stock investing.

You can look at the value of a company in several ways, but the first thing to look at is the price-to-earnings ratio (P/E ratio). It attempts to connect the price of the company’s stock to the company’s net profits quoted on a per-share basis.

Generally speaking, a P/E ratio of 15 or less is a good value, especially if the other numbers work out positively. When the economy is in the recession and stock prices are down, P/E ratios of 10 or lower are even better. Conversely, if the economy is booming, then higher P/E ratios are acceptable.

Don’t forget to compare P/E of your company with its peers in the same industry.

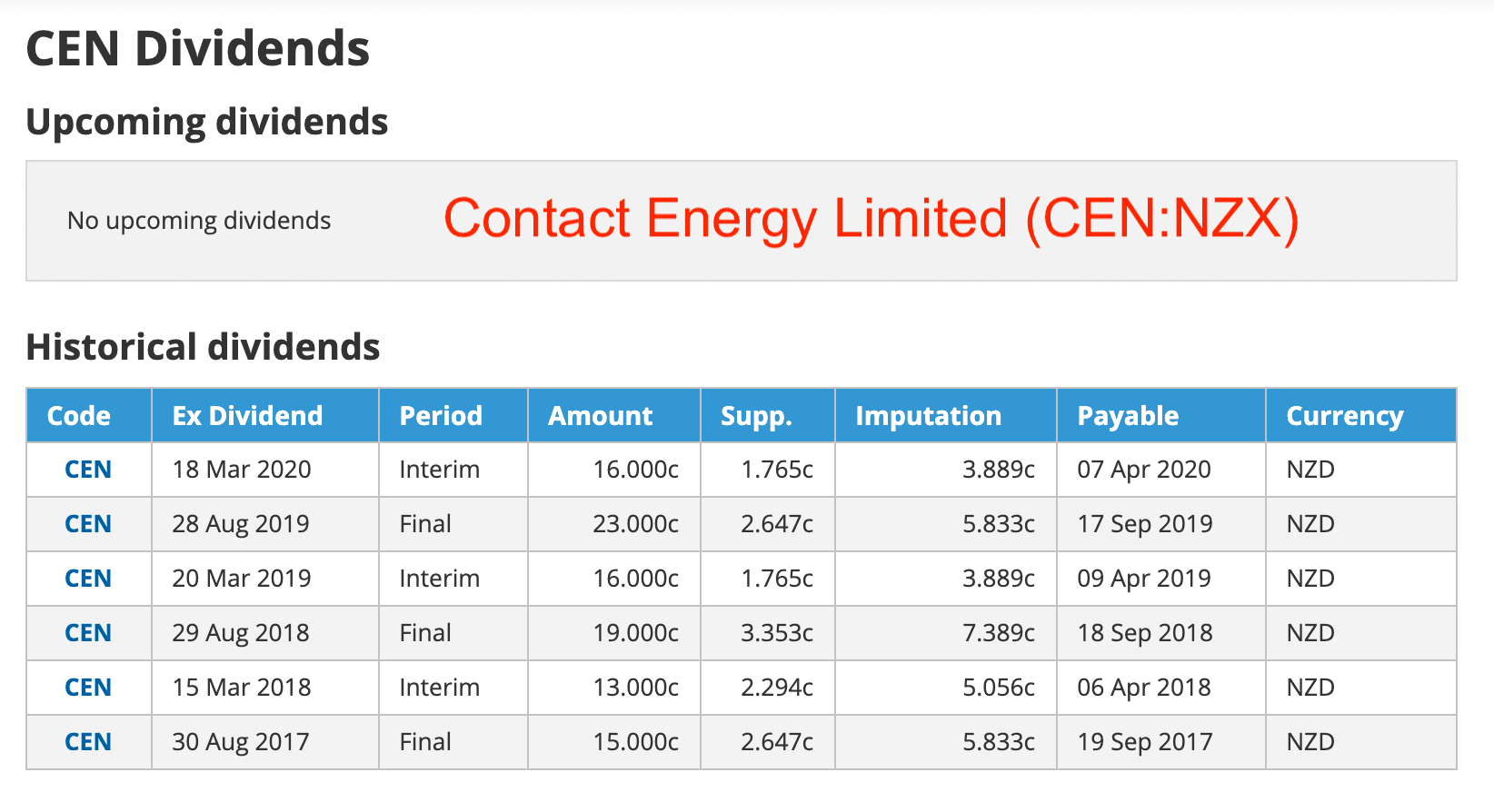

5. Dividends are Growing (View the History)

Long-term investing is where the true payoff is for today’s investors. But before you start staring at your calendar and dreaming of future profits, take a look at the company’s current dividend picture.

Just review the long-term stock chart (say 3 years or longer) of a consistent dividend-paying company.

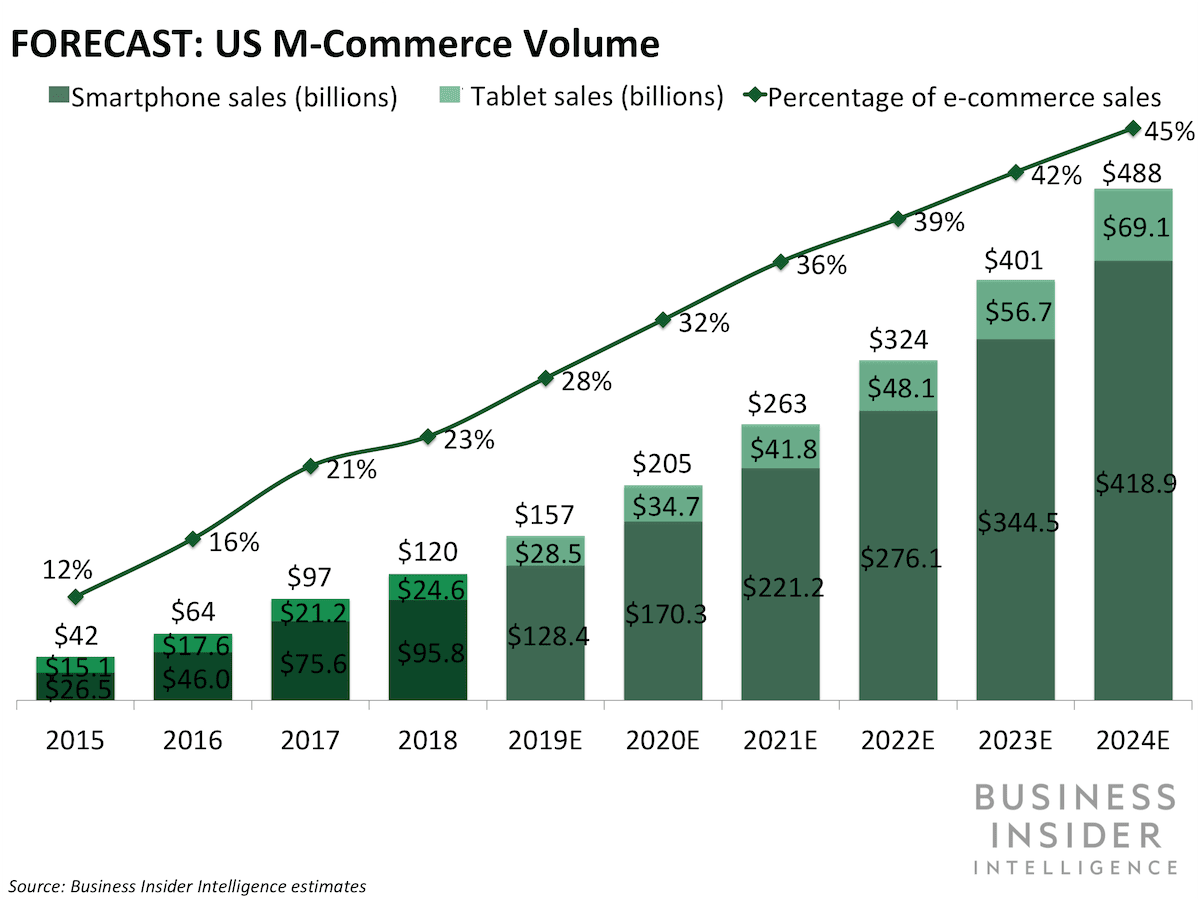

6. The Market is Growing

In this context, the market is growing means the market of consumers for a given product. If more and more people are buying widgets, for instance, and the sales of widgets keep growing, that bodes well for companies that sell (or service) widgets.

You may want to read the example of a company that is taking advantage of the rising trend in online learning.

7. The Company is in a Field with a High Barrier to Entry

A high barrier to entry simply means that companies that compete with you will have a tough time overcoming your advantage. This gives you the power to grow and leave your competition in the dust.

8. The Company has a Low Political Profile

We live in times that are politically sensitive. All too often, politics affects the fortunes of companies and, by extension, the portfolios of investors.

Yes, sometimes politics can favor a company (through back-room deals and such), but politics is a double-edged sword that can ruin a company.

Canasaouth (CBD:NZX) is directly affected by the political decisions because cannabis-related products will be regulated.

9. The Stock is Benefiting from Favorable Megatrends

A megatrend is a trend that affects an unusually large segment of the marketplace and may have added benefits and/or pitfalls for buyers and sellers of a given set of products and services.

The problem is that when a stock has little substance behind it (the company is losing money, growing debt, and so on), it’s up move will be temporary, and the stock price will tend to reverse in an ugly pullback.

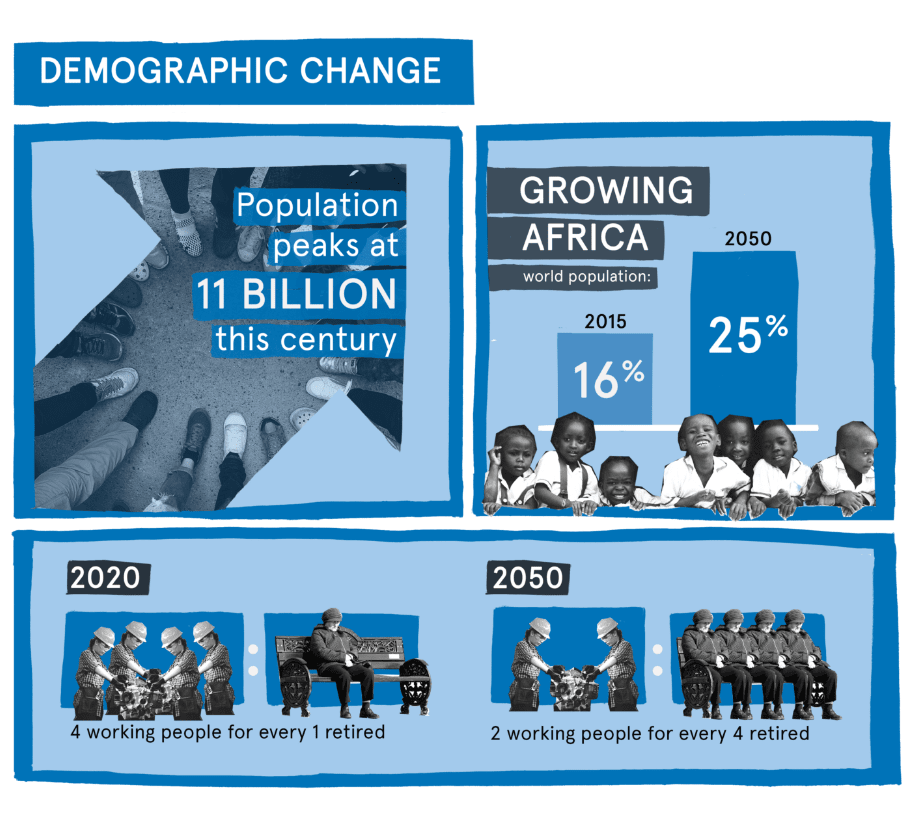

A good example of a megatrend is “the aging of NZ population”, who are getting ready for retirement as they reach and surpass the age of 65.

Those companies (e.g retirement villages) that provide services and products for senior citizens would have greater opportunities to sell more of what they provide and would then be a good consideration for investors.

Did you know? Too many investors buy stocks that have no P/E ratio. These stocks may have the P (price of the stock), but they have no E (earnings).

If you invest in a company that has losses instead of earnings, then you aren’t an investor; you’re a speculator.

P.S. I research and interview economists, NZ investors and successful companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.