(3-min read) Vista Group International Ltd (VGL) was founded in 1996 and listed on the NZX in August 2014. It has an international reach providing SaaS and promotional products to movie distributors and cinemas in over 100 countries. Its mission is “to become the leading provider of software and big data analysis to the global film industry”.

To date it has made considerable progress to achieving this with a global market share of 40% in the 20 plus cinema segment with 97% in Australasia, 85% Canada, and 51% China.

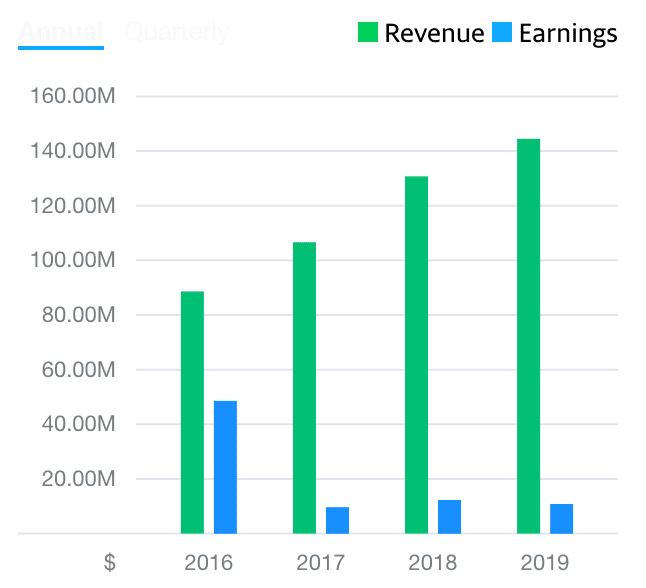

Revenue for FY19 was up 11% at $144.5 million, EBITDA was down 5% at $31.1 million. This included the impact of IFRS16 the new accounting standards around leases. NPAT was flat at $12.8 million.

In the Annual Report released 26 March the company announced it was cancelling the final dividend of 2.1 cents per share due to the impact of Covid-19. The virus has seen the closure of cinemas globally although some are starting to reopen however with lower attendances due to social distancing requirements.

In April, the company announced a placement and institutional entitlement offer to raise $65 million. This was completed in May with 90% of retail investors taking up 76% of their entitlements plus applying for $1.9 million of new shares.

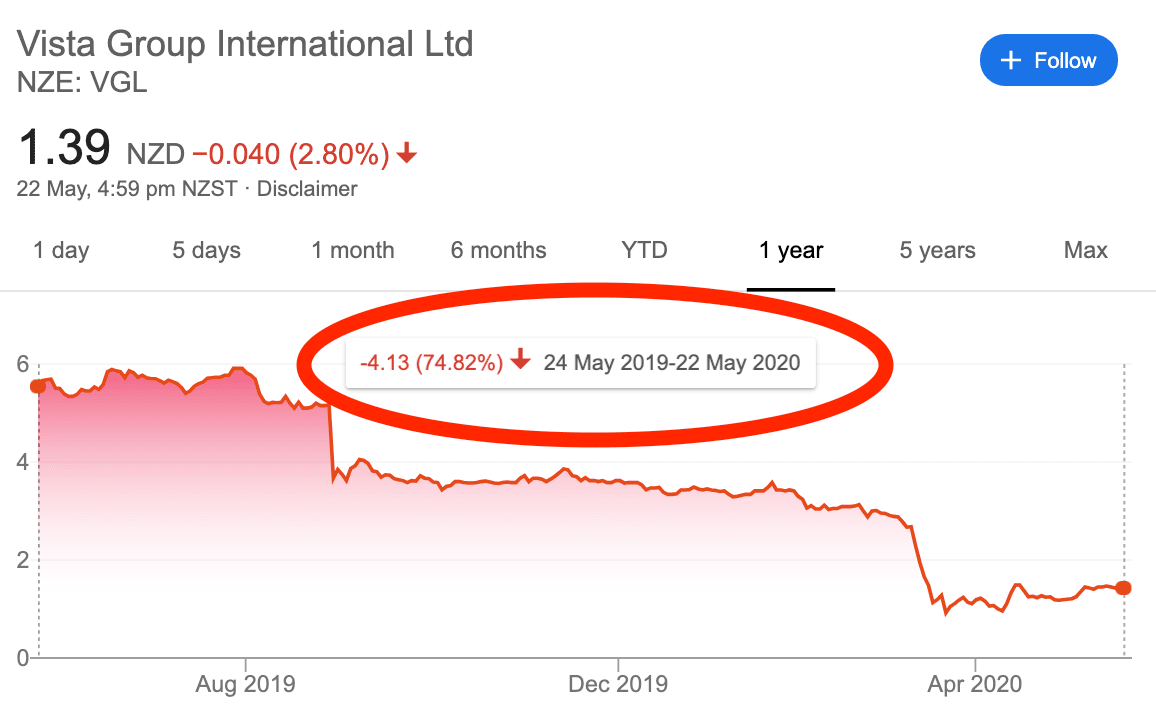

The shares have traded through a range of $5.91/ $0.91 over the past year and are currently trading at $1.46.

Board Composition

The Board comprises a Non-Independent Chair, 2 Non-Independent Directors and 3 Independent Directors, one female and 5 males. The 2 Non-Independent Directors are co-founders of the company and each hold over 3% of the shares. We consider the Boards skill sets to be appropriate to the business.

Due to the Covid-19 restrictions this will be a virtual meeting. Vista will hold its Annual Shareholders Meeting at 3.00pm on Thursday 28 May 2020. You can join the meeting at https://www.virtualmeeting.co.nz/agm/vgl20/register

P.S. I research and interview economists, NZ investors and profitable companies to find tools & tactics that you can use to achieve financial freedom.

➔ Join my private newsletter to be the first one to learn insider tips! Here are examples of what you’ll get. It’s FREE. You can unsubscribe at any time. I treat your email as my top secret.