(2-minute read)

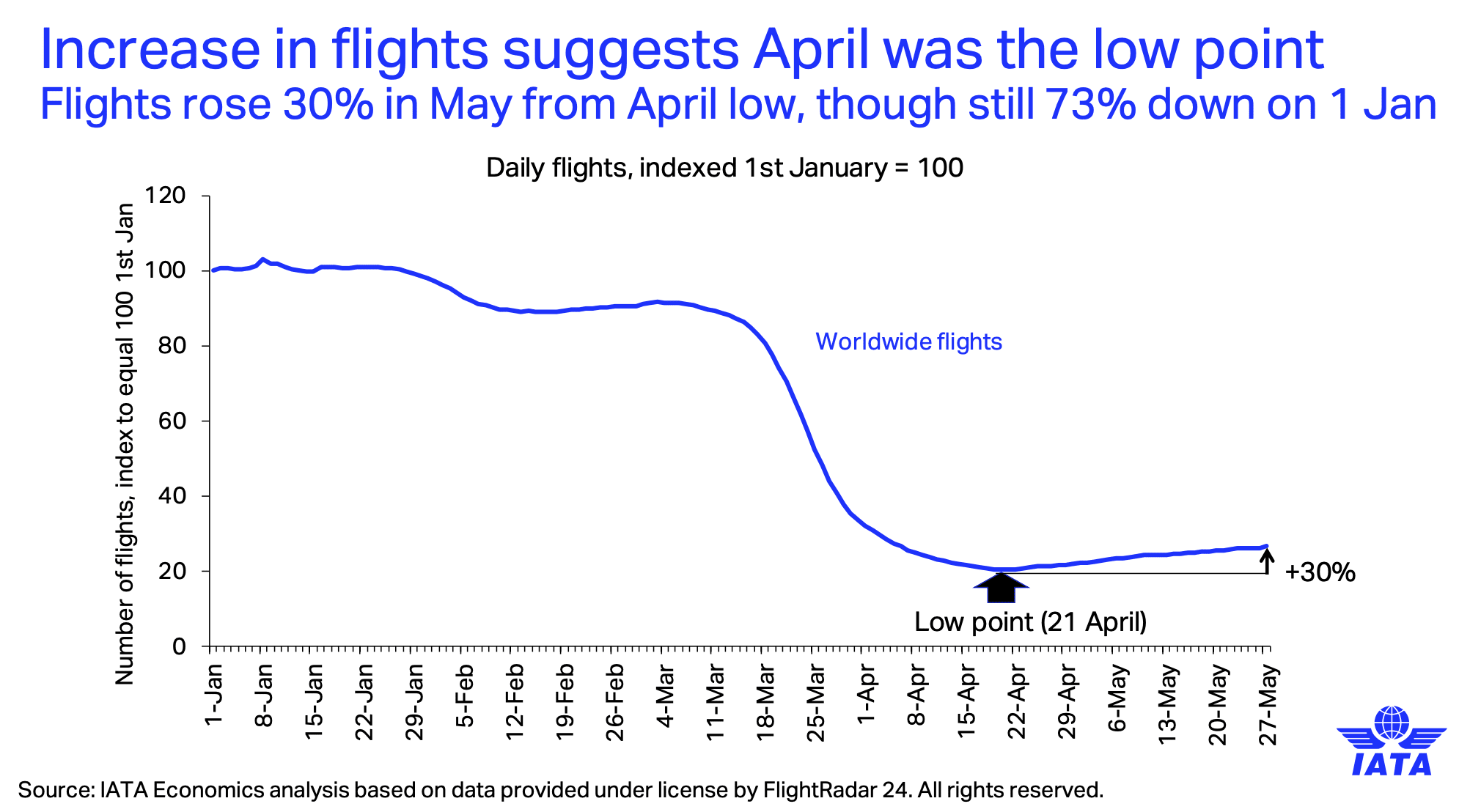

International Air Transport Association’s (IATA) monthly analysis shows that traffic volumes have likely bottomed in April and will gradually recover, with the initial support of domestic travel. Domestic aviation markets would recover faster than international ones.

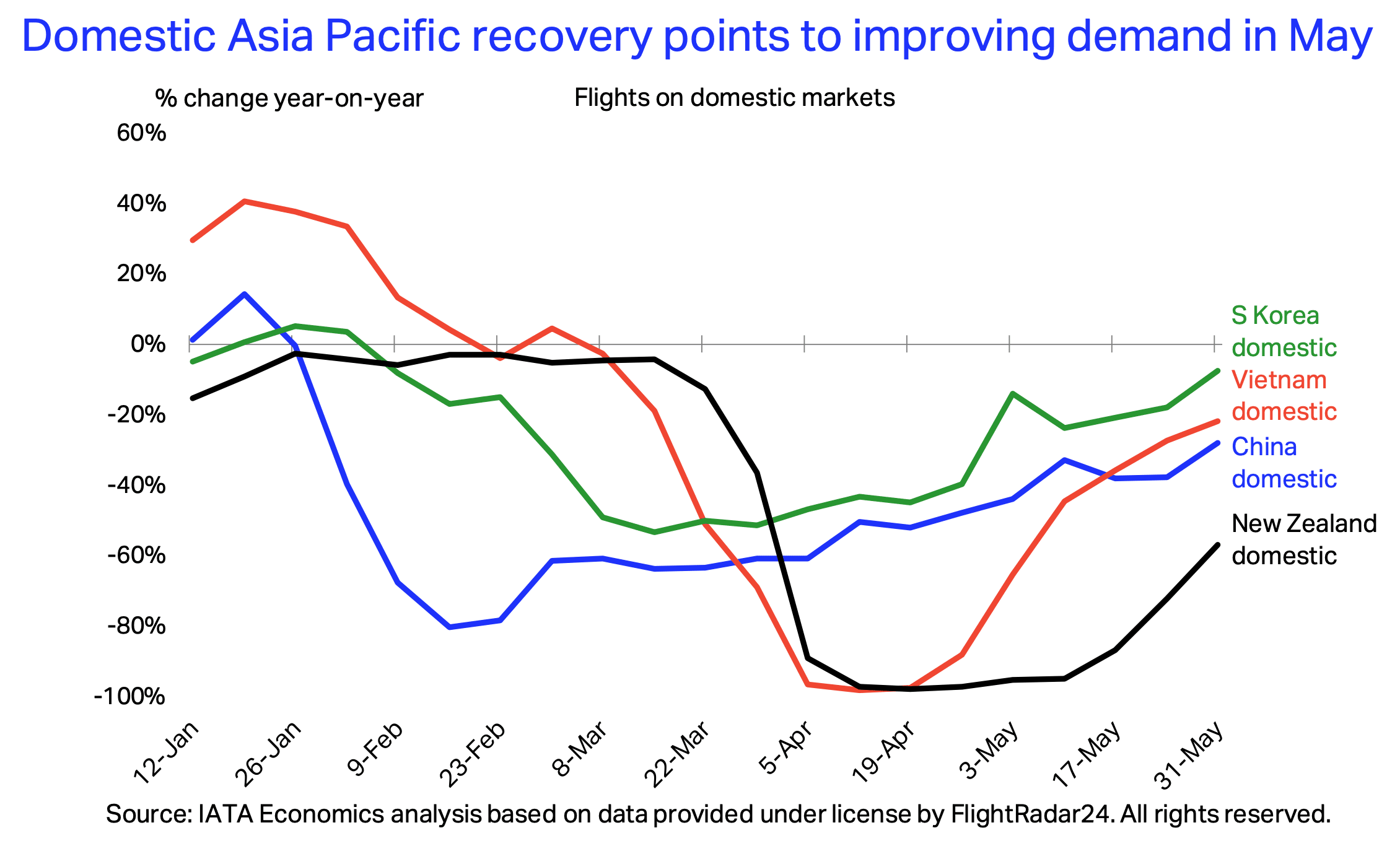

This week’s chart shows the pattern of domestic market recovery in a sample of countries which appear to have contained COVID-19 successfully.

South Korea, Vietnam, China and New Zealand are amongst the domestic markets showing clear signs of rebound. South Korea has been successful at containing the spread of COVID-19, with muted daily growth rate in COVID-19 cases since early April.

The country kept a relatively light-touch lockdown in place, helping to maintain a moderate level of air transport operations; traffic was down ~55% yoy during the worst week (ending March 15).

Vietnam and New Zealand both reacted quickly to the pandemic by implementing strict containment measures early in the crisis, which resulted in generally low growth in the number of cases but also brought air transport to a halt.

Vietnam eased most social isolation rules on April 23, while New Zealand took a similar step around May 13. In both cases, those decisions were followed by a robust recovery in the number of flight operations.

Chinese airlines maintained a skeleton network throughout the crisis. Despite the pandemic being mostly under control in China since mid-March, the domestic market recovered relatively slowly.

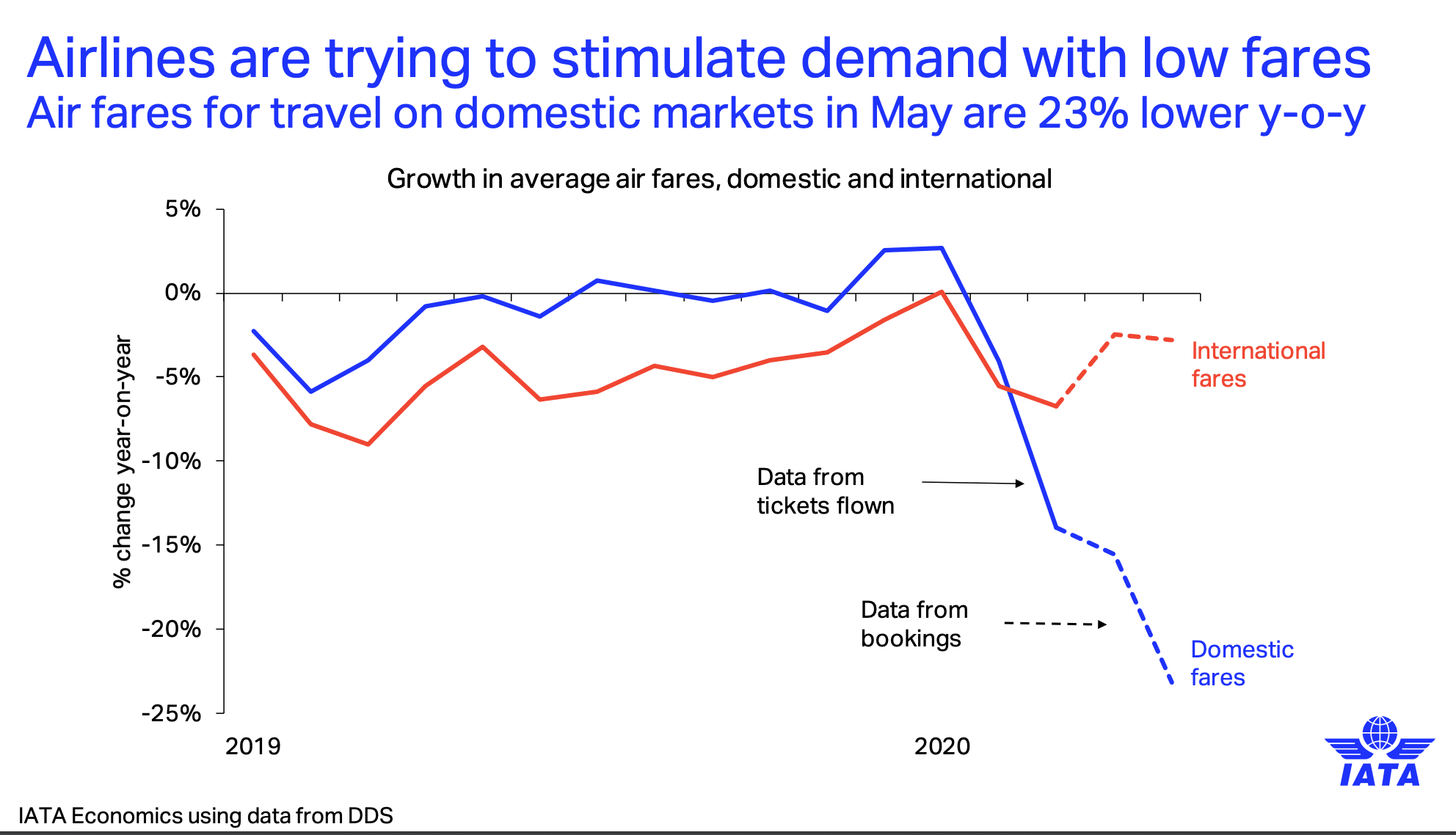

More generally in many domestic markets, airlines adjusted their fares down (c. -25%yoy in May) to stimulate demand on internal routes.

All the above markets are located in Asia Pacific, the first region to have been impacted by the virus. The propagation of the outbreak suggests that we might see domestic markets recovering in Europe in the coming weeks, followed by domestic markets in the rest of the world.

While international volumes will remain muted in the near term, the domestic recovery points to global passenger volumes lifting off the record lows seen in April.

Investors took on a confident attitude after Prime Minister Jacinda Ardern signalled New Zealand could be out of alert level 2 as early as 10 June 2020.

Level 1 would be a return to life as normal — albeit with the border still closed — clearing the path for economic recovery from the shutdown which stamped out the virus.

Air NZ shares rose 19.71% during the last week. It announced the plans to increase operations to 55% of normal domestic capacity. The news coincided with progress on a trans-Tasman bubble with a detailed set of proposals due to be delivered to the New Zealand and Australian governments by the end of the week.

Refining NZ stock price climbed 27.14% over the last 7 days. Investors were happy to buy on the expectation of growing demand for fuel as the economy bounces back. The share price is still half where it started the year, despite jumping more 20 percent this week.

Source: IATA, NZX

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.