Juice: Many of you may have seen this last night, The Block television show. It was the big finale. It’s been one of the highest rating shows of all time for TV3.

And if you didn’t see it, there were surprise winners, Andy and Nate. So there’s four couples, right, they all put their house up for auction.

And Andy and Nate’s got passed in. I believe the first time in the history of that particular show that a house has been passed in. That means they didn’t meet the reserve, and so no sale. And then, so it looked like another couple were going to win.

And then they announced after the end of the auctions, they were putting Andy and Nate’s house back on the market. A lot of people were quite shocked by that, particular the women who thought they’d won, they’d already been celebrating.

And so it raised quite a few questions for us about, well, different things. One is whether property speculation might be affected by what we saw on the show last night. Whether a show should be encouraging property speculation, as it seems to have done.

Whether it was fair, what we saw last night. Whether the fact that the houses barely made it past their reserve is a sign that things are cooling. Well, to help us sort of navigate some of these issues, we’re joined by the chief executive officer of the Property Institute.

She’s Ashley Church. And Ashley’s here to discuss what last night’s episode says about the country’s property market. Hey there, Ashley.

Full Audio Interview (transcription below):

Ashley Church: Good day, Juice. I’m actually a bloke, but —

Juice: Yeah, I just realised halfway through. It could have gone either way. And because it’s Monday, of course, it went the wrong way. Sorry, Ashley. Nice to have you on.

Ashley Church: All good. Thank you.

Juice: Yeah. Hey, did you watch last night?

Ashley Church: Look, I actually didn’t. I just got back from New York and I was asleep. But I’ve been immersed in it today like pretty much the rest of the country has through social media and so I’m pretty acquainted with the various issues –.

Juice: Yeah, okay. So first of all, what did you think of the ending? It sounded like it was a bit of a– either sort of decided on the fly last night or adlibbed when they sort of put that house back on at the end and changed the result, basically, of who won, what did you make of that?

Ashley Church: Yeah, look, I think that’s actually the crux of the issue. So I don’t for a moment doubt that TV3 or the producers of the show were fully within their rights and had probably disclosed to the contestants in advance that that was the process that would be followed.

But that doesn’t take away from the fact that Anita and Stacy, I think, were pretty hard done by. They thought they’d won, and then suddenly at the death, in comes the opportunity for Nate and Andy to have another crack, and they won.

So on that basis, I think you can understand the uproar on social media about this thing, given that, I think sort of the Kiwi values kick in and you think, “Well, hey, that’s not really fair.”

Juice: Remind us, what does the Property Institute do? What’s your sort of role?

Ashley Church: Yeah, no. So we advocate on behalf of a range of property issues. We represent a range of property professionals that operate within the market. And we’re pretty vocal on issues around housing particularly in Auckland but also around different parts of the country.

Juice: Okay. Are shows like The Block bad for the industry?

Ashley Church: Look, no, I don’t think they are. And in fact, they sort of cast a light on the fact that property’s alive and well. And it’s interesting because I heard in your intro, you were talking about what this might mean for speculators or for speculation.

And one of the good things, I think, Jesse, that’s come out of this for us is that we’ve been rabbiting on for quite some period of time about the difference between property investors, who are typically mums and dads who invest for the long term, and speculators, who are people who get in and out of the market quite quickly.

And depending on how they do that, they can either be a good for the market or a blight. So let me give you a difference. When markets are hot, speculators can come in, they can buy a property.

They literally just have to wait for a short period of time, and that can sometimes just be weeks or months, sell the property again and often make a profit on that. And that’s a bit of a blight on the market, to be honest with you.

But the sorts of things that The Block do, the sorts of things that they engage in there, where they’re actually buying a property and they’re renovating, and going through a process of urban renewal, and putting it back into the market in an improved form is actually a pretty strong argument to say that that’s good for the market because it continues to improve the stock that you’ve got available.

So it really depends on what they’re doing as to whether or not they’re good or bad.

Juice: That makes sense to me. And in terms of improving on things, when you had a look at those houses, were you surprised that they didn’t reach a higher value in the auctions last night?

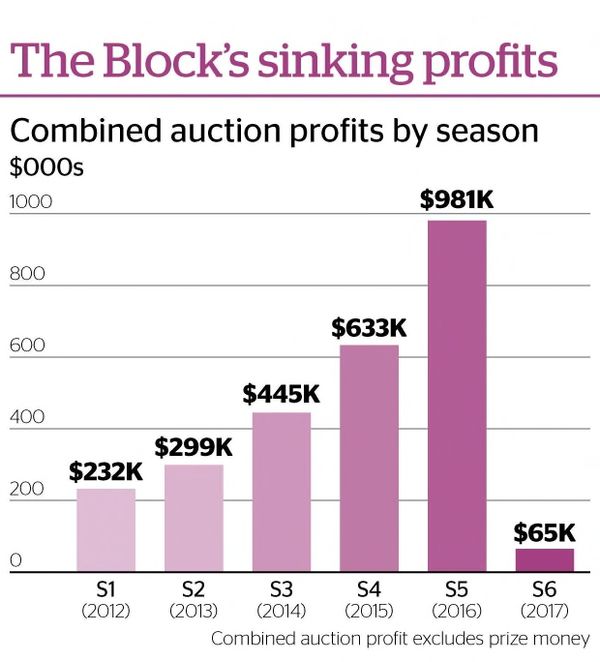

Ashley Church: Not particularly. I think that’s probably a pretty good reflection. In fact, if there’s anything that comes out of this, it’s probably that it’s a good barometer of where the market’s at at the moment.

So I think what it did do was it indicated that the market, has indeed, has flattened, that confidence has disappeared. You could argue, I think, as we did just a few weeks ago, that that may have something to do with election or it may be longer term.

But it’s very much of a reflection of where the market sat. What did surprise me, although it’s difficult to know how the producers would change this format– what did surprise me is that they used auctions as a method for selling, because auctions are notorious in flat markets of being a complete waste of time.

Juice: Really?

Ashley Church: Yeah, in a hot market. And think about this for a moment. In a hot market, you’ve got competing buyers all together in the same room. People that want to buy a property and market values are going up.

So people will compete, and so they’ll outbid each other until somebody ultimately wins and they’re the person that purchases a property. But in a flat market, which we’re in right now, exactly the opposite happens.

You have one, maybe if you were lucky, two people in the room who are genuine, interested buyers. So there is no competition existing, which means that you don’t get the bids. And you don’t have to be a property professional or an expert in property to understand the dynamics of that.

So I’m a little bit surprised that that was the mechanism that they used. Having said that, hard to know what else that they could do in the context of the way that the show works. You couldn’t sell houses —

Juice: Yeah. The old blind tender is not very good TV, actually.

Ashley Church: No. No. Exactly. And maybe that’s it. But in the context of the show, in hindsight, again, it was pretty predictable that this was going to happen. And I’m actually surprised that there was money made on, I think, three of the four of them.

Juice: Out of interest, the fact that it happened the week before or the week of a general election, would you expect that to affect prices?

Ashley Church: I certainly don’t think it was helpful. We released some data about a month ago that basically said that there’s a really clear, causal link between the date on which an election is announced and the market in the period of time between that date and the actual election itself.

And there’s a very clear, empirical drop that you can measure in both 2011 and 2014. So it’s reasonable to assume the same thing’s happened in 2017.

Juice: Okay. What do you expect to happen next week then?

Ashley Church: Election-wise or–?

Juice: Well, yeah. Do you think the market will pick up again, or do you think it will depend on the outcome of the election?

Ashley Church: So there’s a difference between 2011, 2014 as at 2011, we were still coming out of the GFC, so that drop-off was less discernible. 2014, the market took off again very quickly after the election, pretty much straight away, and prices took off again very fast.

There’s a couple of differences this time around, Jessie. One of them is the imposition of those LVR restrictions, which make it harder for people to actually get a deposit together to buy a house.

And the other one is the fact that the banks are actually rationing mortgage funds at the moment, so it’s actually harder to get a loan.

So there’s an argument that says that those will probably act as a bit more of a moderator on the market than might have been the case in 2014, where it was a bit more of free-for-all. But it’ll be interesting.

I’m probably going to be as interested as anybody as to see whether that pick-up takes place sort of on Monday of the week following next.

Juice: Yeah. And, hey, speaking of the banks, I see Tony Alexander, the economist at the BNZ – now, this was a great quote, classic Tony quote – said, “Real estate agents might have to start thinking about getting a second job.” Would you agree with that?

Ashley Church: Yeah. I would, and that’s not particularly unusual. So New Zealand’s very much around boom cycles and then flattening periods. So we don’t tend to have busts, despite what you read in the media.

New Zealand property market doesn’t tend to drop by any discernible amount. But what it does do is it sits still for anything between three and five years between booms.

And one of the features of that apart from the fact that prices don’t move is that the quantity of property sold, the volume of houses sold, is much reduced. So if you think of the maths behind that, it means that you actually physically need fewer agents.

And so the agents who aren’t as good as their job, who might have done okay during a boom tend to find that they can’t get listings, and therefore, can’t sell properties during that period.

So I think he’s probably right, but I don’t that’s necessarily a bad thing. It’s just part of the swings and roundabouts of the way that the industry works.

Juice: Yeah. Why don’t we bust as much?

Ashley Church: That’s a really good question, and it’s one of the things I get a bit frustrated about when I read media here because it always quotes what’s happening in overseas markets.

But in fact, in New Zealand, you’ve got to go back to about 1979 to find anything that even resembles a dramatic drop in prices after a boom. Since then, basically, property prices go up and then they stabilise. They go up and then they stabilise.

And while there’s a bit of movement on the margins – you might get 2 or 3 percent drop over that flattening period – you don’t tend to get those big drops. I think that there’s a couple of reasons for it, Jessie.

One of them is the fact that New Zealand doesn’t have a lot of other capital markets to invest in. So Kiwis are big investors in property. We understand it. We tend to put a lot of money into it, and we tend to be reasonably good at it.

And the other one is, I think that– and I don’t know the reason for this. I just recognise it as a trend. We tend to basically sort of put our hands around waist– sorry, around our shoulders and just sort of sit tight. And we recognise that we’re in a flattening period.

And so rather than rushing out and panicking and selling our properties, like happens in other markets, we tend to just basically say, “Hey, we’re in a flat period. So we’re not going to do anything for a while.” And we wait it out.

Juice: Hey, Ashley. Mr. Ashley Church, really appreciate your time today and your opinions and expertise. Thanks so much.

Ashley Church: You’re very welcome.

Juice: Nice to talk to you.

Source: Radio New Zealand

P.S. Do you know of other people that will find this article useful? Please share it on social media. Thank you!