🕑 (5-minute read)

🕑 (5-minute read)

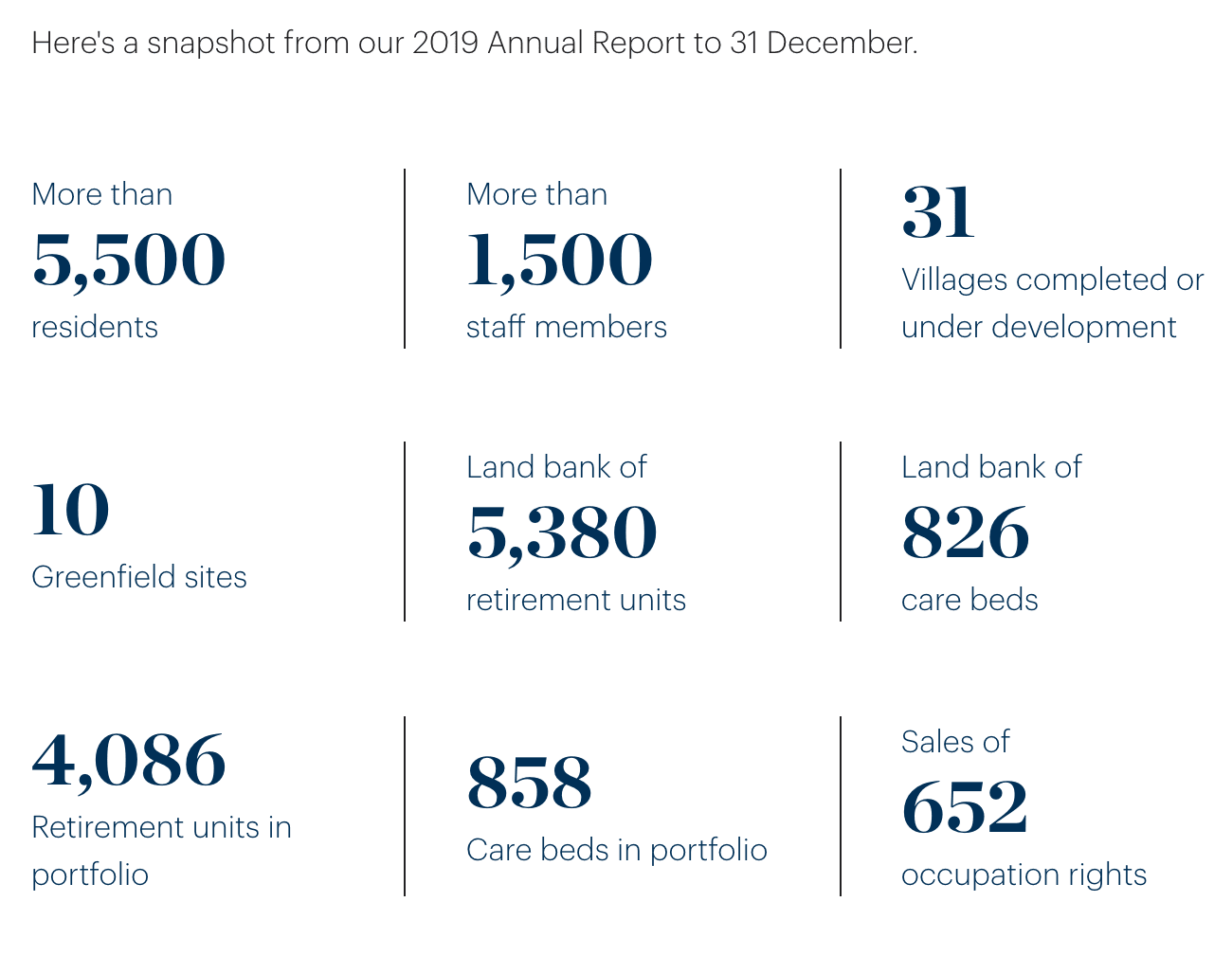

The company owns and operates 31 retirement villages comprising 4086 retirement units and 858 care beds. They have over 5500 residents and 1500 staff.

They also have a landbank equivalent of 5380 retirement units and 826 care beds. During the year the company acquired 2 properties for development in Melbourne, Australia as part of its intended expansion into that market.

Revenue for FY19 was up 11% at $153 million however the movement in property values was down 21% at $165 million resulting in Total Income of $319 million down 8%. Expenses were up 9% at $130 million and NPAT was down 18% at $175 million.

Dividend for the year was 14.1 cents per share. The shares are currently trading at $6.20 having traded through a range of $9.23 to $3.71 over the past year. We note that whilst the NZX50 has declined 17% since its peak earlier in the year SUM share price has declined 34%.

Other listed companies in the retirement village sector have seen their share prices decline from between 28% and 46%.

Underlying profit *

* Underlying profit is a non-GAAP measure and differs from NZ IFRS profit for the period. Underlying profit does not have a standardised meaning prescribed by GAAP and therefore may not be comparable to similar financial information presented by other entities.

The Directors have provided an underlying profit measure in addition to IFRS profit to assist readers in determining the realised and unrealised components of fair value movement of investment property and tax expense in the Group’s income statement.

The measure is used internally in conjunction with other measures to monitor performance and make investment decisions and has been audited by Ernst & Young. Underlying profit is a measure which the Group uses consistently across reporting periods. Underlying profit is used to determine the dividend pay-out to shareholders.

Total assets

Total equity

Net operating cash flow

We consider the short to medium term risk for the company to be balancing its supply of units and care beds to match demand given the uncertain economic conditions.

Both current and potential residents will have seen the value of their capital investments decline and it is likely their income will also decline.

In addition, residential property values may decline leading to potential residents delaying their moving to a village. We also note at least one new entrant to the market intends offering a different model that would see capital gains (and losses) split between the occupier and owner rather than the current model.

Summerset Group Holdings Ltd (SUM) will hold its Annual Shareholders Meeting 1.00pm Wednesday 29 April 2020.

Summerset CEO, Julian Cook will talk about Summerset’s performance during the 2019 financial year and plans for 2020. Questions from shareholders attending the meeting will be invited.

Because of the Covid-19 Level 4 restrictions it will be a virtual meeting.

You can join the meeting at https://www.virtualmeeting.co.nz/agm/SUM20/register

Board Composition

The Board comprises an Independent Chair and 6 Independent Directors, 3 females and 4 males. We consider the Board has a range of skills that are appropriate to the business.

Resolutions

1. That the Board is authorised to fix the auditor’s remuneration for the coming year.

This is an administrative resolution.

We will vote undirected proxies IN FAVOUR of this resolution.

2. To re-elect Rob Campbell as an Independent Director.

Rob Campbell was appointed to the Board in September 2011 at the time the company was listed on the NZX. He was also appointed Chair at that time. He is the Chair of SkyCity Entertainment Group, WEL Group, Tourism Holdings and director of Precinct Properties.

We note that if he is re-elected, he will have served 12 years at the end of that term. It is internationally recognised that a Director ceases to be considered independent after they have served for 12 years. We would expect he and the Board to have a discussion around his future some time during this term.

We will vote undirected proxies IN FAVOUR of this resolution.

3. To re-elect Andrew Wong as an Independent Director.

Andrew Wong was appointed to the Board in March 2017. He is the Managing Director of HealthCare Holdings Ltd, a private investment company and consequently a director of a number of companies including Auckland Radiation Oncology, Mercy Ascot hospitals, Kensington Hospital and Mercy Radiology.

He is an Adjunct Professor of AUT. Andrew qualified as a medical practitioner specialist in Public Health.

We will vote undirected proxies IN FAVOUR of this resolution.

4. To elect Venasio-Lorenzo Crawley as an Independent Director.

Venasio-Lorenzo Crawley was appointed to the Board in February 2020 and is therefore required to offer himself for election. He is the Chief Customer Officer at Contact Energy and an Advisory Board Member at the Auckland University of Technology.

He has also recently completed a term as a Future Board Director for The Warehouse Group. His previous directorships and trustee positions include the Electricity Retailers’ Association of NZ, Gas Complaints Commission (now Utilities Disputes), Loyalty New Zealand, and Workbase.

He held senior executive positions at ASB Group and at IAG in both New Zealand and the UK. Venasio-Lorenzo has an MBA and BA.

We will vote undirected proxies IN FAVOUR of this resolution.

5. To increase the Directors Fee Pool by $72,000 from $768,000 to $840,000.

The details of the increase are set out in the Notice of Meeting. In summary the Board is seeking to restore the headroom that existed post the 2019 ASM where shareholders approved the Pool be increased by $100,000 to $750,000.

The appointment of Venasio-Lorenzo Crawley as an additional Director lead to the Pool being increased to $768,000 to accommodate his Director Fees as provided for in the NZX Listing Rules.

The Board don’t intend to increase the current fees paid to each Director but intend utilising the headroom for any extraordinary work above and beyond the normal duties of the Board or any Committee. These could include due diligence work for the issue of retail bonds or other significant strategic work or projects.

The Board has recently taken a reduction in their individual fees and accordingly New Zealand Shareholders Association (NZSA) views any increase in the Fee Pool as inappropriate at this time.

We will therefore vote undirected proxies AGAINST this resolution.

Proxies

You can vote online or appoint a proxy at http://vote.linkmarketservices.com/SUM/

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 1.00pm Monday 27 April 2020.

Please note you can appoint the Association as your proxy. We will have a representative at the meeting.

STANDING PROXIES – AUTOMATICALLY APPOINT NZSA AS YOUR PROXY FOR SOME OR ALL OF YOUR HOLDINGS WITHOUT HAVING TO FILL IN NEW FORMS EVERY TIME. MAKE YOUR VOTE COUNT!

DETAILS ARE ON THE NZSA WEBSITE,

http://www.nzshareholders.co.nz/shareholders-standing-proxies.cfm

Source: New Zealand Shareholders Association (NZSA)

P.S. I research and interview economists, NZ investors and successful companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.