(4-minute read)

Do you think like a wealthy person or like an average person? You can find out by conducting the following simple thought experiment. When deciding whether to buy a $5 coffee, what do you think about?

The average person only considers whether they have $5 to spend. Although this approach might initially seem sensible, the wealthy person thinks bigger.

Instead, they consider that if they spend this $5 now, that’s money they can’t invest in something else. In other words, having a wealthy mindset means having an investment mindset.

I’m not saying you have to deny yourself pleasures like that — you can buy lattes and become wealthy at the same time. You simply have to realise where you money goes and the opportunity cost.

As long as you have met your saving & investment monthly goals you can shamelessly buy coffee, gadgets, etc. as much as you want.

Yes, money is for spending but don’t forget that some of this money has to be put to work so you can achieve the ultimate financial freedom in the future!

Crucially, multipliers make time for themselves the same way that wealthy people make money – with an investment mindset. Let’s take a look at how investment begets both time and money.

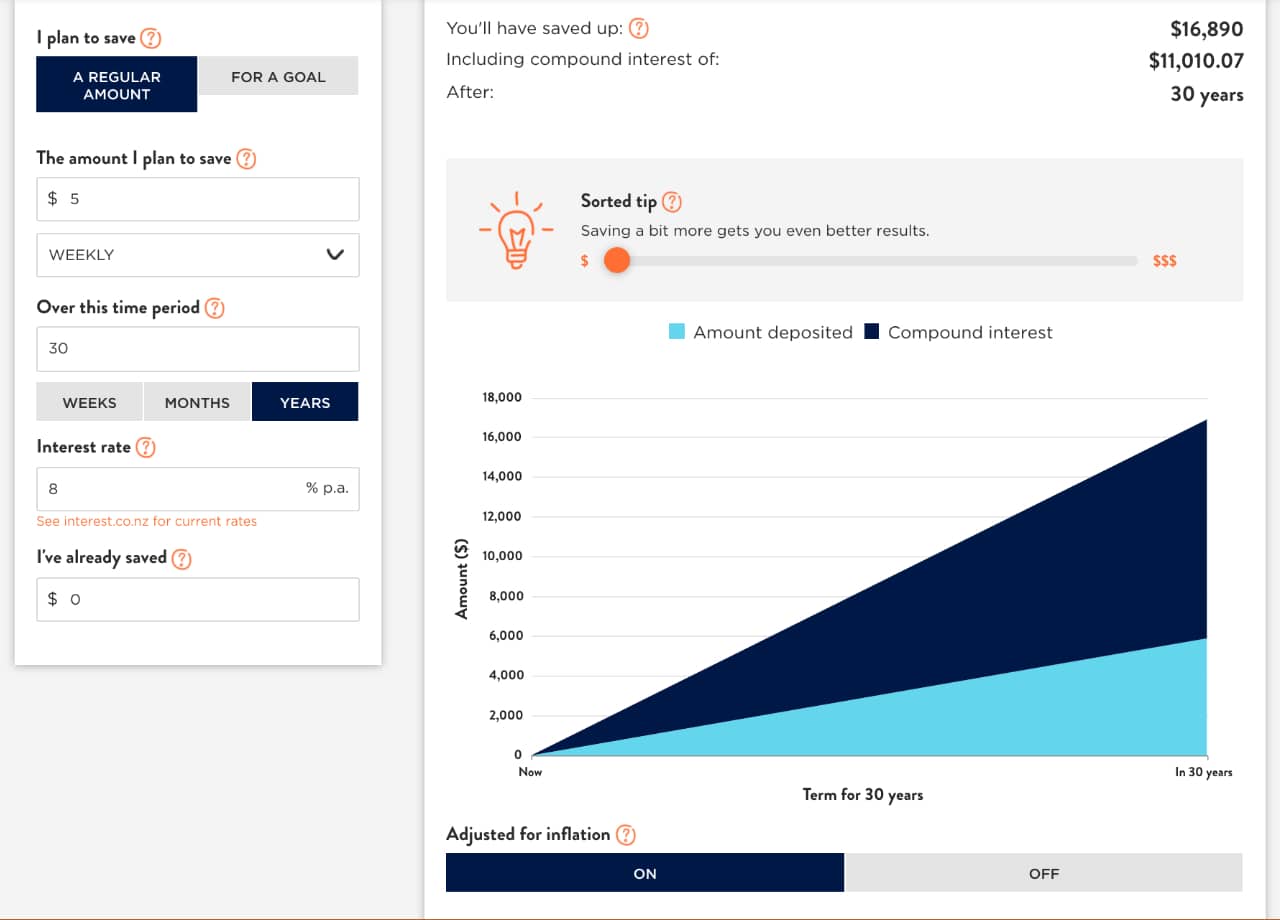

If you didn’t spend the extra $5 on coffee every week, you could invest that money in the stock market at a historically average interest rate of 8 percent.

And, thanks to the magic of compound interest, in 30 years that weekly investment of $5 will become $16,890.

Thus, a wealthy person understands that the true cost of that weekly coffee is $16,890 – the $5 today and the missed opportunity to make $16,890 in the future.

Would you really spend that much money on coffee?

Waiting Until the Last Minute Can Save You Time & Money.

Visit a lake at sunset, and you may find a fisherman there with a line of freshly caught fish. But take a look during the mid-morning, and you won’t see him catching any fish, no matter how long he stands there. Why?

Because fish bite at dusk and dawn, not at 11:00 a.m. This shows that success is not just about taking action or how long you spend doing something. In life, just as in fishing, it’s also about waiting for the right moment.

With this in mind, give yourself permission to procrastinate.

But before you start watching TV instead of going to the gym, let’s clarify a few things. The procrastination we’re talking about here isn’t putting off something you should be doing because you don’t want to.

Instead, we’re talking about having the patience to wait until the optimal time to act. And as every multiplier knows, patience can save you a lot of time & money.

Let’s consider a business owner who likes to get through her monthly to-do list as quickly as possible. When an order comes in for a product that’s due in a fortnight, she’ll pack it up as soon as she’s off the phone with the customer.

But what if that customer calls back to change or cancel their order? In this scenario, she would cost herself time, and possibly money, by unboxing everything and starting all over again.

In contrast, if she’d patiently waited until the day before delivery, she could’ve taken the alterations into account and saved herself precious minutes.

This story highlights the key reason why patience is so important. It allows you to adapt to unpredictable changes, whether that’s a change in the weather, the stock market or a customer’s requirements.

In our fast-paced modern world, things tend to change at breakneck speed. So don’t be scared of a little procrastination, and have the patience to wait and see.

Another example of how waiting until the last minute can save you money is when you want to participate in the SPP (Share Purchase Plan).

You can certainly invest in a company as soon as it is possible. However, if you wait till the last day you may get some valuable information that may change your mind.

You may decide to invest more to take advantage of a good stock tip or avoid this offer altogether if you learn some negative news.

Summary:

You may be wasting the precious time every single day, resulting in huge financial and productivity costs.

Regain control of your schedule by carefully evaluating your activities and determine what can be eliminated and what should be done later.

IMPORTANT: This article is of general nature only and readers should obtain advice specific to their circumstances from professional advisers.

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.